TWSS - Transitional Phase (effective until 4th May 2020)

PLEASE NOTE THIS SCHEME HAS NOW ENDED.

The Government has announced a more enhanced scheme for employers and employees who are facing difficulties as a result of the COVID-19 outbreak.

This new scheme is called the 'Temporary Covid-19 Wage Subsidy Scheme' and takes effect from Thursday 26th March 2020.

This replaces the previous Employer Covid-19 Refund Scheme.

Comprehensive Revenue guidance on the Temporary Covid-19 Wage Subsidy Scheme can be found here

We have summarised the key points of the Scheme below.

General Points

- This scheme replaces the Employer Covid-19 Refund Scheme from 26th March 2020.

- The scheme applies to employers who may wish to top up employee payments and those who are not in a position to do so.

- Employers already registered for the Covid-19 Refund Scheme do not need to re-register for the new scheme.

- Employers that are not registered but wish to register for this scheme can do so through myEnquiries (details on how to do this are in the Revenue link above).

- The Scheme is due to run until the end of August 2020.

Who qualifies for the scheme?

To qualify, employers:

- must be experiencing significant negative economic disruption due to Covid-19

- must be able to demonstrate, to the satisfaction of Revenue, a minimum of a 25% decline in turnover

- be unable to pay normal wages and normal outgoings fully

- retain their employees on the payroll.

The Scheme is restricted to employees who were on the employer’s payroll as at 29 February 2020, and for whom a payroll submission has already been made to Revenue in the period from 1 February 2020 and 15 March 2020

Where employers didn't fulfil their PAYE reporting obligations for February 2020 by 15 March 2020, please click here for further information.

See Revenue guidance on employer eligibility and supporting proofs here

Phase 1 of the Scheme

The scheme is to be run in two phases:

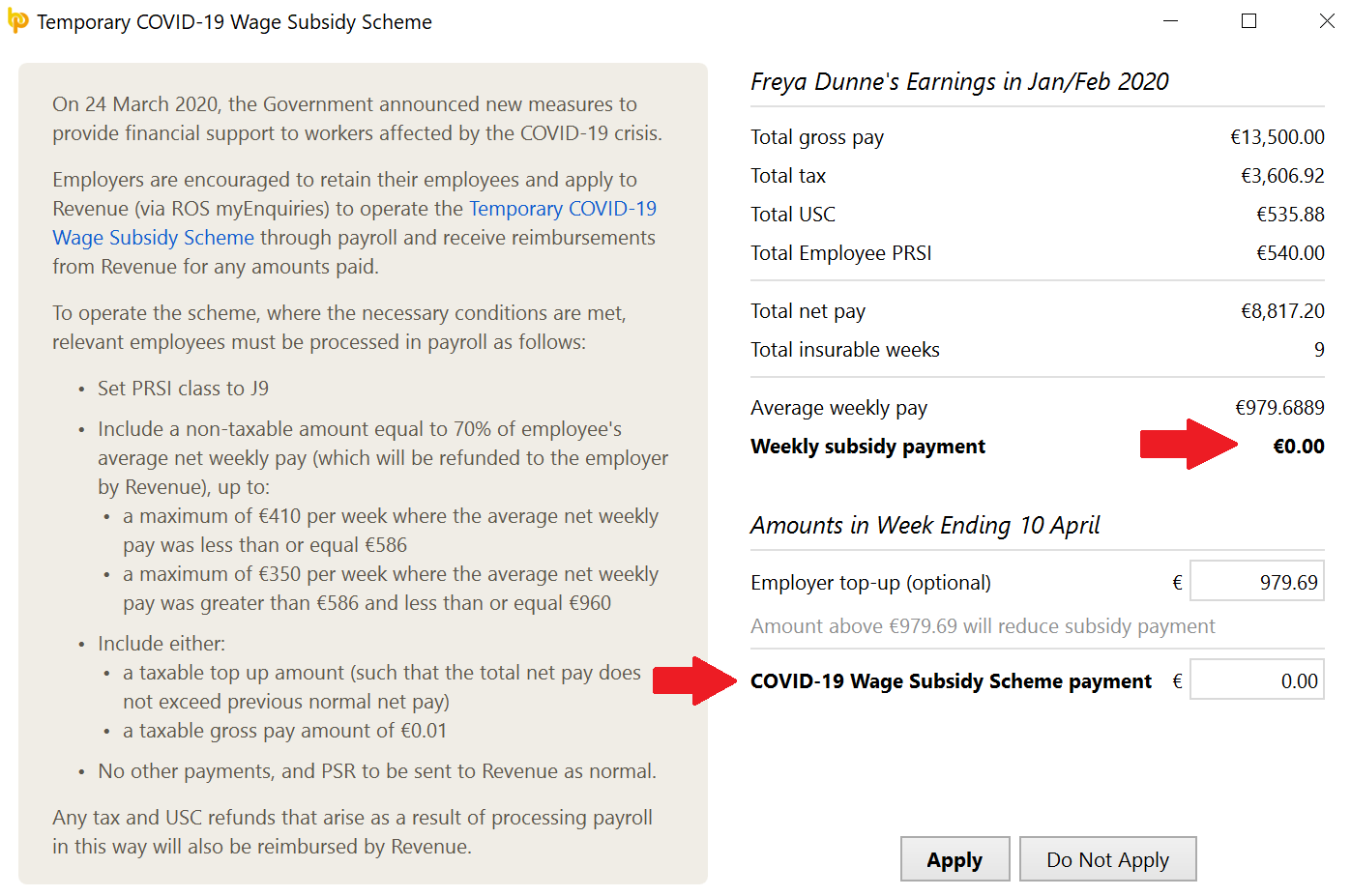

- Under Phase 1, employers can pay 70% of the employee’s average weekly net pay as a non-taxable payment (net pay = Gross less Income Tax, USC & Employee PRSI) and in turn receive a refund from Revenue for this.

This payment is capped at: - €410 per week where the average net weekly pay is less than or equal to €586

- €350 where the average net weekly pay is greater than €586 and less than or equal to €960

(employees with an average net weekly pay greater than €960 will be excluded from the subsidy scheme - please refer to 'Employees whose average weekly pay is higher than €960' below for recent changes)

- The period for calculating an employee's average weekly pay is January & February 2020 (this is automated in BrightPay)

- The refund from Revenue will, in general, be made to the employer within 2 working days after receipt of the payroll submission (PSR)

- During Phase 1, employers must work out the payment that can be made to the employees i.e. the 70% tax free payment and the maximum top-up allowed (this is automated in BrightPay)

- Revenue will automatically refund €410 per week per employee on the scheme (as they won’t know what employees are entitled to)

- At a later date, Revenue will perform a reconciliation and will look for repayment of any overpayments

Phase 1 - Top Up Payments

- Employers may top up this payment if they are in a position to do so.

- This top up amount, when added to the employee’s subsidy payment, cannot be greater than the employee's average net weekly pay.

- If an employer tops up payments by more than the permitted amount, their subsidy will be tapered i.e. for every €1 extra paid to an employee, they will lose €1 on the subsidy

- Any top-up payment made is taxable and USC-able

- The combined payment is to be processed under PRSI Class J9

- The maximum additional pay/top-up is the same for all employees - that is, the treatment is exactly the same for employees on short-time or reduced hours/pay.

Where an employee is on reduced hours, care must be taken that their salary along with their subsidy payment does not exceed their average net weekly pay. Where the maximum allowed is exceeded, the subsidy must be reduced accordingly.

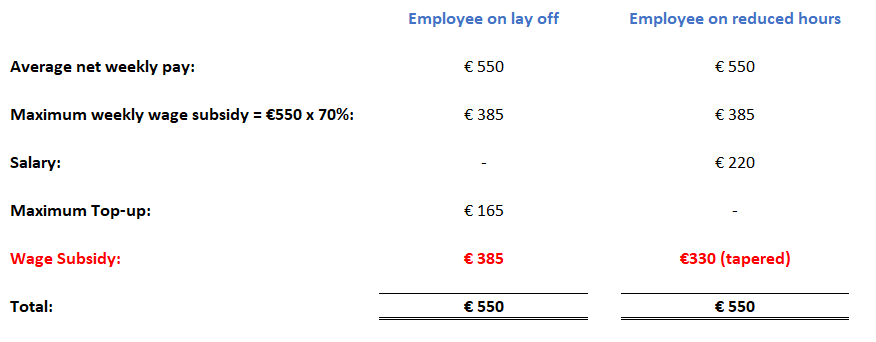

Example:

Please note: where the subsidy is to be reduced, this must be done manually by the user in BrightPay.

Phase 2 of the Scheme

Phase 2 of the Wage Subsidy Scheme has been announced to take effect from 4th May.

We are currently in a consultation phase with Revenue and will provide more information on how phase 2 will operate in due course.

In the meantime, general information regarding Phase 2 can be accessed here

Phase 1 - Processing the Wage Subsidy Payment in BrightPay

In order for Revenue to recognise employees being paid under the scheme, they have requested that PRSI Class J9 is used.

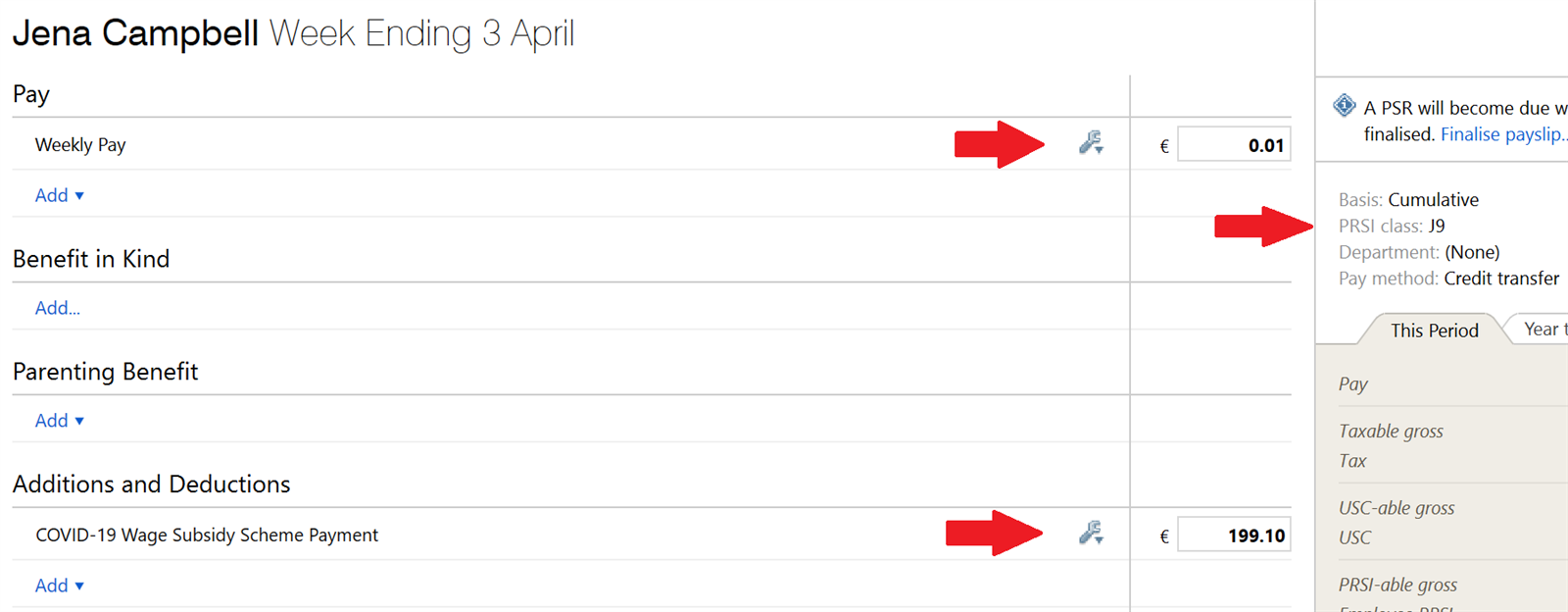

1) To apply the wage subsidy payment to an employee's payslip, within the 'Payroll' utility, select the employee from the left hand listing.

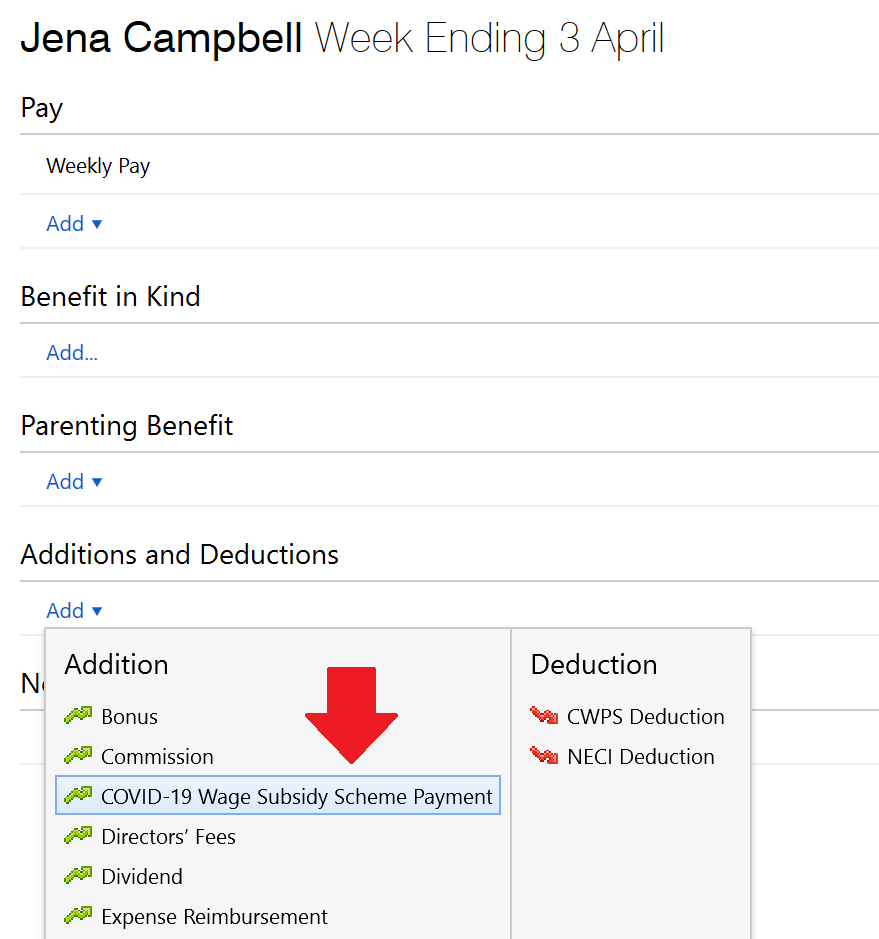

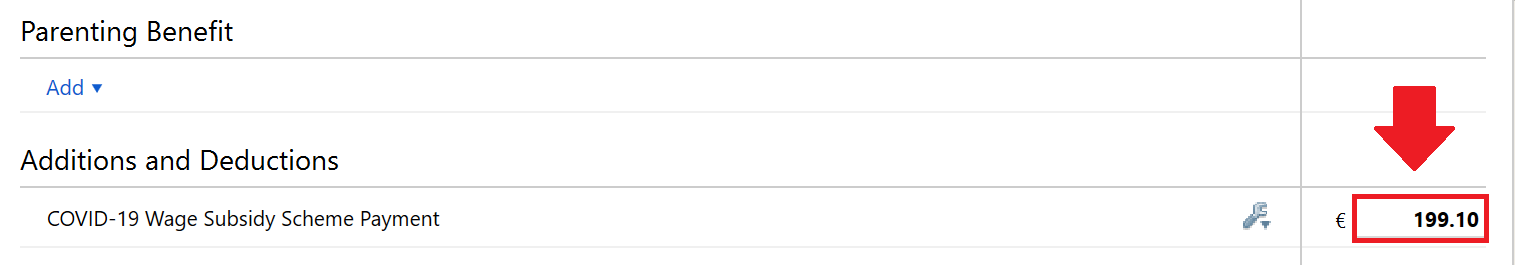

2) Within the Additions and Deductions section, click 'Add', followed by 'COVID-19 Wage Subsidy Scheme Payment'.

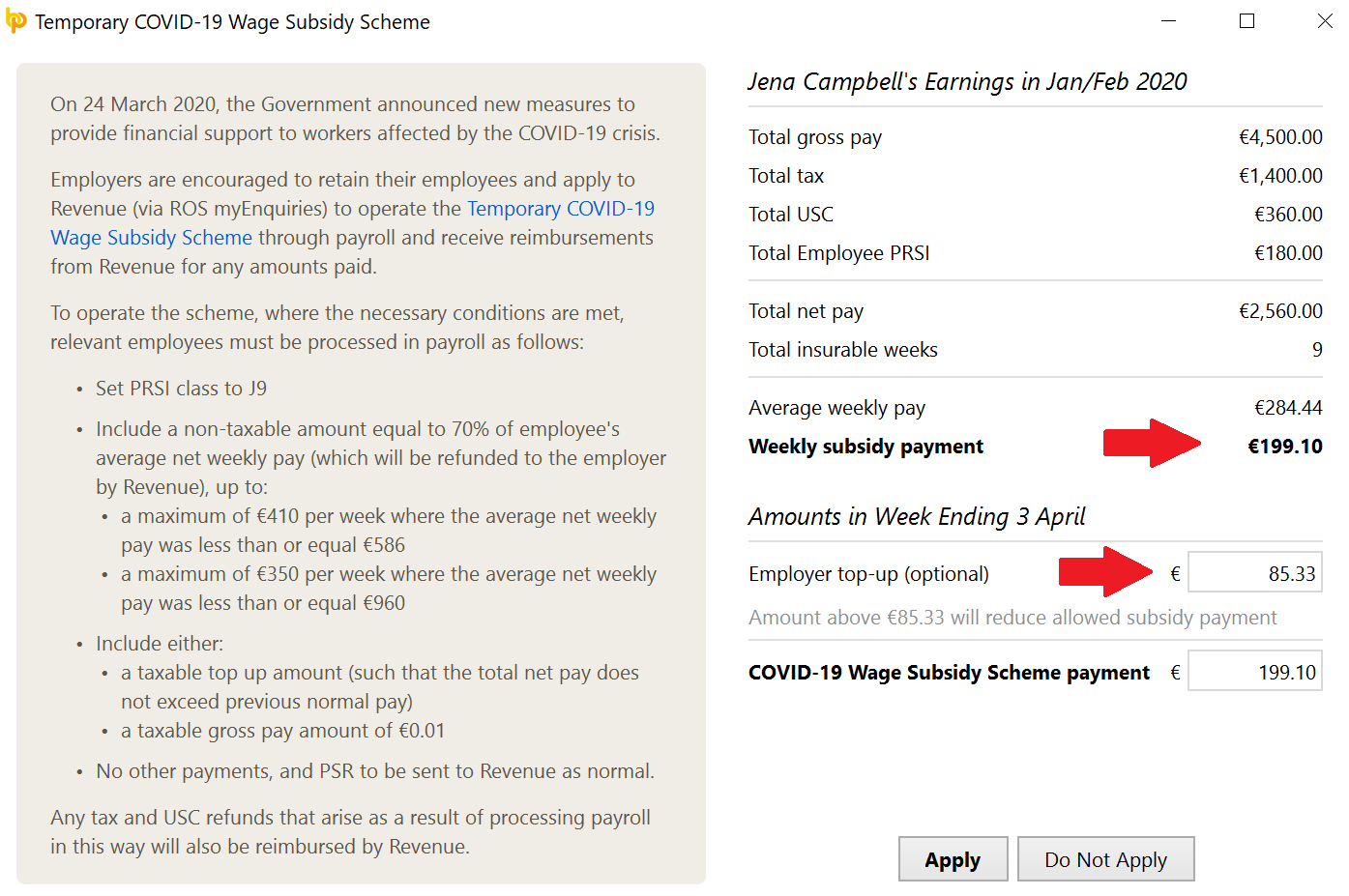

BrightPay will now ascertain what the refundable payment amount is, based on the employee's average periodic net pay during January and February (and taking into account the capped payment thresholds) and display this on screen.

Should you be in a position to be able to top up this payment, this screen will also indicate the maximum top up amount you can give without affecting your subsidy.

Important notes regarding the average pay calculations

- The calculations should be considered as a guide to help you ascertain the amounts to include in the wage subsidy scheme. Due to the rushed nature of this scheme, there are still unresolved queries outside of our control and which we still await clarity on. We can therefore take no responsibility if this calculator results in any loss. We advise you to consult relevant Revenue guidance. Clicking 'Apply' will be taken as your understanding of these potential shortcomings.

- It should also be noted that should you decide to pay a top-up amount above what the calculation recommends, this could result in the tapering of the refund or no refund at all.

- Where an employee is on reduced hours but still receiving some salary, we ask you to refer to the 'Top Up Payments' section above in case a manual adjustment to the subsidy amount is required by the user.

3a) Should you wish to apply the wage subsidy payment as well as the maximum top up amount, simply click 'Apply'

b) If you are in a position to pay some of the top-up amount, amend the top-up amount accordingly and click 'Apply'

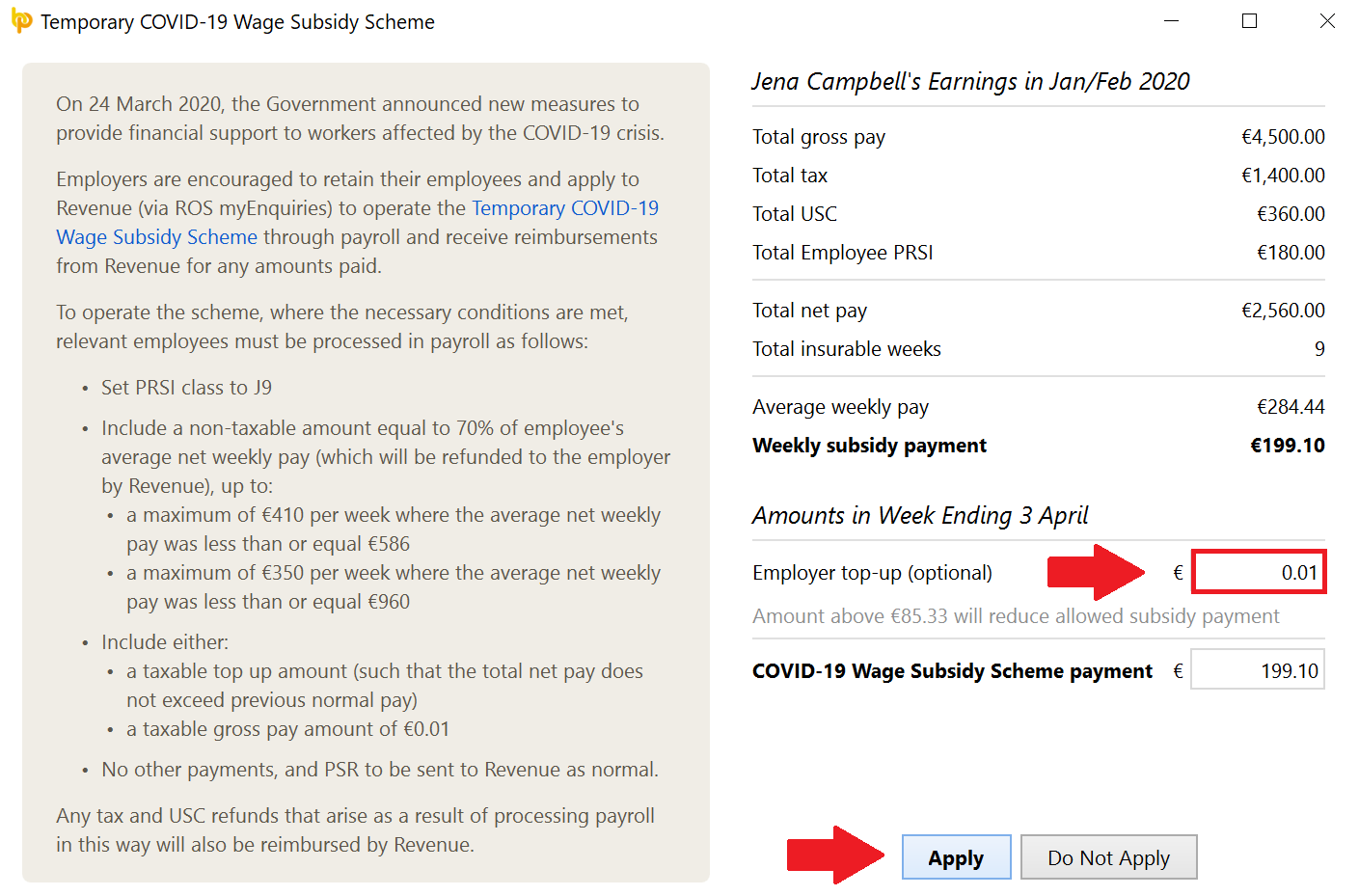

c) If you do not wish to apply a top-up amount, enter a top-up amount of €0.01 (this will act as a notional gross pay amount in order to generate a payroll submission) and click 'Apply':

4) The wage subsidy payment as well as any top-up amount applied will now be pre-populated on the employee's payslip (amend this amount accordingly where appropriate e.g where a monthly paid employee is put on the scheme mid-month).

The employee's PRSI Class will also automatically set to J9.

Please note: All other payments, benefits and deductions will be zero-ised.

5) Should you wish to access the calculation again to view it, simply click on the Covid-19 amount box:

6) Repeat the process above for further employees, if applicable.

7) On finalising your payslips, the above will subsequently flow through to the payroll submission (PSR), from which Revenue can ascertain the refund due to the employer.

Employees whose average weekly pay is higher than €960

Where it is ascertained that an employee's average net pay for January and February exceeds €960 per week, the calculation screen will indicate that the employee does not qualify for the subsidy:

Please note: From 16 April 2020, the wage subsidy is available to support employees where their average weekly net pay was greater than €960 per week. In order to avail of the scheme, the employee's earning's earnings must be reduced.

Where the employee’s earnings have now been reduced by:

- more than 20%, a subsidy of up to €205 would be payable

- more than 40%, a subsidy of up to €350 would be payable

For example:

- employee has an average weekly net pay of €1,250

- employee's earnings now reduced to €750 (40% reduction)

- Subsidy due €350

To apply the subsidy for these employees, please enter the required figures in 'Employer top-up (Optional) and Covid-19 Wage Subsidy Scheme payment and 'Apply'.

Using the example above, the gross pay should be entered as €610 and the wage subsidy figure should be entered as €350. The combined pay cannot exceed €960.

Please note: if the employee isn't eligible because the earnings don't qualify, please select 'Do Not Apply'.

Tax/USC Refunds

In many cases the payment of the Temporary Wage Subsidy and any additional income paid by the employer will result in a tax/USC refund to the employee. Any tax and USC refunds that arise can be repaid by the employer and Revenue will also refund this amount to the employer.

**In this instance, the Finalised Totals report within BrightPay will not match the Revenue statement. In this case, the Revenue Statement will be correct as Revenue will account for the refunds.

Re-hiring Staff

Employees who have been ceased as a result of the Covid crisis can be re-hired and paid under the subsidy scheme. In this instance, the DEASP claim should be ceased

However employees must have been included in submissions between 1st February 2020 and 15th March 2020 under the same PPSN to qualify.

Please note: the software will not calculate average earnings in this instance, so a manual calculation will be required.

Employees claiming from the DEASP directly

Employers must not operate this scheme for any employee who is making a claim for duplicate support (e.g. Pandemic Unemployment Payment) from the DEASP. Where an employee previously laid off has been re-hired, the employee will qualify for the Subsidy scheme if their DEASP claim is ceased.

Need help? Support is available at 01 8352074 or brightpayirelandsupport@brightsg.com.