To access this utility, go to Employees > Import & Export > Import/Update Employees from a CSV File.

1) Browse to the location of your Employee CSV File

2) Select the required file and click 'Open'

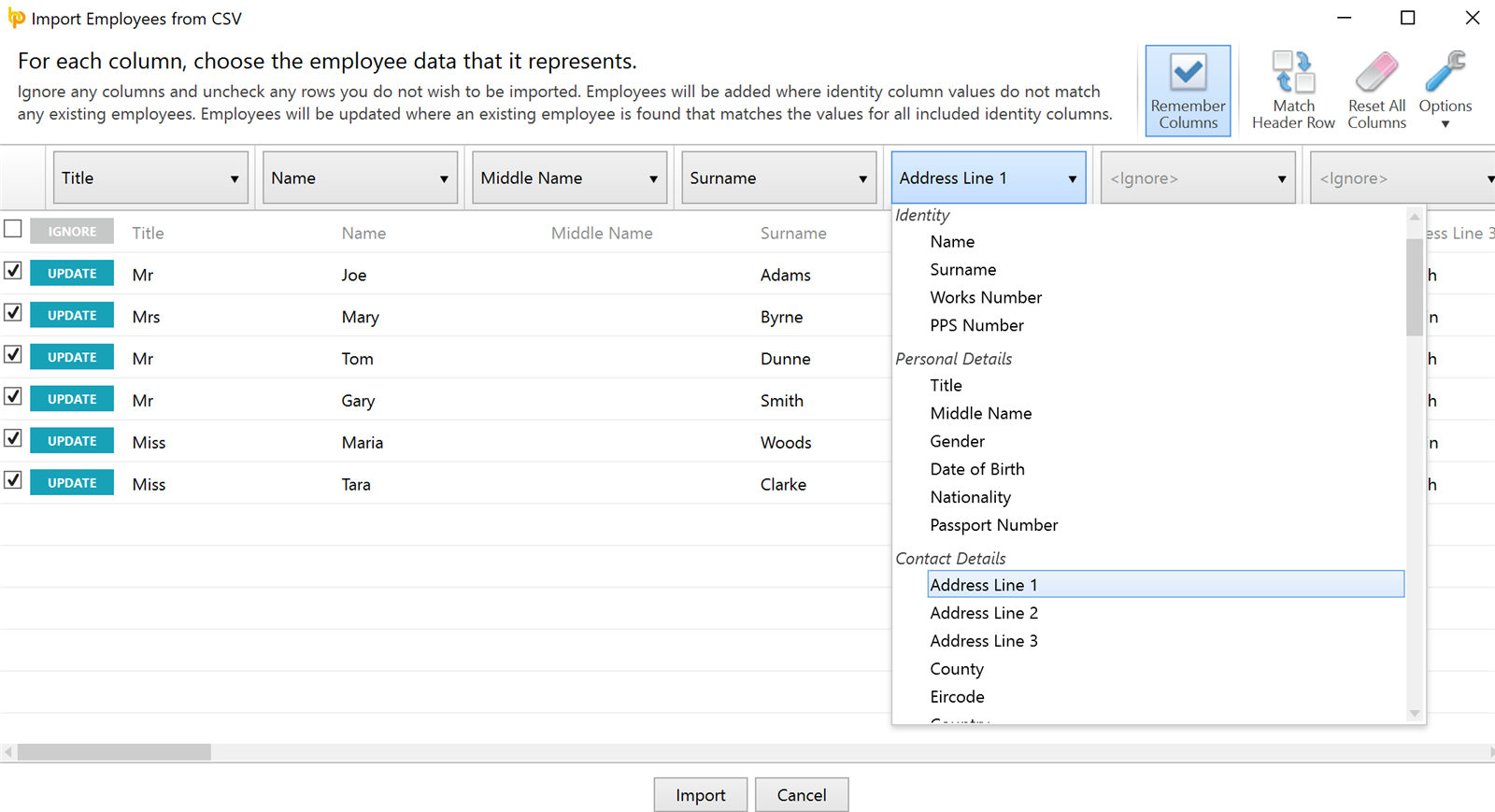

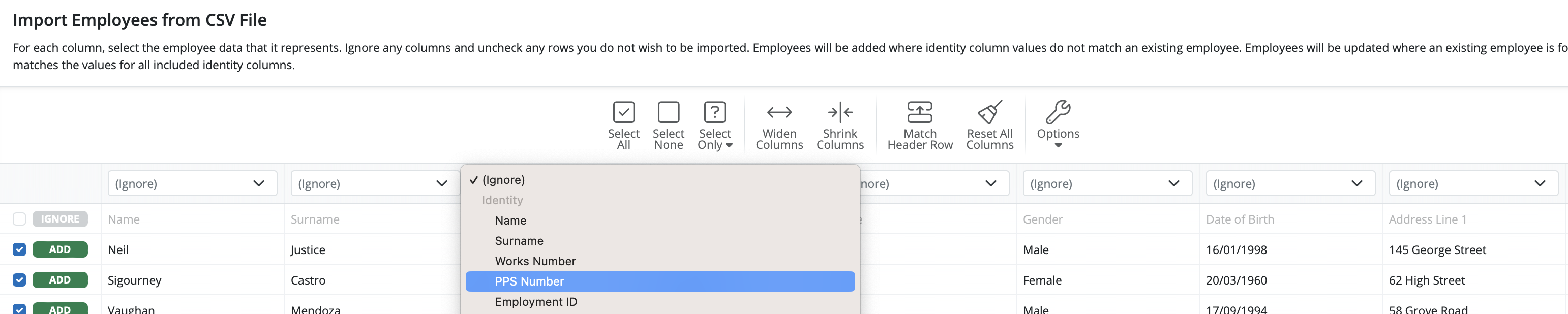

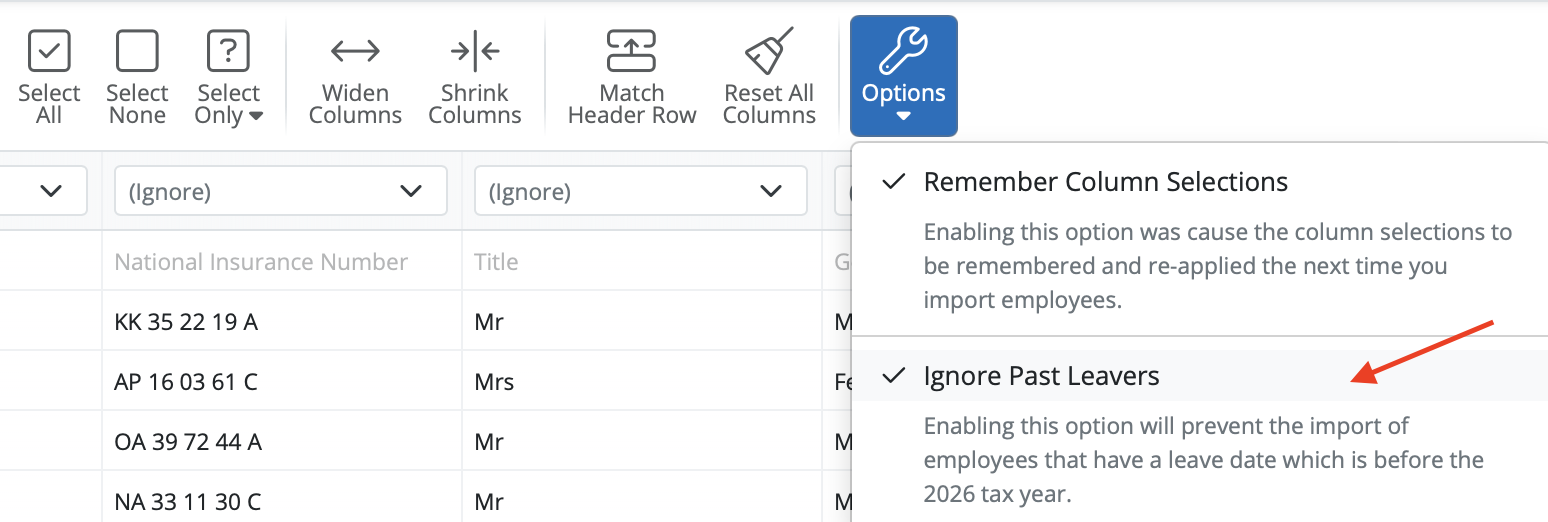

3) Your employee information will be displayed on screen. For each column, choose the employee data it represents. Ignore any columns and uncheck any rows you do not wish to be imported.

Note:

In order for BrightPay to match row data against existing employees, it will use the 'identity columns'. These 'identity columns' are:

At least one of the above columns must be selected by the user to trigger a match attempt. Rows will be deemed to match only if the values for all selected identity columns equal those for the employee.

4) Click Import to complete the import of your employee information.

Employee data which can be imported in to update existing employee records are:

Personal Details:

Title

Middle Name

Gender

Date of Birth

Nationality

Passport Number

Contact Details:

Address Line 1

Address Line 2

Address Line 3

County

Eircode

Country

Email Address

Phone Number

Employment Details:

Employment ID

Department

Directorship

Calculation Basis

Has PAYE Exclusion Order

Has A1 Certificate

Annual Tax Credit

Annual Tax Cut-Off Point

Is Exempt from USC

Annual USC Cut-Off Point 1

Annual USC Cut-Off Point 2

Annual USC Cut-Off Point 3

PRSI Class

Is Exempt From PRSI

PRSI Exemption Reason

Total LPT to be Deducted

ASC Calculation Method

Is on EWSS

Shadow Payroll

Annual Leave Entitlement Calculation Method

Leave Year Start Date

Is Annual Leave Carried Over From Previous Year

Number of Annual Leave Days Carried Over From Previous Year

Number of Annual Leave Days in Year

Number of Annual Leave Days in Month

Number of Hours in Working Day

Is Monday a Typical Working Day

Is Tuesday a Typical Working Day

Is Wednesday a Typical Working Day

Is Thursday a Typical Working Day

Is Friday a Typical Working Day

Is Saturday a Typical Working Day

Is Sunday a Typical Working Day

Starter/Leaver:

Start Date

Previous Employment Taxable Pay

Previous Employment Tax

Previous Employment USC-able Pay

Previous Employment USC

Previous Employment ASC-able Pay

Previous Employment ASC

Leave Date

Is Deceased

Payment:

Payment Frequency

Annual Pay Rate

Period Pay Rate

Standard Daily Rate of Pay

Standard Hourly Rate of Pay

Payment Method

Payment Bank Name

Payment Bank Branch

Payment Bank Sort Code

Payment Bank Account Name

Payment Bank Account Number

Payment Bank Reference

Payment BIC

Payment IBAN

HR:

Job Title

Document Password

Next Review Date

Medical Information

Notes

Additional fields which can be imported if a MID-YEAR setup:

Mid Year Cumulative Notional Pay

Mid Year Cumulative Medical Insurance

Mid Year Cumulative Tax-able Pay

Mid Year Cumulative Tax

Mid Year Cumulative USC-able Pay

Mid Year Cumulative USC

Mid Year Cumulative ASC-able Pay

Mid Year Cumulative ASC

Mid Year Cumulative LPT

Mid Year Cumulative Employee PRSI-able Pay

Mid Year Cumulative Employee PRSI

Mid Year Cumulative Employer PRSI-able Pay

Mid Year Cumulative Employer PRSI

Mid Year PRSI Class 1

Mid Year Cumulative Insurable Weeks at PRSI Class 1

Mid Year PRSI Class 2

Mid Year Cumulative Insurable Weeks at PRSI Class 2

Mid Year PRSI Class 3

Mid Year Cumulative Insurable Weeks at PRSI Class 3

Mid Year PRSI Class 4

Mid Year Cumulative Insurable Weeks at PRSI Class 4

Mid Year Pension Scheme Type

Mid Year Cumulative Employee Pension

Mid Year Cumulative Employer Pension

Need help? Support is available at 01 8352074 or [email protected].