AccountsIQ (API)

BrightPay's payroll journal feature allows users to create wages journals from the finalised payslips and upload into the AccountsIQ accounts package using API .

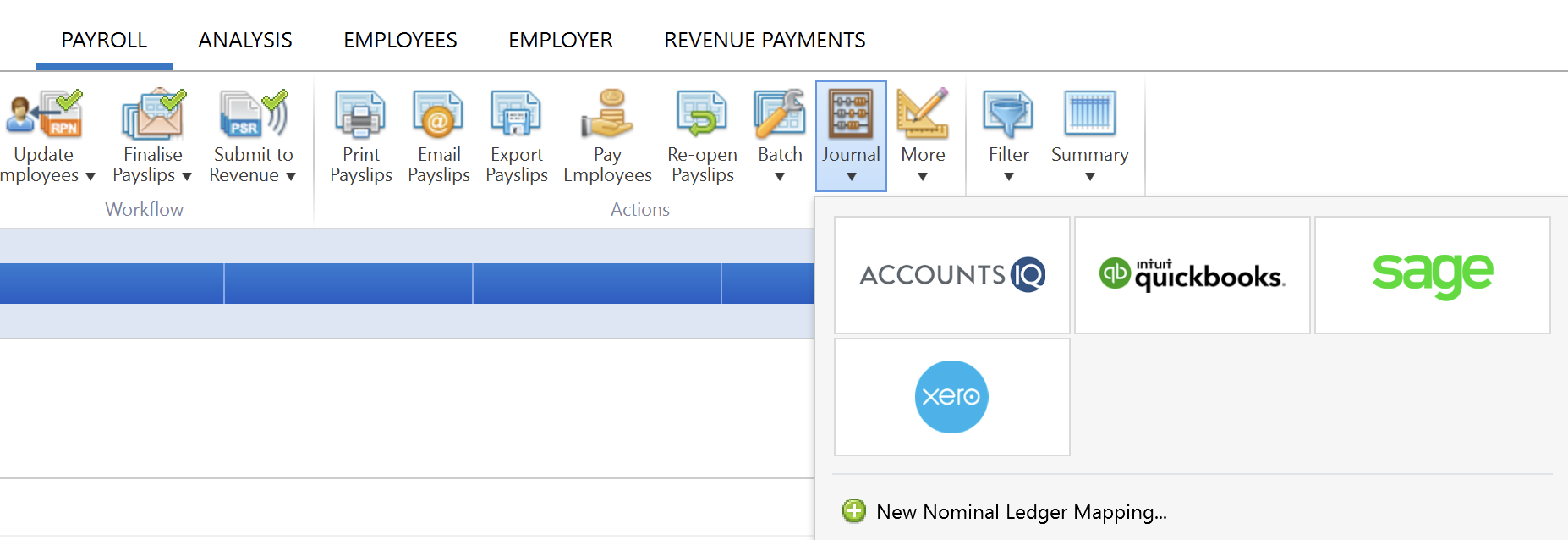

1) Within Payroll, select Journal on the menu toolbar, followed by AccountsIQ:

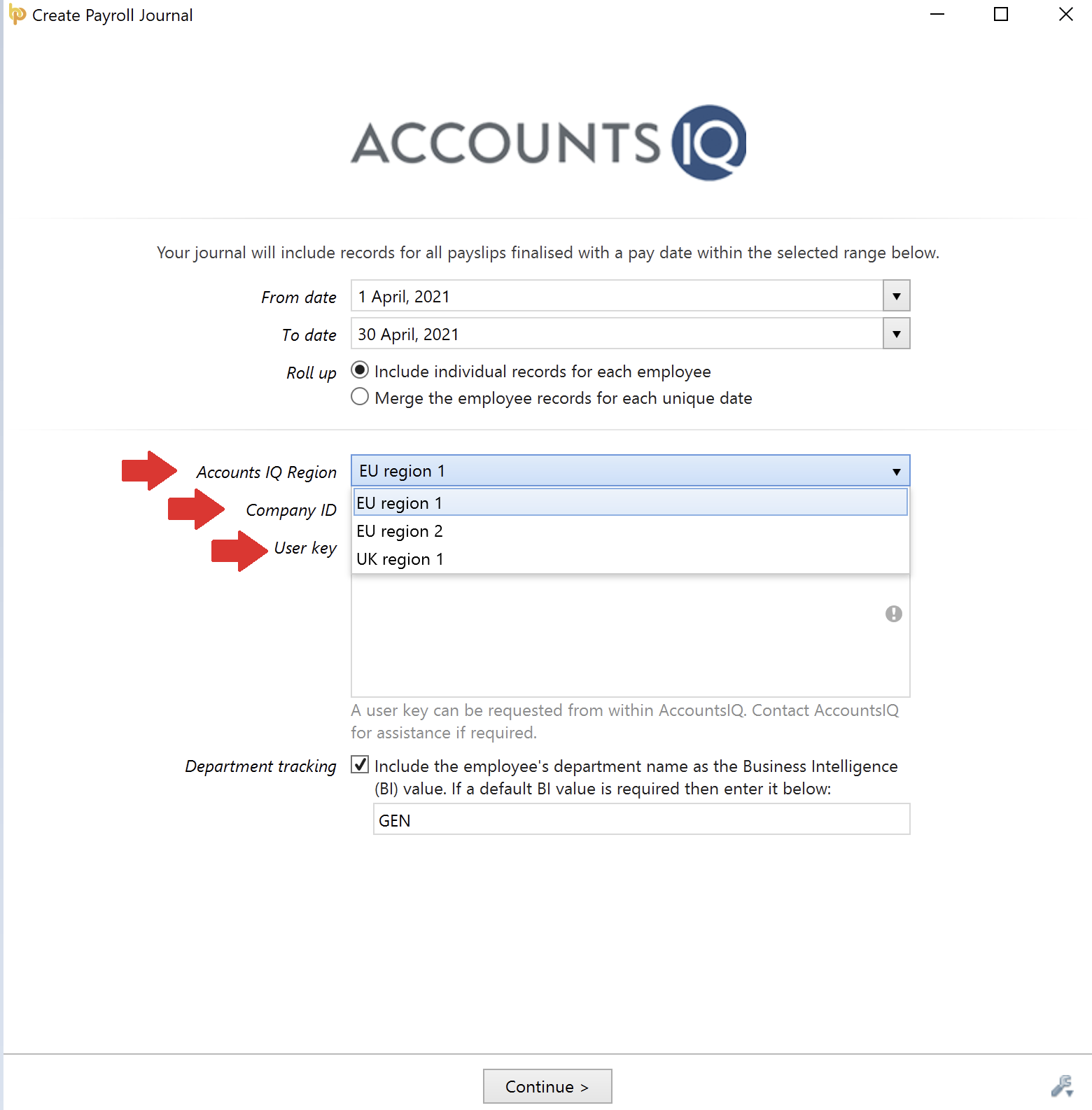

2a) On the next screen, set your Date Range - the journal will include records for all payslips (across all pay frequencies) with a pay date within the selected range.

b) Roll up - select whether you would like the journal to include individual records for each employee or whether to merge the records for each unique date.

c) Select your 'AccountsIQ Region' - AccountsIQ has multiple hosting locations. When you sign up to AccountsIQ, your data is stored in one of these secure locations, and each server has its own separate login portal. Simply select the region in which your data is stored. If unsure where your data is stored, please contact the AccountsIQ support team who can confirm this for you.

d) Enter your AccountsIQ 'Company ID'

e) Enter your AccountsIQ 'User key' - a user key can be requested from within AccountsIQ. Please contact AccountsIQ for assistance with this, if required.

f) Department tracking - tick the box if you wish to include the employee's department name as the Business Intelligence (BI) value. If a default BI value is required, enter accordingly in the field provided.

g) Click Continue.

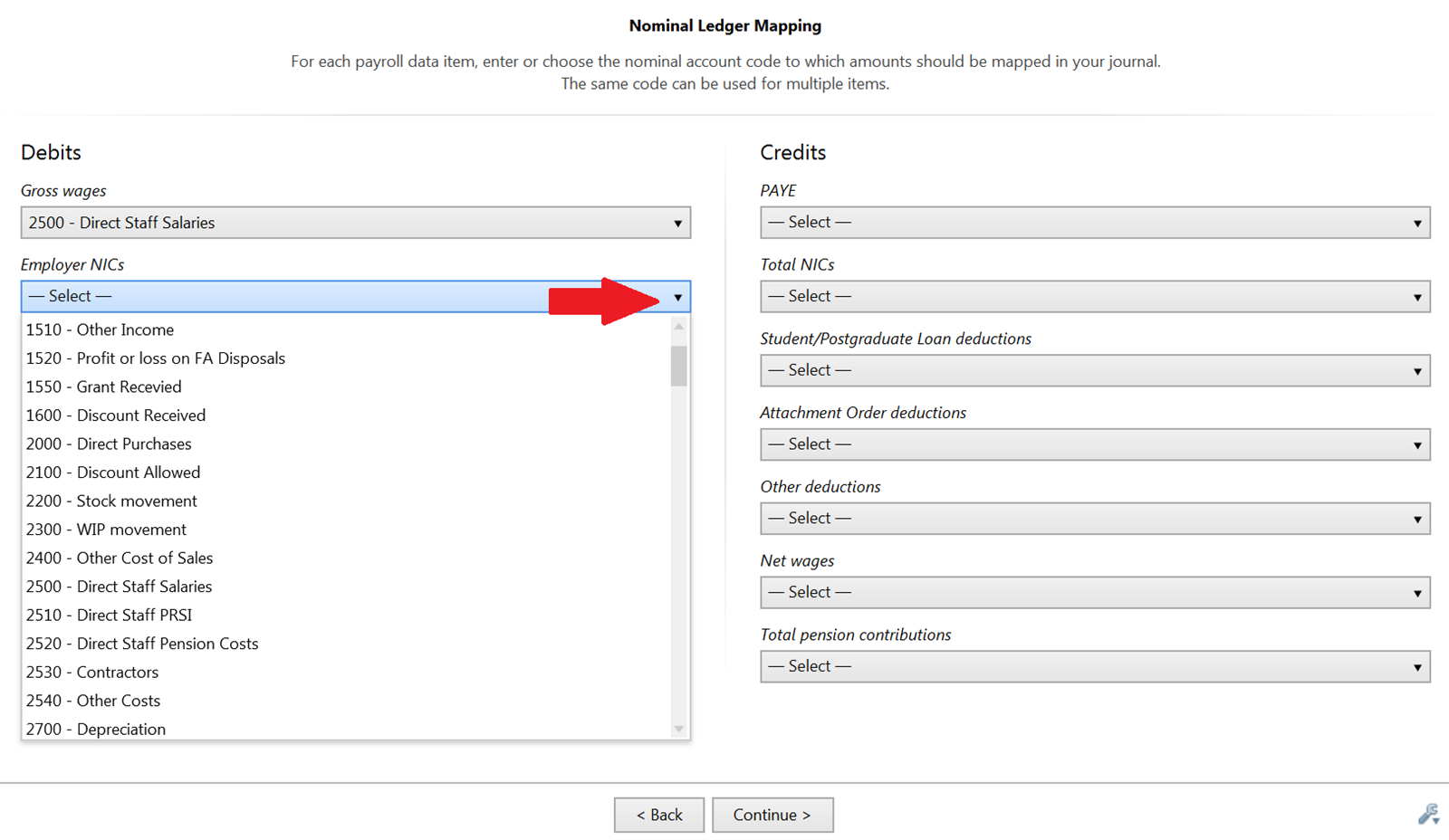

3a) Nominal Ledger Mapping - your nominal ledger codes will now be retrieved from AccountsIQ.

Simply map each payroll data item to the relevant nominal account code. A nominal account code can be used for multiple items.

b) When ready to proceed, click 'Continue'.

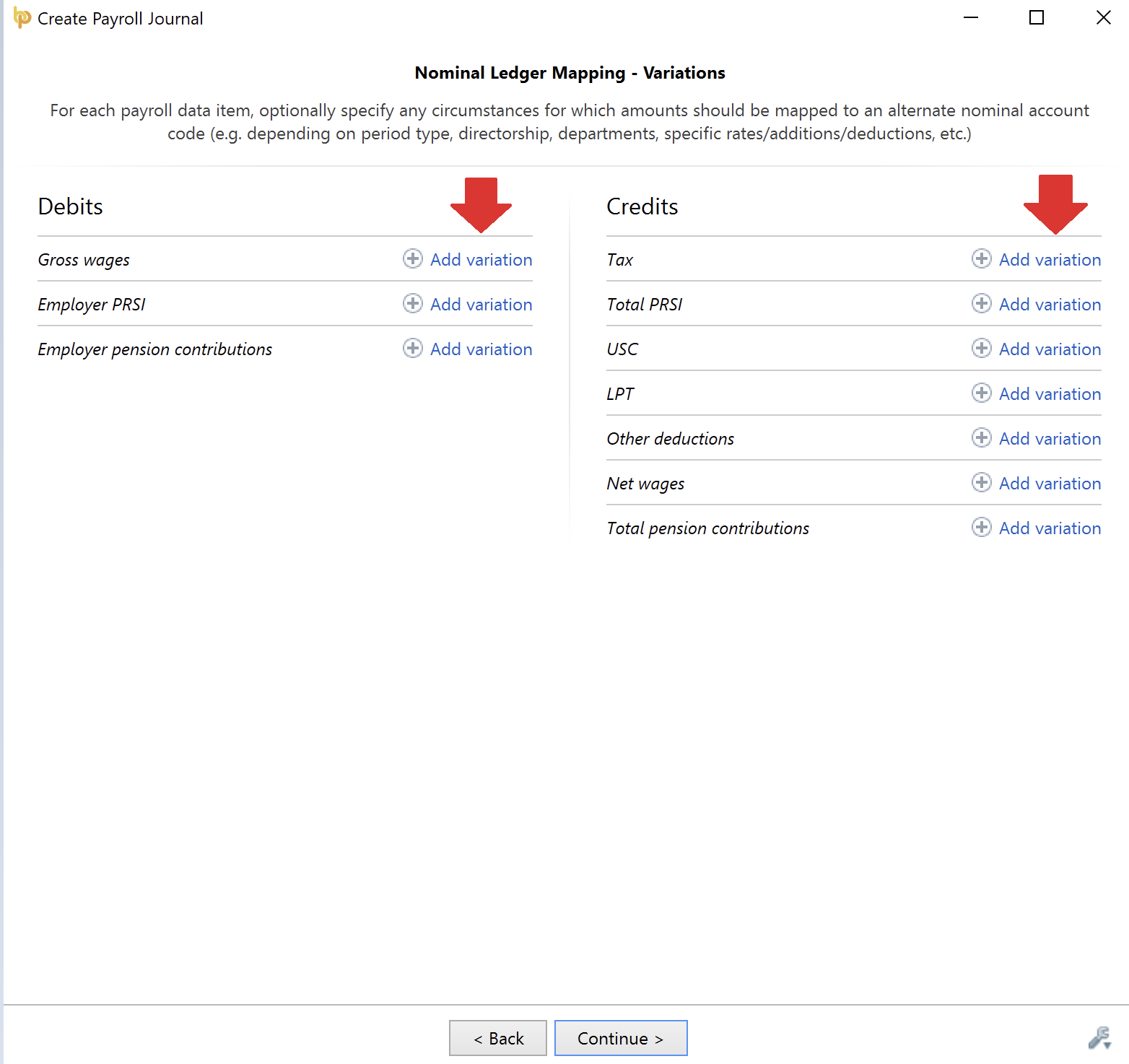

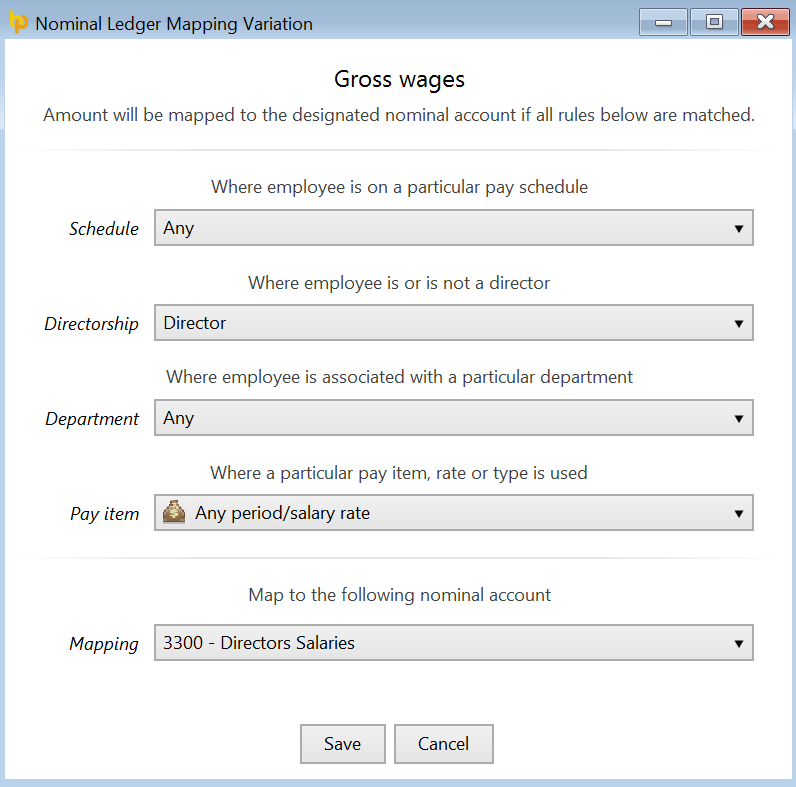

4) Nominal Ledger Mapping - Variations - this screen allows you to specify any circumstances for which amounts should be mapped to an alternate nominal account code (e.g. depending on period type, directorship, departments, specific rates/additions/deductions, etc.)

a) For each payroll data item you wish to add a variation for, click Add Variation:

b) For the payroll data item selected, set the rules to apply in order for the amount to be mapped to the designated nominal account you enter on this screen.

Rules can be set according to period type, directorship, department and specific pay items.

Example

You wish the salaries of all directors to be mapped to the Directors' Salaries nominal account within your accounting software. Your rules may thus be set as follows:

c) Click Save when complete.

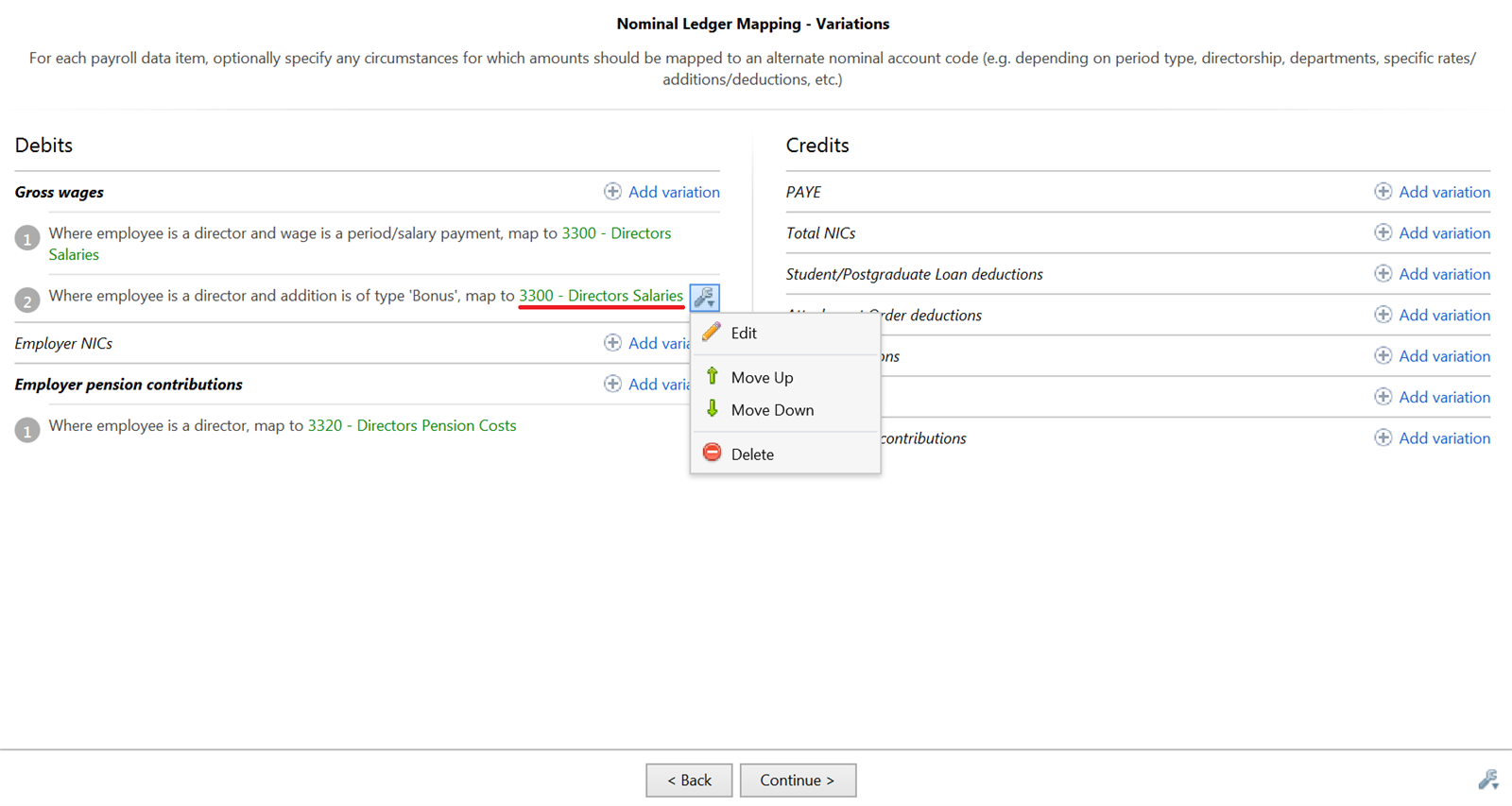

Your rule will now be displayed on screen under the payroll data item it is associated with.

d) Further variations can be added for different pay items or for the same payroll data item by simply clicking Add Variation again and setting the rules to apply.

e) Once variations have been set, these can be edited, deleted or re-ordered by clicking the spanner symbol next to it. In addition, clicking the nominal account information displayed in green provides quick access to the rules that have been set for it.

f) On completion of this screen (where required), click 'Continue'.

Your journal will now be displayed on screen for review. Simply click the 'Back' button to make any amendments.

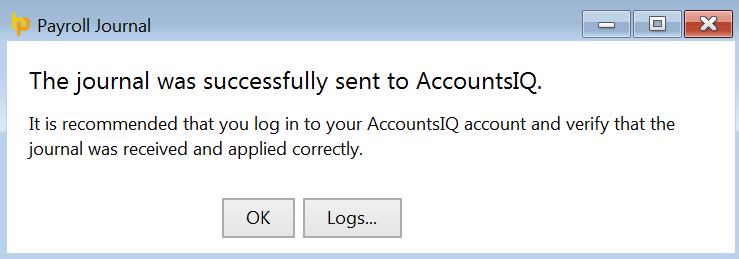

5a) When ready to upload your journal into AccountsIQ, click 'Send to AccountsIQ...'

b) Confirmation will be displayed on screen to confirm successful upload into your AccountsIQ account.

c) Press 'Print' to print, email or export a copy of your journal to PDF.

d) To close the journal screen, simply click the cross at the top right of this screen. If you have made any changes to the journal, you will be asked if you wish to save your changes. Click 'Yes' or 'No' as required.

Need help? Support is available at 01 8352074 or brightpayirelandsupport@brightsg.com.