Oct 2021

28

New Feature: Introducing direct payments through BrightPay

BrightPay has partnered up with payment platform Modulr to give payroll processors a fast, secure and easy way to pay employees directly through BrightPay Payroll software. Up until now, when you wanted to pay employees through credit transfer, you needed to create a bank file that would then need to be uploaded to your online banking account. This can be quite a manual process that is prone to human error. This new method of paying employees cuts down on admin work and eliminates manual entry errors, saving you time.

To use this new integration, first, ensure you have created a Modulr Account. You will also need to download a mobile app called Authy which you will use to authenticate user logins and payments. The Authy app is a second layer of security that will help protect your account from hackers or data breaches.

How does BrightPay’s new direct payments feature work?

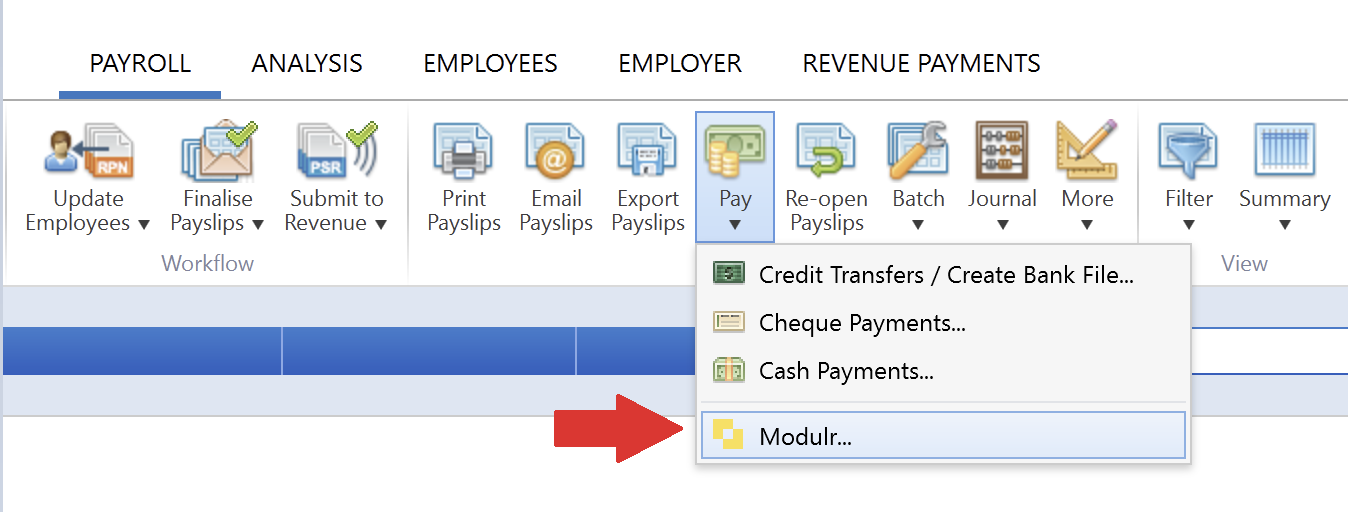

1. Once you have finalised the payslips, under the pay tab choose Modulr.

2. A box will then appear on screen asking you to log into your Modulr account.

3. Once you have entered your details, you will authenticate your login through the Authy app on your mobile device.

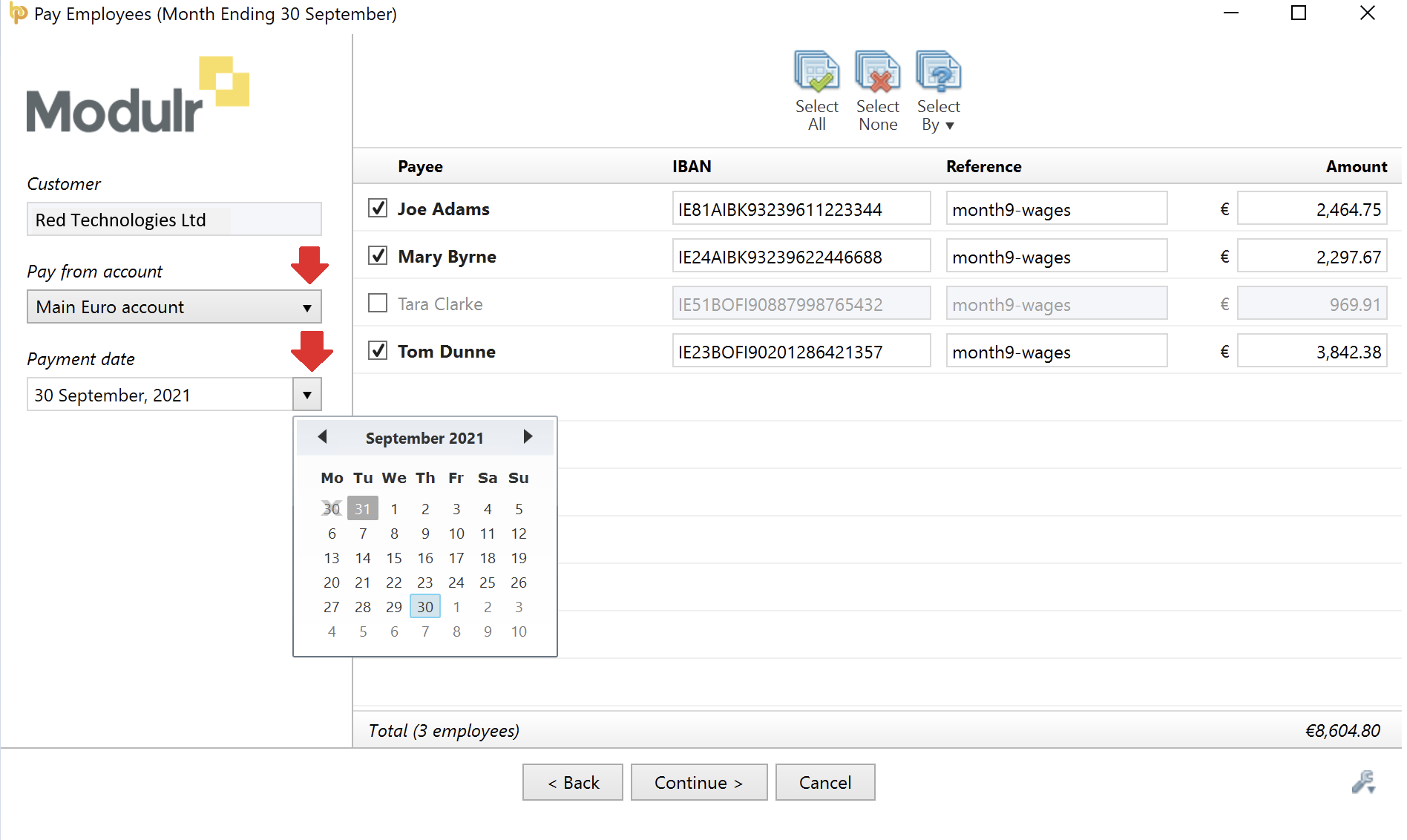

4. Once set up, your payroll information in BrightPay will automatically synchronise with your Modulr account. In the pop up, any employees whose payment method is set to credit transfer will be listed along with their IBAN and the amount they are to be paid for that period, a reference can also be added here.

5. Next, simply select the account you would like to make the payment from and choose a payment date.

6. After clicking continue, you will be shown a summary of your payment request submission. Once you have reviewed the payment request you can click “Send to Modulr.”

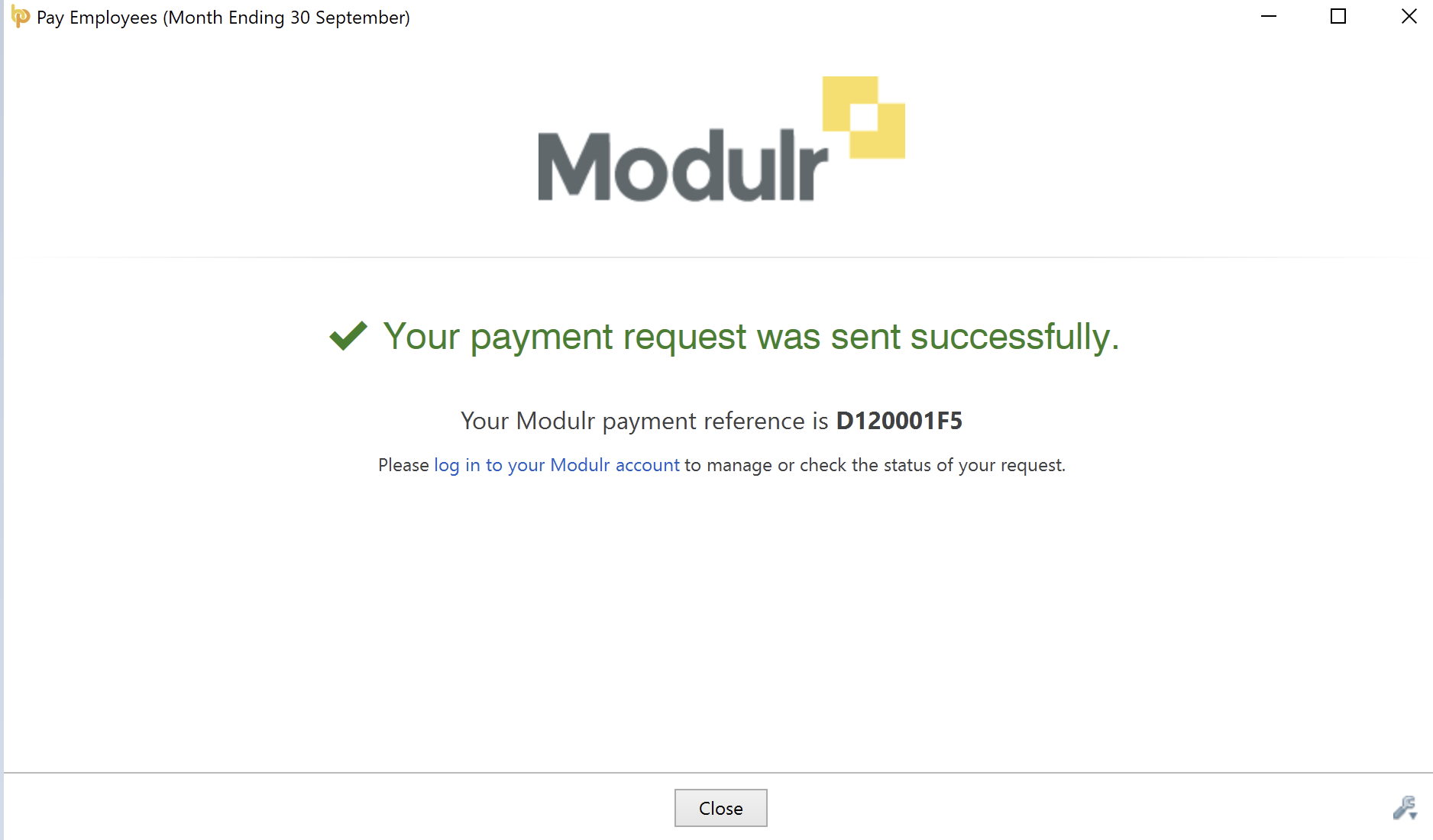

7. You will need to authenticate the submission by once again using your Authy app. The following screen will be displayed to let you know that the transfer has been successful:

8. The final step is for the authorised person to log into their Modulr account and approve the payment request submission. This may be the payroll processor themself or if you are processing payroll for a client then this task can be assigned to the client, giving them control by allowing them to give the final approval on the payment of employees.

For more detailed instructions on how to use Modulr with BrightPay, view our help guide or watch our video tutorial.

What are the benefits of using BrightPay’s Modulr integration to pay employees?

1. Improved workflow and less chance of errors

Paying employees directly through BrightPay using our new integration with Modulr means that you can save yourself time by cutting down on admin work and eliminating the risk of manual entry errors.

2. Secure payments and peace of mind

Encrypted communication between parties and authentication using your mobile means payments made through Modulr are secure and fully traceable, giving you peace of mind.

More flexibility with same day payments

BrightPay and Modulr’s integration allows you to pay employees using SEPA (Single Euro Payments Area). With SEPA, if you authorise the payments before 2 PM the money will land in employees’ bank accounts that same day. If the payments aren’t authorised until after 2 PM then it will go through the next business day. This quick turnaround means that you have the flexibility to change payments up until the day before or even the morning of pay day.

Register for one of our free webinars where we will discuss how our new integration can benefit your business.

To learn more about BrightPay’s new direct payments feature visit our webpage or book a free online demo of our payroll software today.