Auto Enrolment in Ireland is a new retirement savings scheme launching on 1 January 2026, called MyFutureFund. It's designed to help workers who don't currently have a pension save for retirement. Here's how it works:

An employee will be automatically enrolled if they are aged 23-60, earning over €20,000 per year across all their employments, and not already paying into a pension scheme through payroll.

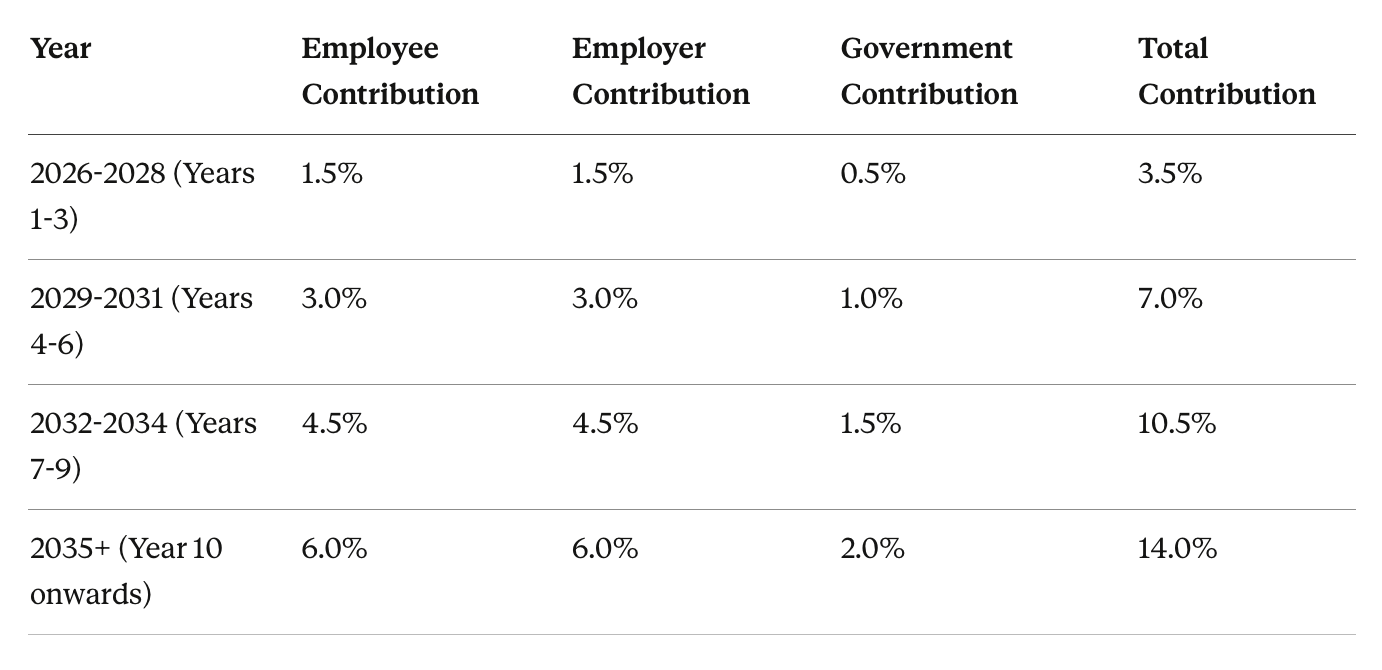

The scheme uses a triple-contribution model where the employee, their employer, and the government all contribute:

Please see the contribution rates below:

Key Points

An employee must stay in the scheme for at least 6 months. Between months 6-8, the employee can opt out and get their own contributions refunded. After 8 months, you can't opt out but can suspend contributions at any time. Even if you opt out, you'll be automatically re-enrolled after two years if still eligible.

The scheme is portable - it moves with the employee between jobs.

Ireland is actually the last OECD country to introduce such a system, addressing the fact that around 800,000 workers currently have no pension provision beyond the State Pension.Thank you13:54You're welcome! If you have any other questions about auto-enrolment or anything else, feel free to ask anytime. Good luck with your retirement planning!

NAERSA stands for the National Automatic Enrolment Retirement Savings Authority. It's a new body that has been established to run the MyFutureFund Auto Enrolment scheme.

NAERSA identifies employees who meet all the eligibility criteria, enrolls them, and sends an updated Automatic Enrolment Payroll Notification (AEPN) to their employer's payroll software. They also manage the employee's pension savings pot throughout the employee's participation in the scheme.

Through NAERSA's employee portal (accessed using their MyGovID credentials), employees will be able to view their savings including all contributions and investment returns, manage their investment strategy by choosing from different risk options, and exercise their rights to opt out, suspend contributions, or opt in to the scheme gov.ie.

Essentially, NAERSA is the government authority that oversees and administers the entire auto-enrolment pension system in Ireland, ensuring it runs smoothly for both employees and employers.Claude is AI and can make mistakes. Please double-check responses.

Need help? Support is available at 01 8352074 or [email protected].