2020 Budget - Employer Summary

- There are no changes to tax credits, cut off points or the rates of PAYE

- There are no changes to the rates of Universal Social Charge (USC)

- The Earned Income Tax Credit will increase by €150 to €1,500

- The Home Carer Tax Credit will increase by €100 to €1,600

- Benefit In Kind will remain as 0% on electric vehicles provided by an employer to an employee until 2022

MINIMUM WAGE INCREASE - 1st FEBRUARY 2020:

- The National Minimum wage will increase from €9.80 to €10.10 from 1st February 2020.

- Employers should also note that the minimum wage for younger workers will also increase as follows:

- Aged 19: €9.09

- Aged 18: €8.08

- Under 18: €7.07

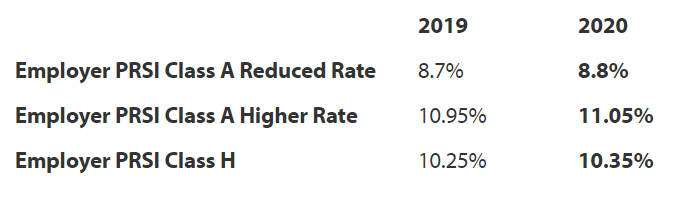

PRSI:

- The National Training Levy which is collected as part of Employer PRSI increases by 0.1% from 0.9% to 1% in 2020 to fund further and higher education.

- As a result of the change to the minimum wage from 1st February 2020, the Class A employer PRSI threshold will increase from €386 to €395, effective from the 1st February 2020 also.

PARENT'S LEAVE & BENEFIT BILL

The Parent's Leave and Benefit Act 2019 introduces two weeks' paid parents leave for any child born / adopted on or after 1st November 2019, in order to allow working parents to spend more time with their baby or adopted child during the first year.

- Parent's Leave is available to both parents and can be taken as a continuous period of two weeks or in two separate one week blocks.

- Such leave must be taken within 52 weeks of the birth of the child or in the case of adoption, from the date the child is placed with the employee. In the case of multiple births, a parent will only be able to claim parents leave once.

- Where an employee has enough PRSI contributions, they will be entitled to a Parent’s Benefit of €245 per week, paid by the Department of Employment and Social Protection (DEASP).

- Employers are not obliged to pay an employee while they are on parent’s leave, however some employers may choose to 'top up' an employee's pay during the leave period.

Further information on Parent's Leave and Parent's Benefit can be found here

Need help? Support is available at 01 8352074 or brightpayirelandsupport@brightsg.com.