PRSI - Overview

Pay Related Social Insurance (PRSI) is a compulsory deduction from earnings which is payable to the Department of Employment Affairs and Social Protection (DEASP) towards the Social Insurance fund of the state which is used to fund social insurance payments in the state. Each periodical contribution creates an employee's record of aggregate contributions which will in turn dictate the level of benefits available to that employee when applicable. The amount of PRSI you pay will depend on your earnings and the class you are insured under.

Social insurance contributions are divided into different categories, known as classes or rates of contribution. The nature of employment mainly determines the PRSI contribution class that applies to the employee. PRSI Class A applies to the majority of employees in the private sector and to employees recruited in the public sector since 6 April 1995.

The type of class and rate of contribution you pay is determined by the nature of your work. Most employees pay Class A PRSI. This class of contribution may entitle employees to the full range of social insurance payments that are available from the Department of Social Protection, if you meet the qualifying criteria.

Each PRSI contribution made in a pay week equates to a week of insurable employment.

PRSI is always deducted on a Week One/Month One basis.

The current weekly threshold for employee PRSI is €352.

PRSI Credit

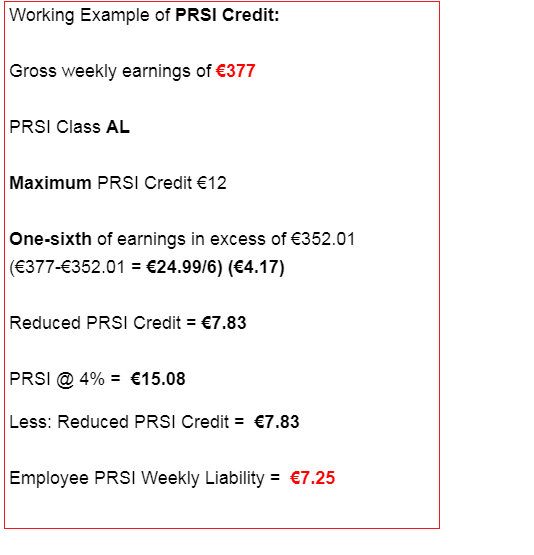

A tapered PRSI credit was introduced in Budget 2016 for employee PRSI. The PRSI credit commences in respect of weekly income of €352.01 and will taper out as a weekly income reaches €424.

For earnings between €352.01 and €424, the maximum weekly PRSI credit of €12 is reduced by one-sixth of earnings in excess of €352.01.

National Training Fund Levy

The National Training Fund Levy (NTFL), collected alongside Employer PRSI for Classes A and H, will increase by 0.1% from 0.9% to 1.0% from 1 January 2020. This means that Employer rates (combined PRSI and NTFL) for Classes A and H will increase by 0.1%

Collection & Remittance of PRSI

Employers are responsible for deducting PRSI from their employees gross salaries. They are only responsible for deducting PRSI from income which he or she is paying to an employee regardless of any other employments or income the employee may have.

PRSI is detailed separately on each payslip.

Employers should remit all PRSI collected to the Collector General at the same time and in the same manner as the deductions under the PAYE system, Revenue will issue a monthly statement to employers.

Contribution Classes explained

Contribution Class A

Class A applies to people in industrial, commercial and service-type employment under a contract of service and civil and public servants recruited since 6 April 1995, whose combined reckonable earnings from all employments bring them into Class A. The appropriate subclass within Class A is based on the earnings in each separate employment.

Contribution Class J

Class J applies to the following groups of people:

employees in industrial, commercial and service-type employment under a contract of service, whose combined weekly reckonable earnings from all employments are below the threshold for Class A (less than €38 per week)

employees over 66 years of age

employees who are also full-time civil and public sector employees and paying PRSI Class B, C, D or H in their full-time job

Contribution Classes B, C and D

Class B, C and D apply to pensionable employees in the civil and public service, including civil servants, teachers, Gardaí, the army and local authority employees who were recruited before 6 April 1995.

Contribution Class H

Class H applies to NCOs and enlisted personnel of the defence forces.

Contribution Class K

Since 2011 Class K applies to office holders ONLY. Office Holders, from 2011, are defined as public office holders, i.e. Judiciary, Government ministers etc.

Up to the end of 2010, Class K covered people receiving income that was not subject to Social Insurance Contributions but which was liable for the Health Contribution. Income included, occupational pensions and income of people aged 66 or over previously liable for Class S.

Since 2011, public office holders will pay PRSI at a rate of 4% on all income, where their income is over €5,200 a year. They should be returned at Class K. Public office holders with weekly income of €100 or less should be returned at Class M. This rule continues to date.

Contribution Class M

In 2010 and prior years a Director in Class S should automatically go to Class K when they reach 66. Since 2011 a Director who contributes under Class S reaches 66 should thereafter change to a Class M contributor.

In addition Class M also applies to:

- Under 16 years of age

- Class K1 employee where earnings are up to €100 per week

Contribution Class S

Class S applies to self-employed contributors who pay tax and PRSI under the self-assessment system (Schedule D).

Directors whose income is assessable under Schedule E tax may also be liable to pay Class S.

Directors - Depending on the circumstances, Directors can either be employees paying PRSI at Class A insurance or self-employed under a contract for services and therefore paying PRSI at Class S.

In previous years when a Class S contributing employee reached the age of 66 Class K should be applied to earnings thereafter. Since 2011 Class K is no longer applied but Class M.

For clarification on the Class of PRSI for specific company directors you should contact Scope Section of the Department of Social Protection.

PRSI minimum contribution

For 2020, the minimum annual PRSI contribution for people with annual self-employed income over €5,000 is €500.

To access the 2020 PRSI Tables click, here

Need help? Support is available at 01 8352074 or brightpayirelandsupport@brightsg.com.