Easily integrate BrightPay with your accounting software

BrightPay’s payroll journal feature allows users to create wage journals from finalised pay periods so that they can be added into various accounting packages. BrightPay includes direct API integration with a number of accounting packages.With this direct integration, users will be able to directly send the payroll journal to the accounting package from within BrightPay. This accounts software integration eliminates the need to export the CSV file from the payroll software and import it into the accounting system, saving time and reducing the risk of errors.

Book an online demo of BrightPay today to see how the accounts integration features can benefit your business.

BrightPay includes direct API integration with the following accounting packages:

Payroll Journals in BrightPay

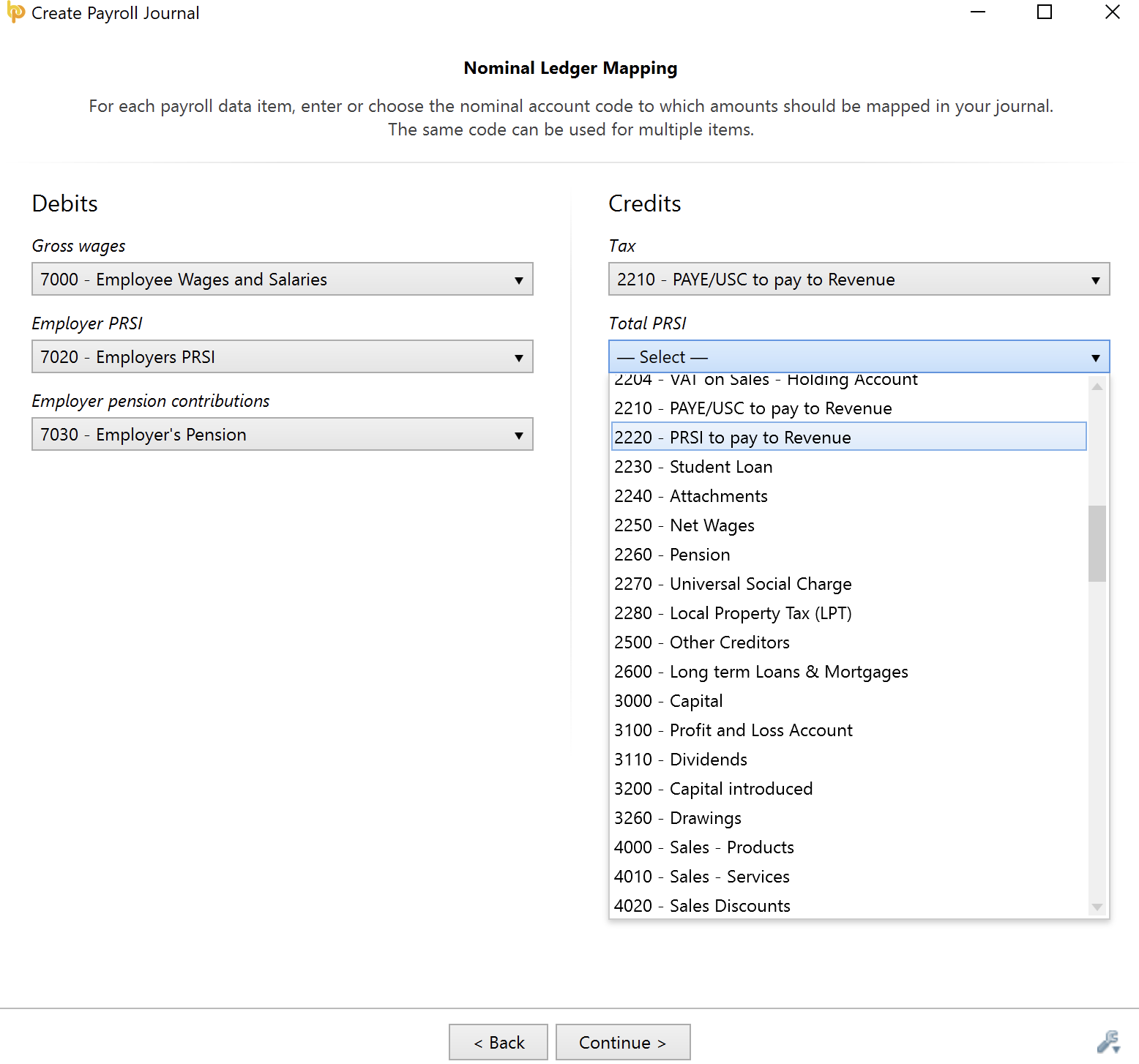

In BrightPay, each payroll journal file is customised to the individual accounting software provider, with compatible files and built-in nominal ledger mapping. Essentially, this mapping tells the payroll where things get posted to in the accounting system.With BrightPay, users can decide if they wish to include individual journal records for each employee, or if they want to merge the employee records into total records for each unique payment date. There is also the option to specify circumstances where amounts are to be mapped to alternate nominal account codes (e.g. depending on period type, directorship, departments, specific rates/additions/deductions, etc.).

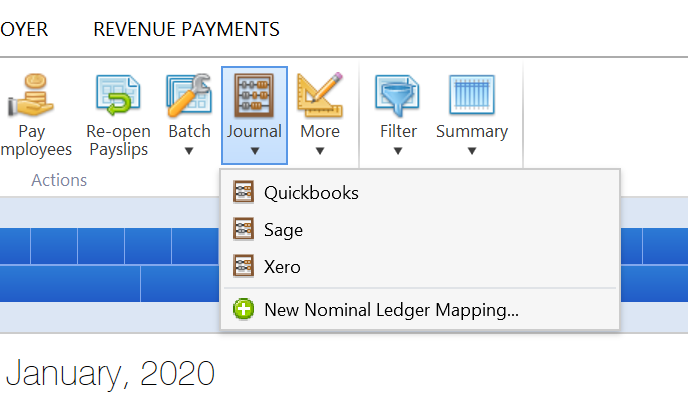

Payroll Journal Export to Accounting Packages

With BrightPay, there is also the option to export payroll journals via CSV file, and then manually import the journal into the accounting software. BrightPay includes export file formats with default nominal ledger code mapping for three accounting software providers - Quickbooks (desktop), Sage, and Xero. A 'generic' journal option is also available for those who use other accounting software packages. Generic payroll journals can be saved and added to your journal listing for future use.