On 15 March 2020, the Government announced the implementation of exceptional measures, administered through the Department of Employment Affairs and Social Protection (DEASP), to enable workers who are temporarily laid off due to the COVID-19 (Coronavirus) pandemic to claim a special support payment of €203 per week.

Revenue has worked closely with DEASP to provide an option for employers to make this payment to their employees through the normal payroll process. The amounts paid to employees under the scheme are not subject to tax, USC or PRSI.

Employers are encouraged to facilitate employees by operating the scheme, where possible. The amounts paid to employees and notified to Revenue through the payroll submission (PSR) will then be transferred into the employer’s bank account by Revenue. This reimbursement will, in general, be made on a ‘next day’ basis. It will ensure a speedy payment process for employees and minimise the hardship for employees who are temporarily laid off.

Employers wishing to operate the scheme must first register through 'ROS > My Enquiries' and by selecting the category ‘Employer COVID -19 Refund Scheme’.

The employer should also ensure that they have a bank account on ROS to accept the refunds (ROS > Manage Bank Accounts > Manage EFT)

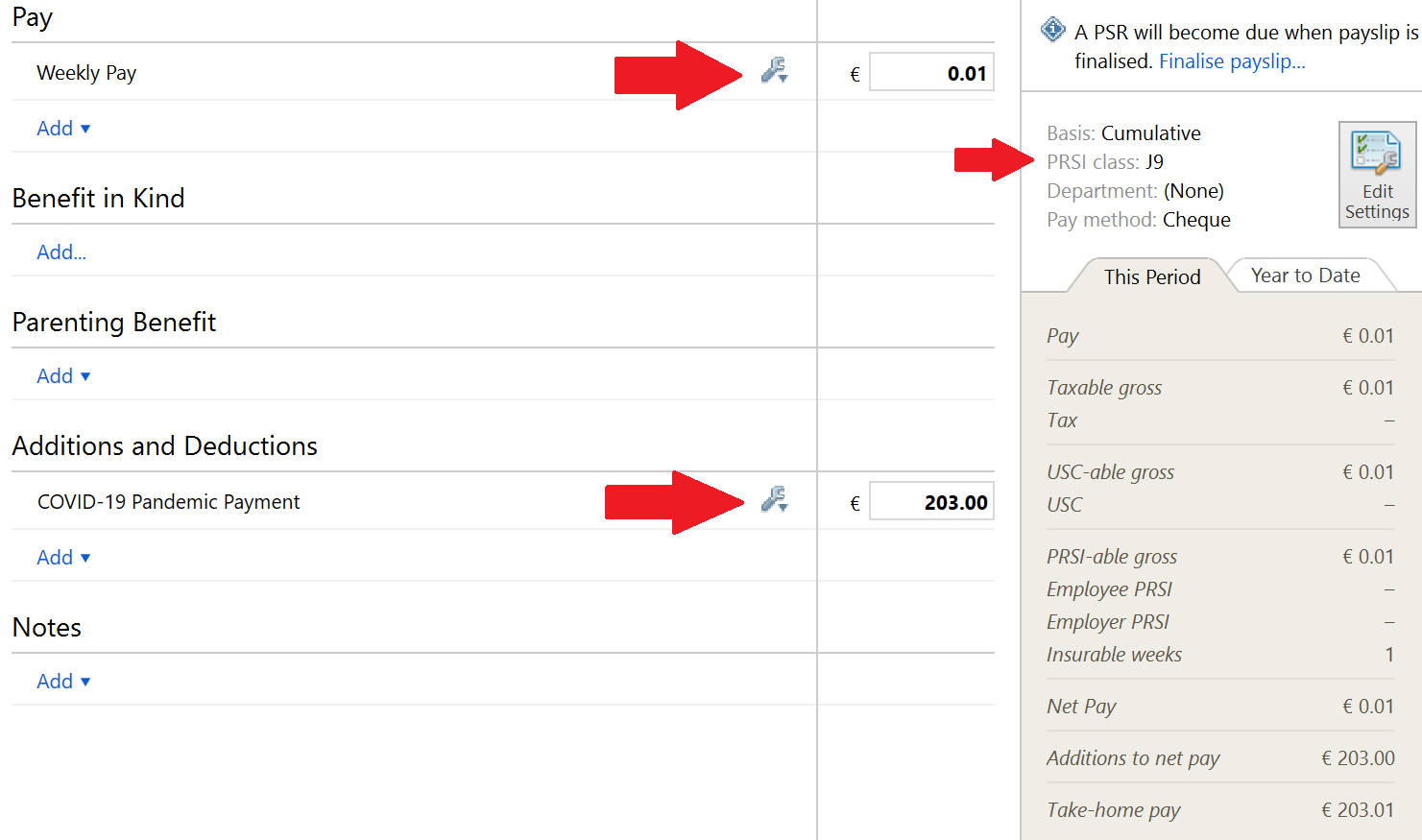

In order for Revenue to recognise employees being paid under the scheme, they have requested that PRSI Class J9 is used. There will also be a notional gross pay amount of €0.01 applied to generate a payroll submission.

(Where employees are being paid this payment together with other salary (e.g. where a monthly paid employee is laid off mid-month), Revenue will allow the full payment to be processed under PRSI Class J9 in this scenario).

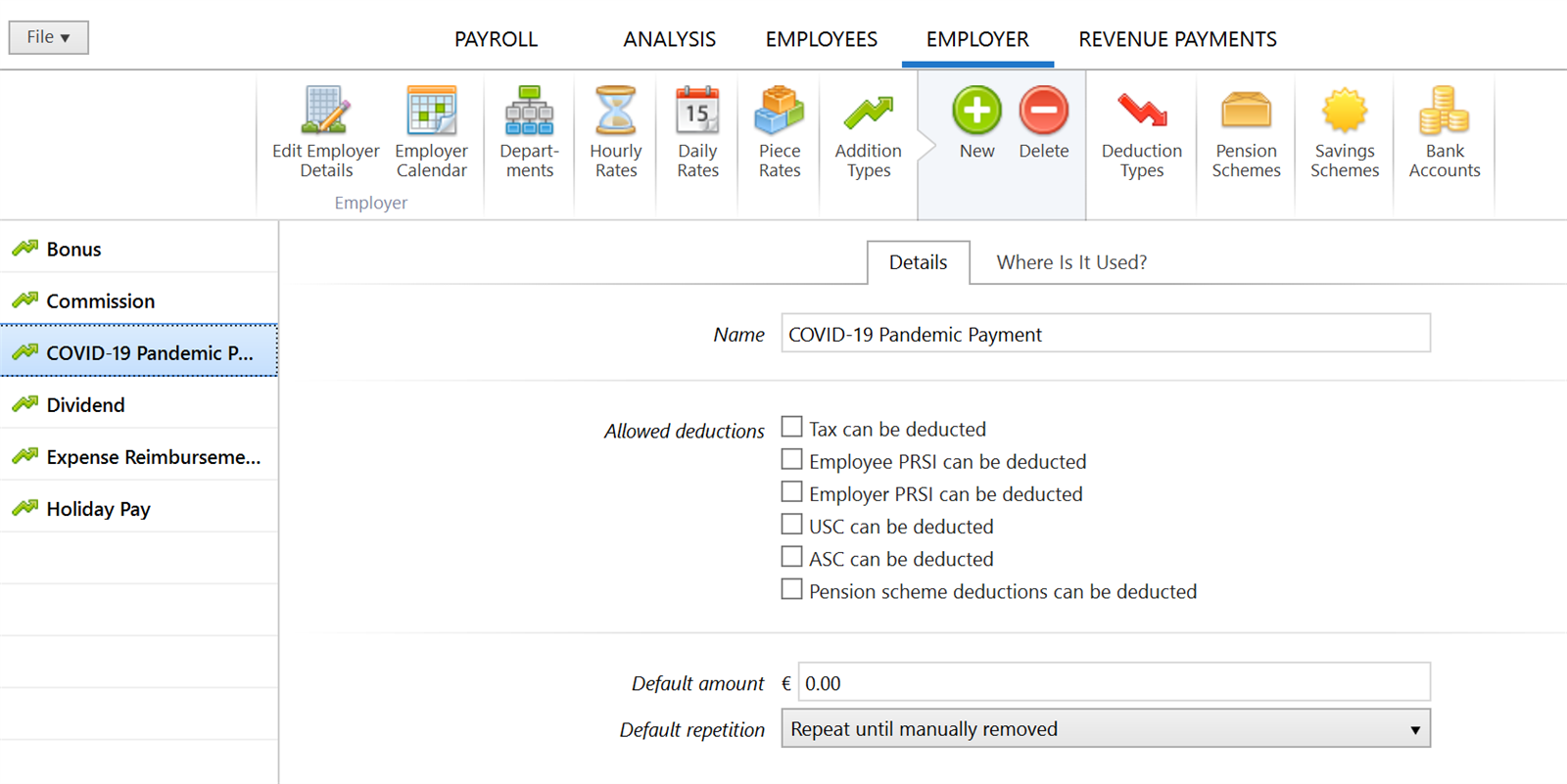

a) Within the 'Employer' utility, you will find a preset addition type called 'Covid-19 Pandemic Payment' set up for you:

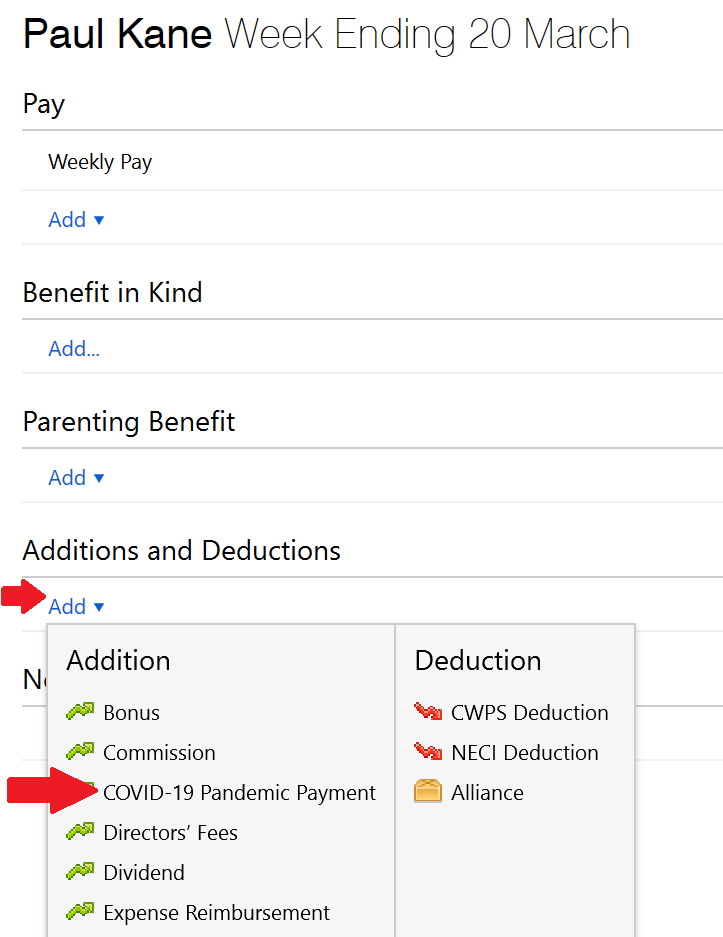

b) To apply the payment to an employee's payslip, within the 'Payroll' utility, select the employee from the left hand listing.

c) Within the Additions and Deductions section, click 'Add', followed by 'COVID-19 Pandemic Payment'.

At the prompt, click 'Yes' to apply the payment.

A notional gross pay of 1 cent together with a non taxable payment of €203 will now be pre-populated on the employee's payslip (amend this amount accordingly where appropriate e.g where a monthly paid employee is laid off mid-month). The employee's PRSI Class will also automatically set to J9.

Please note: All other payments, benefits and deductions will be zero-ised.

d) On finalising the payslip, the above will subsequently flow through to the payroll submission (PSR), from which Revenue can ascertain the refund due to the employer.

With regard to the refund, if employers wish, they may submit their payroll submission to Revenue at the start of their pay period (e.g. on Monday, but paying employees on the Friday) as this will ensure they have the received the payment from Revenue before paying employees.

**Where a tax/USC refund arises when processing the €203 payment, the employee will be entitled to receive this refund alongside this payment. Such amounts will also be refunded to the employer by Revenue through the scheme.

In this instance, the Finalised Totals report within BrightPay will not match the Revenue statement. In this case, the Revenue Statement will be correct as Revenue will account for the refunds.

Where employees will be claiming from the DEASP directly, please note a cessation date will be required on a payroll submission for such employees.

For comprehensive Revenue Guidance on the above please click here

The refund scheme is for employees who have been temporarily laid off and we have also prepared some guidance on this subject here.

Need help? Support is available at 01 8352074 or [email protected].