EWSS Sweepback

PLEASE NOTE: REVENUE'S SUBMISSION DEADLINE FOR EWSS SWEEPBACK WAS 14TH OCTOBER 2020.

EWSS Sweepback Rules & Assumptions

A utility is available within the EMPLOYEE menu to prepare the EWSS Sweepback CSV file.

Due to extremely tight time lines, this utility has not received adequate testing.

1. If employer claimed TWSS at any stage for any employee

- If employee had no pay in Jan/Feb 2020, then employer should qualify for EWSS in respect of that employee because the employee would not have been eligible for TWSS.

- Non TWSS eligible employees paid during July and August should qualify for EWSS sweep back. Revenue will exclude payments outside of the EWSS payment thresholds.

Note: if no payroll data available to software for Jan/Feb, this could result in a false positive (e.g. as in the case of a mid year setup).

2. If employer did not qualify for TWSS and now qualifies for EWSS

- All employees paid during July and August should qualify for EWSS sweep back. Revenue will exclude payments outside of the EWSS payment thresholds.

Other Notes of Importance

- The indicative claim amounts assume that all PSRs were successfully submitted to ROS.

- The CSV file is simply a list of PPSN numbers and employment IDs for those employees you are requesting the sweep back for.

- If you are aware of other employees who should be included or employees who have been incorrectly included, please edit the file accordingly using Notepad.

Full Revenue guidance and details of how to claim can be found here.

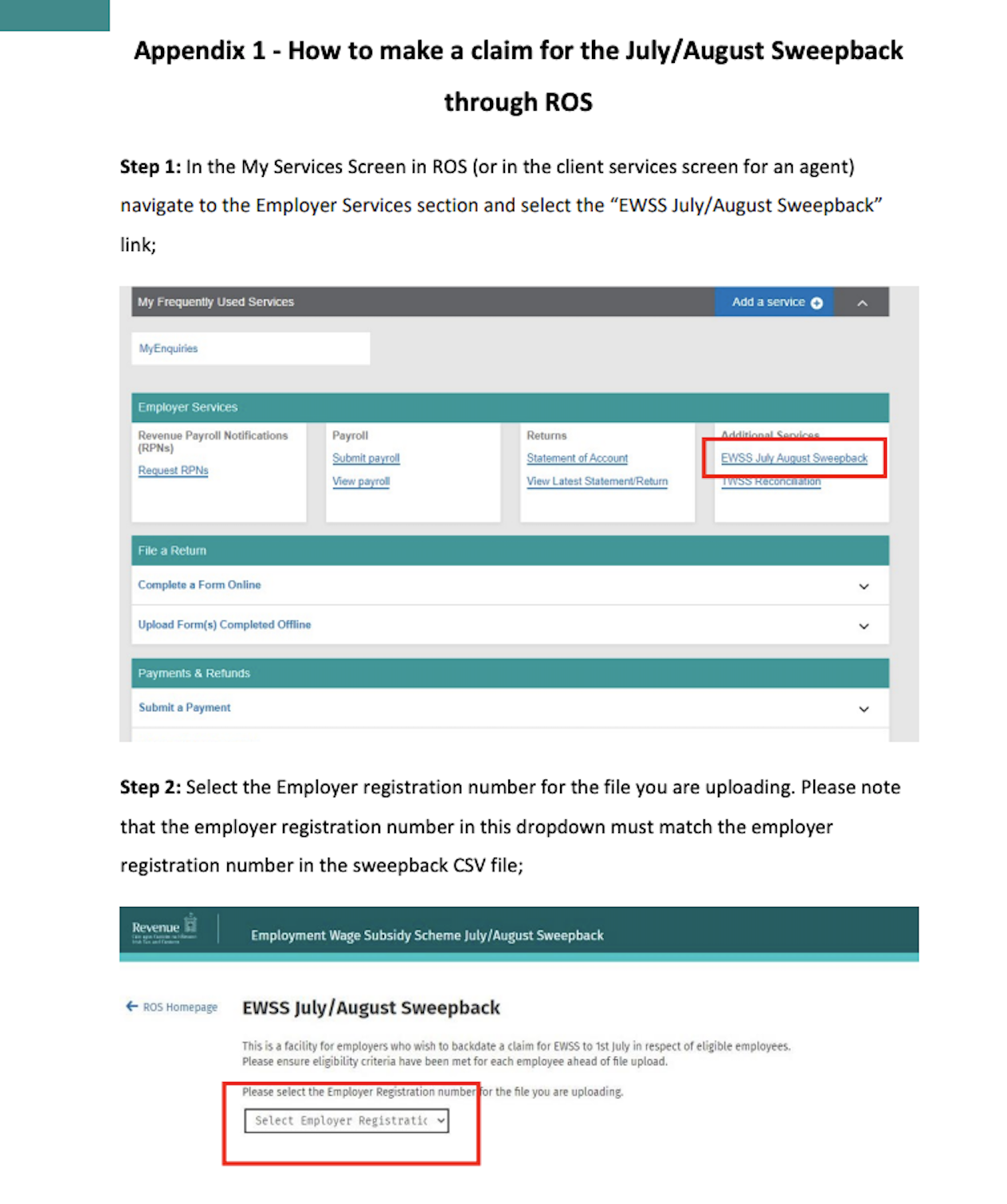

How to make your Claim through ROS

Please note: the 'EWSS July/August Sweepback' option will only be visible in ROS to employers that have registered for EWSS.

Important Information about your Claim

- Sweepback CSV files can be uploaded until 14th October 2020.

- On receipt, Revenue will process these every Tuesday night from 22nd September until 14th October and associated remittances each Wednesday.

- Once processed, the corresponding July/August payslips that match the details on the CSV file will be updated to show the amount of subsidy the employer will receive or the reason the payslip was not eligible for subsidy.

Employers can view this information by using ‘View Payroll’ within ROS. - The July/August Statement of Account will also be updated with the employer PRSI credit.

Need help? Support is available at 01 8352074 or brightpayirelandsupport@brightsg.com.