Vehicles

For further information on Benefit in Kind, click here

Benefit in Kind on Cars/ Vans

Meaning of 'Car'

For the purposes of the PAYE, Universal Social Charge & PRSI calculation, a car means a mechanically propelled road vehicle constructed for the carriage of the driver or the driver and one or more passenger.

Meaning of 'Van'

For the purposes of the PAYE, Universal Social Charge & PRSI calculation, a van means a mechanically propelled road vehicle which is constructed for the carriage of goods and has a roofed area to the rear of the driver's seat which has no side windows or passenger seats.

Car/Van Pools

There will not be a charge to PAYE, Universal Social Charge & PRSI in respect of a car or van which is in a car/van pool. A car/van can be treated as being in a pool if:

- The van is made to, and is used by more than one employee and is not ordinarily used by one employee to the exclusion of others.

- Any private use of the car/van by an employee is merely incidental to business use.

- It is not normally kept overnight at the home of any employee.

Benefit in Kind on Cars

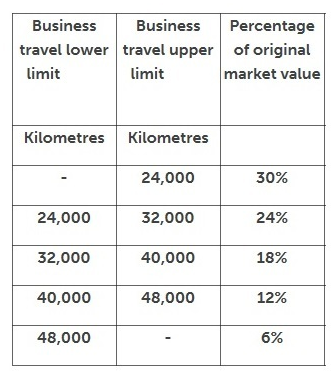

An employee's business kilometres to date will determine the amount of Notional Pay he/ she will pay. To calculate cumulative business kilometres to date:

Annual Business km's / by 52 or by X No.of weeks the car is used by the employee

e.g. Annual Business Km's : 26,000km's/ 52 weeks = 500 km's per week

500 km's x 10 weeks = 5000 km's

Annual business mileage is defined as total business mileage less a minimum of 8,000 private km's. In line with Revenue regulation, employees should submit periodical mileage records to the employer when an employee is provided with a company car.

Cumulative kilometres to date should be adjusted accordingly within the payroll to record an accurate value to the benefit given to the employee.

Benefit in Kind on Vans

Employees with a company van will pay a set rate of 5% of the Original Market Value of the van regardless of business mileage.

Processing Benefit in Kind on Vehicles in BrightPay

To access this utility go to Employees, select the employee in question from the listing and click Benefits on the menu toolbar, followed by Vehicle.

1) Type - indicate whether the vehicle is a car or a van.

2) Description - enter a description of the vehicle e.g. make, model or vehicle registration number.

3) Original Market Value - enter the OMV of the car/ van. The original market value of a car is the price (including any duty, VRT or VAT) which the vehicle might reasonably have been expected to fetch, if sold in the State singly in a retail sale in the open market, immediately before the date of its first registration in the State or elsewhere.

4) Carbon Class - once in force, the carbon class will determine the rate of BIK to be applied to new cars purchased after the effective date. Please note, a commencement order indicating the start of this treatment is still pending. Until such time as it has been brought into force, leave the carbon class at "A".

5) Reduction - tick the field provided if the employee qualifies for the reduced rate, due to being away from premises at least 70% of the time, along with other specific requirements.

6) Start Date - enter the date the employee first started using the vehicle in the current tax year.

7) End Date - if the employee returns the vehicle in the current tax year, enter the date of return.

8) Kilometres - to automatically increment the employee's business km's each pay period, enter the average number of kilometres the employee is expected to do each pay period.

9) Employee Contribution - enter any amount made good by the employee directly to the employer towards the cost of providing and running the vehicle.

9) Click Save to save the Benefit In Kind entry.

The 'Notional Pay' will be added to the employee's gross income each pay period to ensure that the correct PAYE, Universal Social Charge and PRSI are charged.

Need help? Support is available at 01 8352074 or brightpayirelandsupport@brightsg.com.