Dec 2022

22

BrightPay year-end payroll checklist

Now that 2023 is almost upon us, let’s get you up to speed on your year-end duties. Here are some final things to note, and some common questions that’ve come in, so you can have your payroll software all set and ready to go for January.

Download BrightPay 2023

You can purchase your licence for the new tax year by simply logging into your BrightID. From here, go to ‘Licences’ and ‘purchase a desktop licence key’. Just select the type of licence you require, select a payment method, enter your billing details, and you’ll be emailed your licence key. To download the software for the new tax year, click here.

Import data from previous software

Once you’ve downloaded the 2023 software, on the open screen, select Import Employer(s) > Choose import from BrightPay 2022 and click Open. If you have more than one employer file, highlight all and then click 'Open'. BrightPay will let you know when the import’s complete.

Get your year-end summary report

Year-end summary reports are available in BrightPay under Analysis > Year to Date, and choose ‘Tax Year’ as your period type.

No P60s and P35s needed – employees just access their EDS

P60s are no longer used as of 2019, and have been replaced with Employment Details Summary (EDS). This is essentially a summary of an employee’s pay, income tax, USC, PRSI and LPT and is available for to access, print or save through Revenue’s myAccount. We advise that employees wait until after the 15th of January to access their EPS, as employers can make corrections on them up until this date.

P35s are also no longer used, and have been replaced with PSRs that are submitted each pay period through your payroll software to Revenue.

When will 2023 RPNS be available?

RPNs for next year will be available in December 2022, but won’t be updated in real time until 2023. If an employee’s payment date is 2023, you must use 2023 RPN as a 2022 RPN can’t be used in 2023. We advise payroll processors to not make payroll submissions with a 2023 pay date until the RPNs are available, as emergency tax will apply.

What is a ‘Week 53’ and do I have one?

A ‘Week 53’ is when there’s an extra day in the tax year and a pay day falls on the 31st of December or, in a leap year, on the 30th or 31st of December, and is not the employee’s normal payday.

It only applies to employees who are paid weekly (53 weekly payments) fortnightly (27 fortnightly payments) or every four weeks (14 four-week payments) pay days in the year.

If a ‘Week 53’ payment applies to an employee, PAYE Regulations state that the employers should use the latest RPN to apply an extra pay period’s Tax Credit and Cut-Off Points, and deduct Income Tax and USC on a Week 1 basis.

Your payroll software should automatically apply the ruled outlined above. Just make sure to run ‘Week 53’ as a separate payroll run to other pay periods, so the is submitted with the correct payment date to Revenue. BrightPay will know by your payment schedule if a week 53 is applicable and will only offer it if it’s required to do so.

Please note that if an employee's normal pay day has changed during this tax, additional USC cut off points don’t apply. To let the software know and prevent these extra USC cut off points from being allocated, go to Employees > Select the employee > Click their Revenue Details tab> Tick Exclude the employee from the week 53/54/56 USC concession box > Save changes.

What if an employee's pay straddles between two tax years?

If an employee’s pay straddles between two tax years, credits and rate bands cannot be given in advance. So if an employee is receiving two weeks of pay on the 23rd of December this year for the following two Mondays on the 26th December and 2nd January, the payment date must be reported as December 23rd using the credits and rates from week 52. They will then receive the benefits of two weeks’ credits and rate bands in week 2 of 2022. ‘Week 53’ will not apply to this situation and if attempted, will result in underpayments to employees.

Here at BrightPay, we work hard behind the scenes to ensure our payroll software has all the latest updates, and is simple and easy to use. For all the latest payroll trends and news, subscribe to our weekly newsletter. Interested in learning about our cloud extension, BrightPay Connect? With our cloud-extension, you have access to a self-service dashboard, an employee app, an annual leave management tool and much more. Book a demo today to see what you’re missing.

Dec 2022

15

What's New in BrightPay 2023?

BrightPay 2023 is now available (for new customers and existing customers). Here’s a quick overview of what’s new:

2023 Tax Year Updates

- 2023 rates, thresholds and calculations for PAYE, USC, PRSI, LPT and ASC.

- Support for retrieving and using 2023 Revenue Payroll Notifications (RPN).

- Support for creating and sending 2023 Payroll Submission Requests (PSR).

- Support for the new CO2 emissions based calculation of vehicle benefits from 2023 onwards.

- Support for Statutory Sick Pay.

BrightPay is now 64-bit

BrightPay is now a 64-bit application. This does not make any difference to the experience of using BrightPay or its functionality, but it comes with a few nice optimisations:

- 64-bit apps just run better on 64-bit versions of Windows (which our telemetry shows us over 95% of our customers are using).

- 64-bit apps are able to access more computer memory than 32-bit apps can. This means that BrightPay will more smoothly handle employer files with a very large number of employees.

A 32-bit version of BrightPay for Windows will continue to be made available for those who need it.

Other New Features and Updates in 2023

- Support for manual journal entries.

- Improves handling of employee payment/bank details – changes to details now automatically apply across the whole tax year, meaning that finalised payslips no longer need to be re-opened first.

- Several additional minor improvements throughout the entire BrightPay user interface, as well as the latest bug fixes and security improvements.

- Signing into Connect uses your Bright ID, which makes getting started with Connect easier and simpler.

What's Next?

We're continually at work on the next version of BrightPay, developing new features and making any required fixes and improvements. See our release notes to keep track of what has been changed to date at any time.

Feb 2022

18

“It’s just so easy to use” – What customers have to say

We were delighted to have received a 99% Customer Satisfaction rate in our 2021 Customer Survey. The survey asked BrightPay payroll software customers to rate a number of different features, including its payroll features, its value for money, time saving capabilities, cost savings, and user interface. The results showed an overall 99% satisfaction rating with an overwhelming number of customers commenting on the software’s easy-to-use interface and intuitive design.

What are customers saying about BrightPay?

Whether you’re a business owner with a small team of employees or an accountant with 50 clients processing payroll for hundreds of employees, your payroll software should provide you with essential help. From quickly running multiple payment schedules side-by-side, to utilising the flexible report builder, and sending Payroll Submission Requests each pay period, BrightPay customers experience a quicker and more straightforward payroll process.

The interface:

The importance of an intuitive software design cannot be overstated. It allows users to easily understand how the software works, learn how to use the software quickly with minimal instruction, and it provides for a more pleasant user experience. Payroll comes with many different components and factors to it and while BrightPay’s payroll software provides full functionality, it has not compromised on its design. Customers, both new and old, have commented on this. When asked why they would recommend the software to a colleague, replies included:

- “Compared to other payroll software we've used, it's easy to use and intuitive”.

- “Hassle free and easy to operate”.

- “If I can use it, anyone can. It’s so easy to use, coupled with excellent back-up service”.

Response to COVID-19:

It’s been a challenging year for payroll processors, adapting to new schemes and subsidy rates, from the Temporary Wage Subsidy Scheme (TWSS) followed by the Employment Wage Subsidy Scheme (EWSS). BrightPay has quickly rolled out updates in response to these changes and have supported customers by partnering with Revenue to host frequent webinars. This allowed businesses and payroll processors to ask any questions that they had and ensured they had the most up-to-date information on the schemes. 99% of customers rated the free online webinars and payroll upgrades as excellent and 100% of customers rated phone and email support as excellent.

“COVID-related webinars, especially early on in the pandemic were excellent. Without doubt the best source of user-friendly information available.

I was especially appreciative of the question & answer sessions, which helped me appreciate that I wasn't the only person who had queries regarding administering the new protocols.

The speakers were always well informed and had pragmatic solutions to any issues raised. The quality of these presentations was the main reason I moved our payroll to Brightpay.”

- BrightPay Customer

More on Customer Support:

BrightPay’s excellent customer support is a point of pride, and we were delighted to see 98% of customers were extremely satisfied with the support they received the past year. The support offered to customers includes phone and email support from payroll specialists to free product demos, webinars, guides, and other documentation. Customer support is included in all licences and has been free for nearly 30 years!

What can BrightPay customers expect next?

BrightPay continues its development plan and to evolve to create the best customer experience possible. We recently rolled out new integrations with several accounting software so customers can send their payroll journals directly to their accounts at a click of a button. In addition to this, we launched an API with Modulr, the payments platform, facilitating direct payments to employees.

We’d like to thank all customers who took part in our customer survey. Your feedback is used to adapt the development strategy to ensure we’re delivering on what you really want when it comes to payroll software.

Discover more:

To discover more about BrightPay and how it can improve your payroll services and save you time, schedule a 15-minute demo with a member of our team today.

Related Articles:

Jan 2022

7

Revolutionize your payroll this year with digital banking

Similar to their European counterparts, Irish consumers have increasingly moved online, both for their shopping and for their banking. Over the past year, consumers who had previously never used digital channels turned to online and mobile banking for the first time. The use of cash declined while contactless payments surged, with a record €1 billion payments made in May 2021. While the use of digital banking has been on the rise for a number of years now, the pandemic urgently accelerated a shift in digital behaviour. A survey conducted at the start of this year found that 69% of Irish consumers trust digital banking providers with 62% of these saying it was due to the simplicity of their services.

It should come as no surprise that this change in digital behaviour is also reflected in how businesses are managing their payments. As technology continues to advance and consumers become more experienced with digital banking, their behaviour is reflected in their decision making in the workplace. This has already been seen in the payroll sector.

In the UK, we’ve seen payroll processors adopt digital banking solutions in order to improve their payroll workflow, have more flexibility with making payments, and to send faster payments to their employees. Accountants and payroll bureaus have also begun offering it as a new service to customers.

How does digital banking improve the payroll workflow?

An integrated system between the payroll software and the digital finance platform can offer a smoother, more efficient payroll workflow. Using an API (Application Programming Interface) users can initiate payments from within the payroll software enabling them to pay employees and subcontractors with a few clicks of a button. It saves time and is more efficient.

How does digital banking offer more flexibility?

Those payroll processors experienced with using traditional bank payment methods will be used to the overly long process of submitting bank files every month or even every fortnight, to pay employees’ wages. You’re typically required to submit bank payment files at least three days in advance of when the payment is due which can be quite a manual process with numerous steps involved in it.

Digital banks offering access to the Single Euro Payment Area (SEPA) allows businesses to send payments across the EU member states (and 8 other countries) and can also offer the option of EUR and GBP accounts. Payments can be sent on the day they’re due (before 2.00pm) and if they’re sent any time after that or sent on a non-working day, they’ll arrive by the following working day.

How can payroll processors access digital banking?

BrightPay users now have access to Modulr, the payments platform behind banking app Revolut, to pay employees. Payroll processors looking to speed up their workflow with a more convenient payment method will have access to SEPA credit transfers. By signing up to Modulr, the payroll processor can initiate payment from within BrightPay once the payroll has been finalised. The payment then needs to be approved by two-factor authentication using their phone before being sent to employees.

Learn more about BrightPay's integration with Modulr.

What is the future of SEPA?

SEPA is a much better alternative to bank payment files which is why there has been such an uptake of it across the EU. It allows for quicker payments and faster processing times. However, as part of their long-term strategy, the European Payments Council have developed SEPA Instant Payments. With this, users can send payments instantly 24/7. While this has not been rolled out by retail banks in Ireland yet, it’s likely we’ll see the rollout of this by more digital banks in the near future. Stay posted!

To keep up with the latest payroll news, check out our new Bright website. There, you'll be able to register for any of our upcoming payroll webinars and download our payroll guides.

Related Articles:

Dec 2021

14

What's New in BrightPay 2022?

BrightPay 2022 is now available (for new customers and existing customers). Here’s a quick overview of what’s new:

2022 Tax Year Updates

- 2022 rates, thresholds and calculations for PAYE, USC, PRSI, LPT and ASC.

- Support for the Employment Wage Subsidy Scheme (EWSS) continues to be available in the 2022 tax year.

- Support for retrieving and using 2022 Revenue Payroll Notifications (RPN).

- Support for creating and sending 2022 Payroll Submission Requests (PSR).

Pay Using Modulr

You can now create and send payment requests to Modulr directly from BrightPay, provided you have an active Modulr account that is set up for making payments. Payee information and amounts are automatically populated using the data from your payroll, making it a simple, fast and efficient way to pay your employees.

Integration with Surf Accounts

BrightPay can now post payroll journals to Surf Accounts.

Other 2022 Updates in BrightPay

- The way of setting up a pay schedule for the tax year has been changed in response to customer feedback, making it clearer and more flexible.

- Ability to auto-zeroise individual basic payments, additions and deductions for each pay period (i.e. repeat them into the next pay period as usual, but with a zero amount)

- Ability to auto-generate works numbers.

- BrightPay now shows the total "number of employees" in many more on-screen summaries and report documents.

- Lots of minor improvements throughout the entire BrightPay user interface, as well as the latest bug fixes and security improvements.

What's Next?

We're continually at work on the next version of BrightPay, developing new features and making any required fixes and improvements. See our release notes to keep track of what has been changed to date at any time.

Nov 2021

17

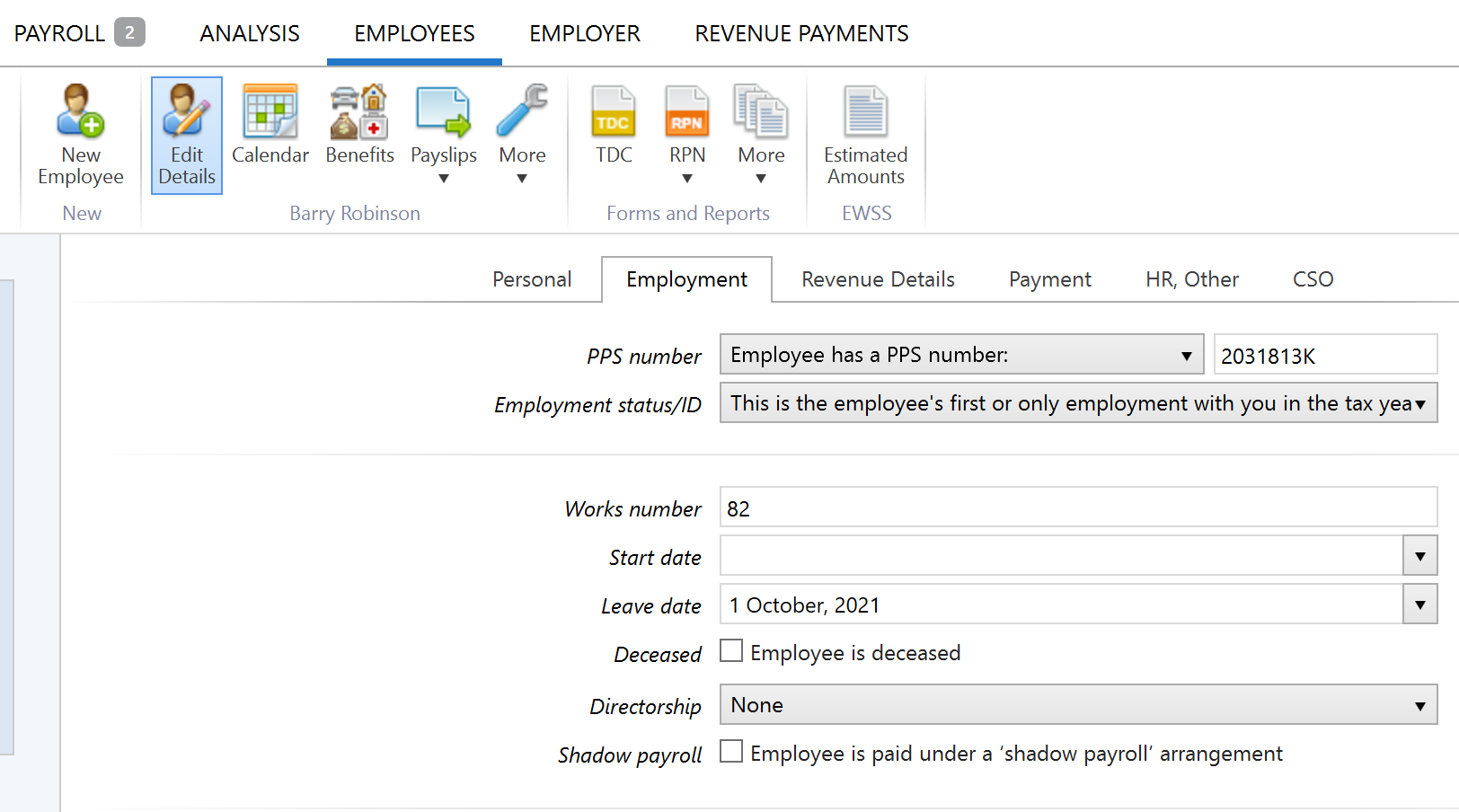

How to process a leaver in BrightPay

When an employee leaves their job, they must be marked as a leaver in the payroll. The employee’s leave date must be entered before their final pay period is finalised. This sends information to Revenue when the Payroll Submission Request is sent to let them know that the employee has left. Under PAYE Modernisation, employers are no longer required to issue a P45 to an employee and submit the P45 Part 1 to Revenue.

How to process a leaver in BrightPay

It couldn’t be easier to process a leaver in BrightPay. To do so, follow the step-by-step instructions below:

1) Before finalising the payslip, access the employee record by clicking on their name within the Payroll utility. Next, you can select the employee’s last day of work from the dropdown menu. Click 'Save Changes'.

2) Once saved, return to the Payroll utility and finalise the employee's payslip when ready to do so. On finalising the employee's payslip, you will be prompted to submit the associated payroll submission to Revenue. This submission will contain the employee's leave date and report it to Revenue.

As a result, the leaver will no longer be included in any future pay periods. However, the employees’ payslip history will be still available on BrightPay if needed.

BrightPay runs free online demos daily to show you the ins and outs of how the software works. Book your free place now.

Related articles:

Nov 2021

11

BrightPay Payroll: Evolving to exceed customers expectations

In this year’s annual customer survey, BrightPay Payroll Software received a 99% customer satisfaction rate. The score, along with our customers’ comments, reflected and highlighted the software’s easy-to-use interface and the variety of functions it provides. The customer survey is a great way for us to understand what our customers love about the software, and more importantly, what they’d like to see improve. The suggestions and feedback are used to help us plan our product development timeline and to ensure we’re continually evolving to not only meet our customer’s expectations, but to exceed them. Our focus on improvements and creating a better customer experience has seen two new features recently added to BrightPay payroll software; payroll journal integrations and a payments integration.

Send payroll journals directly from BrightPay to your accounting software:

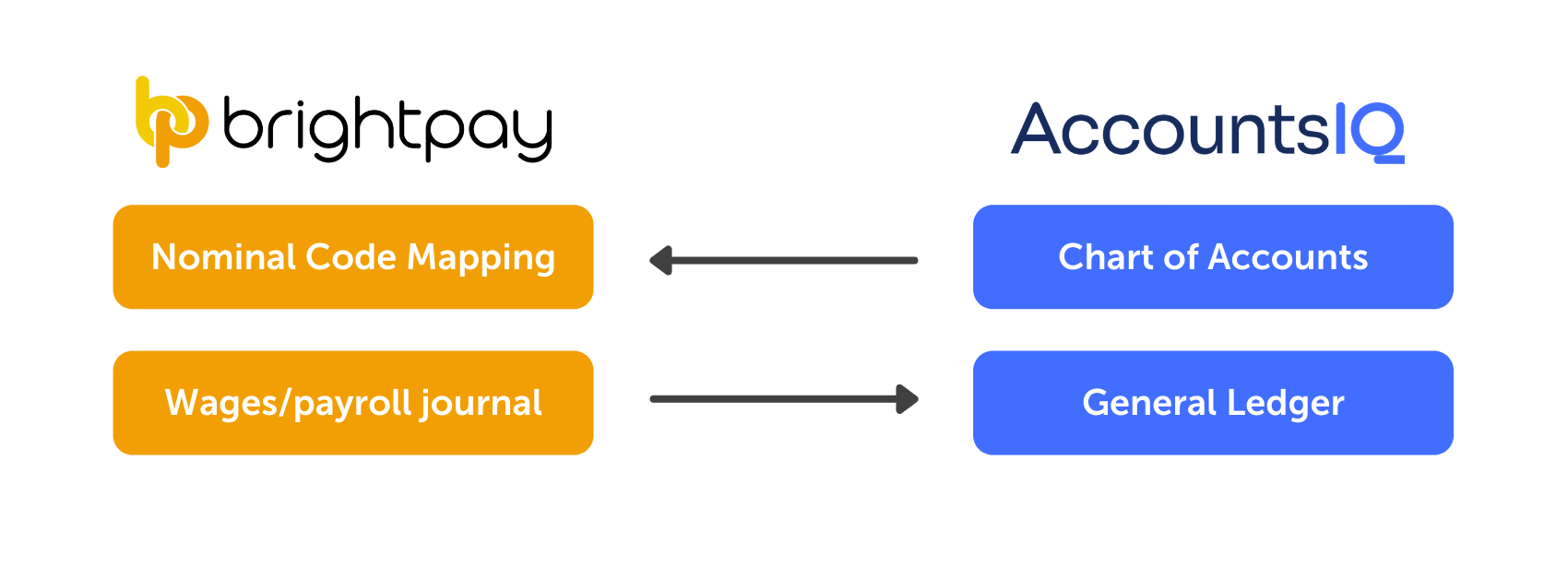

The payroll journal feature allows users to create wage journals from finalised pay periods so that they can be added directly into various accounting packages. Four new payroll journal integrations have been added to BrightPay payroll software, allowing you to send your payroll journals directly from BrightPay to AccountsIQ, Quickbooks Online, Sage Business Cloud Accounting, and Xero. Thanks to the integrations, you’ll no longer need to export CSV files from the payroll software and import them to the accounting software. Instead, BrightPay's APIs facilitate direct access to your accounting software, saving you time, reducing mistakes, and improving your payroll workflow.

How does it work?

Your payroll journal file is customised to the accounting package you use. It includes compatible files and a built-in nominal ledger mapping system. With the nominal ledger mapping, you can decide where payroll items get posted to in your accounting software. Once you’ve decided which nominal accounts they will be added to, you can save the settings. For future use, you simply select the date range you want the payroll journal to include and click send.

Credit Transfer Integration:

To make paying employees quick and easy, BrightPay have introduced a new payments integration with Modulr, the payments platform. Modulr is a fintech company who are the payments platform behind the digital banking app, Revolut. With the Modulr API you have access to the Single Euro Payment Area (SEPA), the European-wide payments scheme. From BrightPay, you can initiate credit transfer payments to employees, saving you time and simplifying the payroll payments workflow.

How does it work?

Once the payroll has been finalised, Modulr customers can pay employees by selecting ‘Pay by Modulr’ in BrightPay’s payroll software. You’ll be asked to login to your Modulr account and to approve the payment using two-factor authentication on your mobile phone. The payments will then land in your employees account by one working day. If you don’t have an account with Modulr, you must first register as a new customer. To learn more about this feature, click here.

Please note that to avail of this new feature, customers will be subject to additional charges.

Discover more:

To discover more about BrightPay and how it can improve your payroll services and save you time, schedule a 15-minute demo with a member of our team today. Or to try BrightPay for yourself, why not begin your 60-day free trial today. The free trial is fully featured with all functionality.

Related Articles:

Nov 2021

5

No cost, no commitments: try BrightPay for free for 60 days

Procrastination is something which we can all be guilty of in different areas of our lives. Whether it’s making a phone call or getting new tyres for your car, we can all fall prey to putting things off or leaving things to the last minute. “Procrastination is the thief of time” is a phrase from a 1742 poem that is still very relevant today. And this saying couldn’t be more true when it comes to switching payroll software provider. We usually procrastinate tasks that we perceive to be difficult or unpleasant and it is understandable that you may feel this way about trying a new payroll software. However, this doesn’t need to be the case.

You may have been thinking about switching your payroll provider for some years now. You’ve been delayed, perhaps because, in previous years you were busy and didn’t get around to doing it. Before you knew it, the new tax year was looming, and you decided it’s easier to just stay put with your old provider. This is a common mistake often made by payroll processers and one that can turn into a vicious circle that goes on for years. Meanwhile, you may be wasting time and money by using a subpar payroll software.

When is the best time to switch payroll software provider?

NOW is the time to do your research and make the important decision as to which software is best suited to your needs. When it comes to switching your payroll provider, the worst thing you can do is to leave it until the last minute. The beginning of the new tax year is of course the most common time people switch, mainly because they want to get their money’s worth from their previous software subscription, and they don’t want to have to pay for a whole new subscription that will only be used for a few months. However, waiting until then to make your decision is not advisable. If you wait until December, you are not leaving yourself enough time and chances are you’ll end up putting it off for another year.

Another worry for payroll processors is moving the payroll data from one software to the other. However, the new tax year will be the busiest time of the year for payroll software providers’ migration and customer support teams. By deciding to move now, you can avoid the rush, and will also receive extensive support in migrating your payroll data.

BrightPay are offering a 60-day free trial of our software where you can experience the full functionality of BrightPay at no cost and with no commitments. 60 days gives you plenty of time to try out our software, make an informed decision and migrate your data with the help of our experts, all before the beginning of the new tax year. By utilising our free trial, you can copy over your data and run a dummy payroll on BrightPay alongside your current software. Doing this allows you to discover the advantages BrightPay may have over your current provider before you fully switch.

By downloading our free trial, you won't be left asking yourself “what if?". You have nothing to lose, and it means getting something else ticked off the to-do list. Even if you think you are happy with your current software, a free trial allows you to discover what you may not even know you are missing.

Click here to begin your 60-day free trial today. The free trial is fully featured with all functionality.

Related articles:

Oct 2021

1

The hassle-free way to maximise your profits from processing payroll

Accountants and payroll bureaus sometimes find that processing payroll takes a lot longer than they would like. Because of this, some accountants may be making little to no profit from offering payroll as a service. Nevertheless, it is a service expected by customers. If you aren’t making a profit from payroll processing, this could be down to not using the right payroll software. By switching to a payroll software that automates tasks you can transform payroll from a time-consuming manual process into an easy process where certain tasks take care of themselves, saving you both time and money.

Not only can you make a profit from processing payroll but depending on what payroll software you use it can be an opportunity to maximise profits by allowing you to offer new services to your clients which you may not have considered before. When it comes to introducing your staff and your clients to new services, you may think you have enough on your plate and that it would take up too much of your time. However, BrightPay Connect, a cloud add-on to BrightPay Payroll software, has little to no learning curve, allowing you to immediately begin offering additional services to clients. Offering new features such as a self-service dashboard for clients, a mobile app for their employees or giving your clients access to new HR tools is a lot easier than you think.

In our upcoming free webinar, we will discuss how cloud technology and automation is transforming payroll services and allowing payroll bureaus and accountants to increase profits. Register here.

Webinar agenda:

- Automatic cloud backup

- Payroll reports accessible by the client

- Annual leave management tool

- Integration with accounting software

- Support for remote working

- Client payroll entry & approval

- Bureau and client self-service dashboards

Please note: This webinar is specifically designed for accountants, bookkeepers, and payroll bureaus.

Webinar Information:

The webinar takes place on 7th October at 11.00 am and is free to attend for accountants in practice and payroll bureaus.

If you are unable to attend the webinar at the specified time, simply register and we will send you the recording afterwards.

Sep 2021

16

Seamless integration at your fingertips

BrightPay recently announced that new journal integrations were added to the payroll software. These integrations allow customers of AccountsIQ, Quickbooks Online, Sage Business Cloud Accounting, and Xero to send their payroll journal directly from BrightPay to their accounting software at the click of a button. In BrightPay, your payroll journal file is customised to the individual accounting software provider, with compatible files and built-in nominal ledger mapping. Using the integrated system means you can save time, reduce mistakes, and improve your payroll workflow.

How important is an integrated accounts and payroll system?

An integrated accounting and payroll system can simplify how you work and allows you to have the best of both worlds. You can have your payroll software with its easy-to-use interface and full functionality without having to spend unnecessary time exporting payroll data to your accounting software. With the journal API (Application Programme Interface) integrations you can:

Save time:

If you are responsible for carrying out payroll duties and sending this data to your accounting package each pay period, you are familiar with the amount of time it can take. By using the API you can significantly reduce the amount of time you spend on this task. Instead of exporting and importing the figures manually, the payroll journal is sent directly to your accounting software and the figures are automatically added to the general ledger.

Reduce costly mistakes:

Double entry of figures can result in costly mistakes that end up taking time to identify and correct. The API integration means that this data is transferred straight from BrightPay payroll software directly to the journal, avoiding any chance of errors occurring.

Improve efficiency:

The purpose of an API integration is to allow two systems to communicate with one another in order to improve business processes and enhance productivity. With the payroll journal integration you can benefit from a quicker and more efficient workflow. The payroll information can be set up to be sent to the relevant ledgers. For example, you can post wages and salaries cost from the payroll to the nominal ledger account in your accounting software called ‘Wages and Salaries’. If you want to create any exceptions to this, you can. For example, you can separate out the costs of directors’ salaries to be mapped into a separate nominal account.

How does the BrightPay journal integration work?

The set-up of the API for the different accounting software is very similar. Using the API for AccountsIQ as an example:

- First, sign into your AccountsIQ account in BrightPay.

- The nominal ledger accounts will be retrieved.

- Map each payroll data item to the relevant nominal account.

- The payroll journal can include records for payslips across multiple pay frequencies.

- A nominal account can be used for multiple items.

- Specify any circumstances for which amounts should be mapped to an alternate nominal account code.

If you are using a different accounting software, you can discover how to set it up by clicking the following links: Xero, Quickbooks, and Sage Business Cloud Accounting.

Learn more:

If you’re interested in learning how BrightPay can improve your payroll services and save you time, schedule a 15-minute demo with a member of our team today.

Related Articles: