Dec 2022

15

What's New in BrightPay 2023?

BrightPay 2023 is now available (for new customers and existing customers). Here’s a quick overview of what’s new:

2023 Tax Year Updates

- 2023 rates, thresholds and calculations for PAYE, USC, PRSI, LPT and ASC.

- Support for retrieving and using 2023 Revenue Payroll Notifications (RPN).

- Support for creating and sending 2023 Payroll Submission Requests (PSR).

- Support for the new CO2 emissions based calculation of vehicle benefits from 2023 onwards.

- Support for Statutory Sick Pay.

BrightPay is now 64-bit

BrightPay is now a 64-bit application. This does not make any difference to the experience of using BrightPay or its functionality, but it comes with a few nice optimisations:

- 64-bit apps just run better on 64-bit versions of Windows (which our telemetry shows us over 95% of our customers are using).

- 64-bit apps are able to access more computer memory than 32-bit apps can. This means that BrightPay will more smoothly handle employer files with a very large number of employees.

A 32-bit version of BrightPay for Windows will continue to be made available for those who need it.

Other New Features and Updates in 2023

- Support for manual journal entries.

- Improves handling of employee payment/bank details – changes to details now automatically apply across the whole tax year, meaning that finalised payslips no longer need to be re-opened first.

- Several additional minor improvements throughout the entire BrightPay user interface, as well as the latest bug fixes and security improvements.

- Signing into Connect uses your Bright ID, which makes getting started with Connect easier and simpler.

What's Next?

We're continually at work on the next version of BrightPay, developing new features and making any required fixes and improvements. See our release notes to keep track of what has been changed to date at any time.

Dec 2021

14

What's New in BrightPay 2022?

BrightPay 2022 is now available (for new customers and existing customers). Here’s a quick overview of what’s new:

2022 Tax Year Updates

- 2022 rates, thresholds and calculations for PAYE, USC, PRSI, LPT and ASC.

- Support for the Employment Wage Subsidy Scheme (EWSS) continues to be available in the 2022 tax year.

- Support for retrieving and using 2022 Revenue Payroll Notifications (RPN).

- Support for creating and sending 2022 Payroll Submission Requests (PSR).

Pay Using Modulr

You can now create and send payment requests to Modulr directly from BrightPay, provided you have an active Modulr account that is set up for making payments. Payee information and amounts are automatically populated using the data from your payroll, making it a simple, fast and efficient way to pay your employees.

Integration with Surf Accounts

BrightPay can now post payroll journals to Surf Accounts.

Other 2022 Updates in BrightPay

- The way of setting up a pay schedule for the tax year has been changed in response to customer feedback, making it clearer and more flexible.

- Ability to auto-zeroise individual basic payments, additions and deductions for each pay period (i.e. repeat them into the next pay period as usual, but with a zero amount)

- Ability to auto-generate works numbers.

- BrightPay now shows the total "number of employees" in many more on-screen summaries and report documents.

- Lots of minor improvements throughout the entire BrightPay user interface, as well as the latest bug fixes and security improvements.

What's Next?

We're continually at work on the next version of BrightPay, developing new features and making any required fixes and improvements. See our release notes to keep track of what has been changed to date at any time.

Oct 2021

28

New Feature: Introducing direct payments through BrightPay

BrightPay has partnered up with payment platform Modulr to give payroll processors a fast, secure and easy way to pay employees directly through BrightPay Payroll software. Up until now, when you wanted to pay employees through credit transfer, you needed to create a bank file that would then need to be uploaded to your online banking account. This can be quite a manual process that is prone to human error. This new method of paying employees cuts down on admin work and eliminates manual entry errors, saving you time.

To use this new integration, first, ensure you have created a Modulr Account. You will also need to download a mobile app called Authy which you will use to authenticate user logins and payments. The Authy app is a second layer of security that will help protect your account from hackers or data breaches.

How does BrightPay’s new direct payments feature work?

1. Once you have finalised the payslips, under the pay tab choose Modulr.

2. A box will then appear on screen asking you to log into your Modulr account.

3. Once you have entered your details, you will authenticate your login through the Authy app on your mobile device.

4. Once set up, your payroll information in BrightPay will automatically synchronise with your Modulr account. In the pop up, any employees whose payment method is set to credit transfer will be listed along with their IBAN and the amount they are to be paid for that period, a reference can also be added here.

5. Next, simply select the account you would like to make the payment from and choose a payment date.

6. After clicking continue, you will be shown a summary of your payment request submission. Once you have reviewed the payment request you can click “Send to Modulr.”

7. You will need to authenticate the submission by once again using your Authy app. The following screen will be displayed to let you know that the transfer has been successful:

8. The final step is for the authorised person to log into their Modulr account and approve the payment request submission. This may be the payroll processor themself or if you are processing payroll for a client then this task can be assigned to the client, giving them control by allowing them to give the final approval on the payment of employees.

For more detailed instructions on how to use Modulr with BrightPay, view our help guide or watch our video tutorial.

What are the benefits of using BrightPay’s Modulr integration to pay employees?

1. Improved workflow and less chance of errors

Paying employees directly through BrightPay using our new integration with Modulr means that you can save yourself time by cutting down on admin work and eliminating the risk of manual entry errors.

2. Secure payments and peace of mind

Encrypted communication between parties and authentication using your mobile means payments made through Modulr are secure and fully traceable, giving you peace of mind.

More flexibility with same day payments

BrightPay and Modulr’s integration allows you to pay employees using SEPA (Single Euro Payments Area). With SEPA, if you authorise the payments before 2 PM the money will land in employees’ bank accounts that same day. If the payments aren’t authorised until after 2 PM then it will go through the next business day. This quick turnaround means that you have the flexibility to change payments up until the day before or even the morning of pay day.

Register for one of our free webinars where we will discuss how our new integration can benefit your business.

To learn more about BrightPay’s new direct payments feature visit our webpage or book a free online demo of our payroll software today.

Dec 2020

15

What's New in BrightPay 2021?

BrightPay 2021 is now available (for new customers and existing customers). Here’s a quick overview of what’s new:

2021 Tax Year Updates

- 2021 rates, thresholds and calculations for PAYE, USC, PRSI, LPT and ASC.

- Support for the Employment Wage Subsidy Scheme (EWSS) continues to be available in the 2021 tax year. The Temporary COVID-19 Wage Subsidy Scheme (TWSS) concluded in 2020 and is no longer available.

- Support for retrieving and using 2021 Revenue Payroll Notifications (RPN).

- Support for creating and sending 2021 Payroll Submission Requests (PSR).

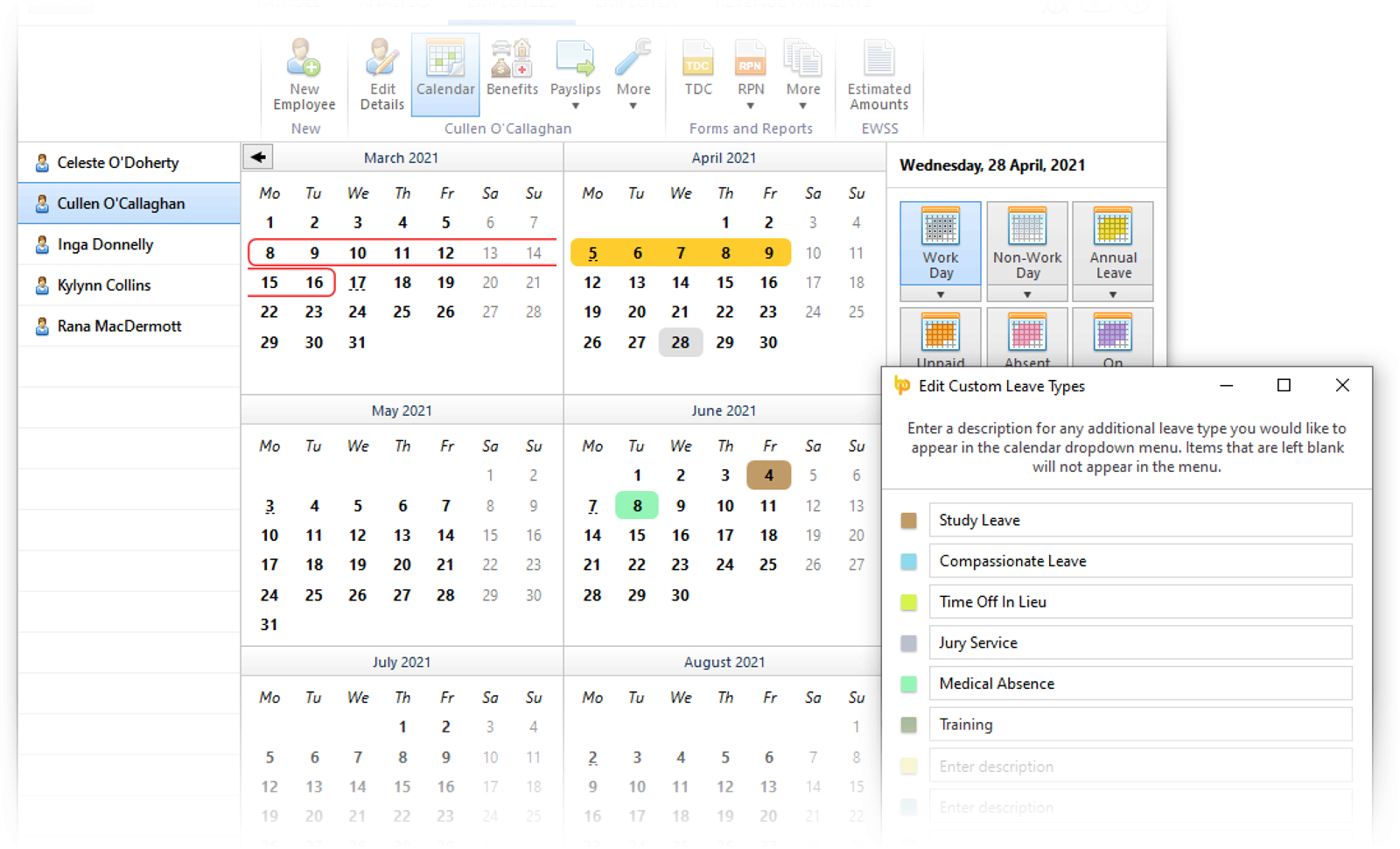

Define and Set Custom Leave Types on Employee Calendar

- You can now define up to nine additional custom types of employee leave. Six of the custom types are set up with default descriptions, which you can edit, add to, or remove as need be.

- Custom leave types act like the existing built-in kinds of leave, in that they are mutually exclusive and can only be applied to working days. They can be set on a per-employee basis, or batch set for multiple employees at once.

- Custom leave types also appear on the employer calendar. Mouse-hover tooltips have been added to the various views of the employer calendar to help determine what each colour indicates where it's not clear.

- A new Calendar Report (which replaces the previous Print Calendar functionality) gives you the power and flexibility to create and/or share a customised report of employee leave that can be filtered by type of leave, and presented individually for each employee, or as a summary containing multiple employees.

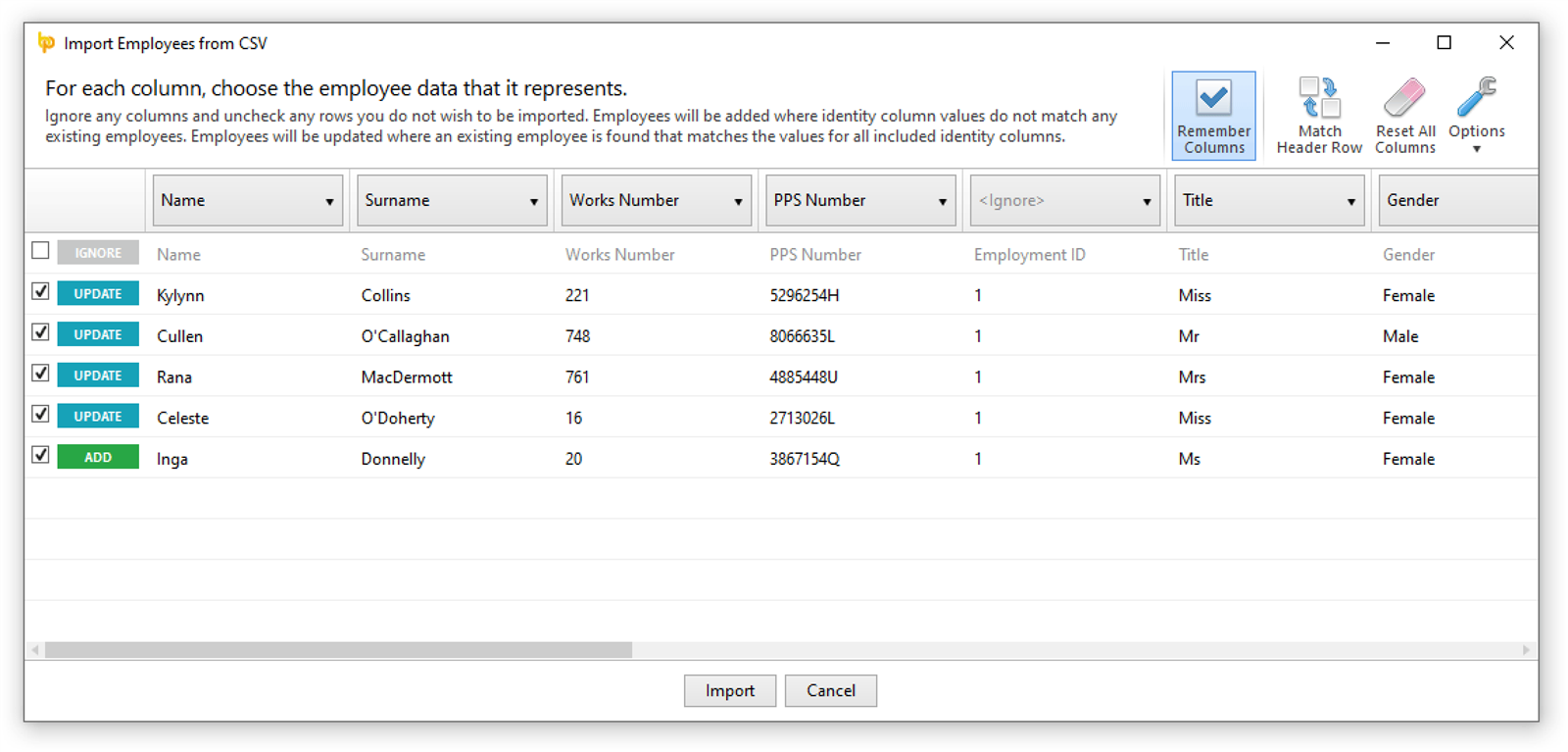

Update Employees from CSV File

BrightPay has traditionally only allowed new employees to be added from a CSV file. Now, you can both add new employees and update existing employees from a CSV file.

BrightPay Connect

- Supports two-factor authentication sign in.

- When you open an employer in BrightPay, and your version of file is older than the version in Connect (i.e. that you or a colleague synchronised to Connect from another computer), you will be immediately prompted to download the latest version.

- When you open an employer in BrightPay that a colleague is currently already working on on another computer, you will be immediately notified in BrightPay (and given the option to be told when the employer is free to work on again).

Other 2021 Updates in BrightPay

- Annual leave entitlement calculations now include 'upcoming booked annual leave days', which can optionally be included on reports and payslips.

- When zero-ising payslips, new options to set amount to zero, or remove items altogether.

- When importing payments from CSV, any lines which failed to import (e.g. due to not matching an employee pay record, or due to the matching pay record being already finalised) are now clearly indicated in the response dialog (instead of the previously unhelpful 'X of Y succeeded' message).

- Public holidays on employee calendar are now shown with a dotted text underline (rather than appearing as if they were non-working days by default).

- Shows RPN “date/time downloaded” in RPN details view.

- Ability to preview CSO EHECS report in a printable/shareable format.

- New CSO columns in analysis.

- Ability to import saved reports from another BrightPay data file into the currently open file.

- Allows one of the added emergency contacts for an employee to be set as the 'primary' contact. New analysis columns (and a new report) for emergency contact details have been added.

- Ability to import hourly/daily payments by rate code

- Lots of minor improvements throughout the entire BrightPay user interface, as well as the latest bug fixes and security improvements.

What's Next?

We're continually at work on the next version of BrightPay, developing new features and making any required fixes and improvements. See our release notes to keep track of what has been changed to date at any time.

Dec 2019

17

What's New in BrightPay 2020?

BrightPay 2020 is now available (for new customers and existing customers). Here’s a quick overview of what’s new:

2020 Tax Year Updates

- 2020 rates, thresholds and calculations for PAYE, USC, PRSI, LPT and ASC.

PAYE Modernisation

- Support for retrieving and using 2020 Revenue Payroll Notifications (RPN).

- Support for creating and sending 2020 Payroll Submission Requests (PSR).

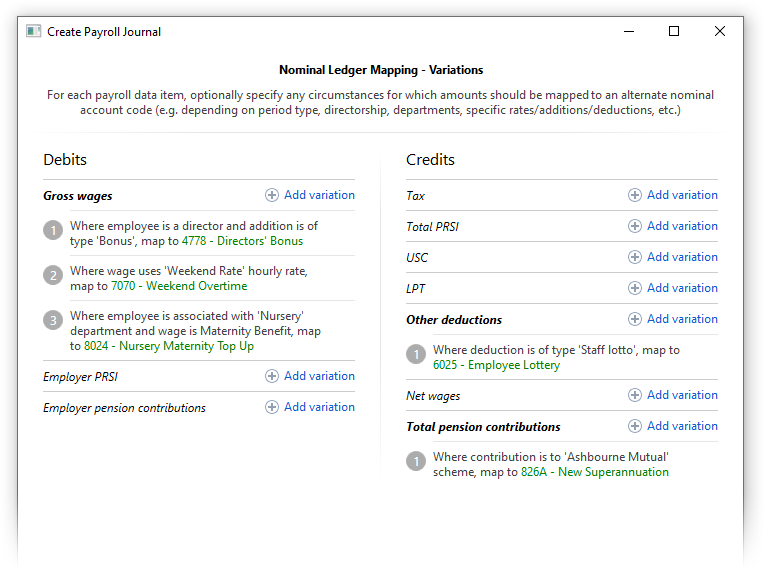

More Flexible Journals

A popular customer request has been to create a 'departmental' payroll journal in BrightPay. We've went one step further, allowing not only for a simple departmental mapping of nominal account codes, but for an advanced multi-option mapping as well.

For example, if you want to map commission paid to directors on a weekly basis in the sales department to a particular account code, you now can.

For Xero journals, BrightPay now supports including the department as the Xero tracking option, including where employees are split across multiple departments.

To make all this easier to manage, the Create Journal window in BrightPay now remembers it's size and position between usages.

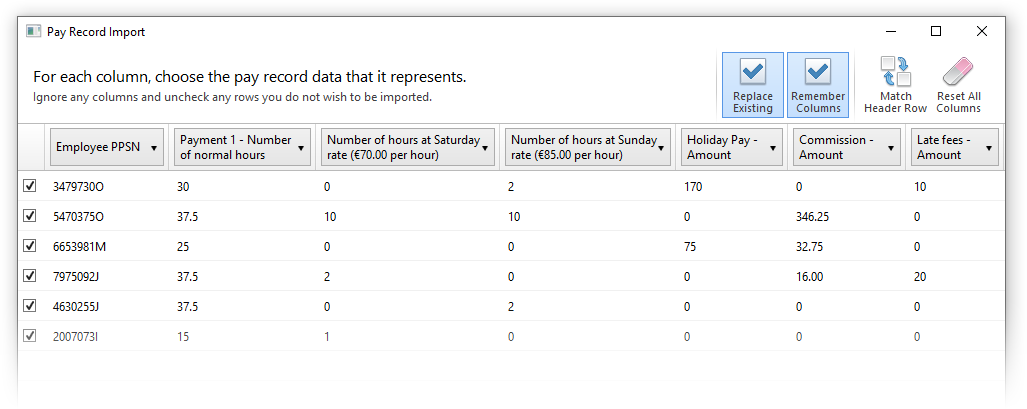

Importing Pay Records from CSV

We have significantly improved the power and flexibility of how pay records are imported from CSV, effectively allowing an entire pay run to be imported from a single CSV file if need be.

- Multiple pay items (of a single payment type, or mixed types) can now be imported from a single CSV line.

- Daily/hourly payments can more easily be imported under a named employer-wide daily/hourly rate

- Additions/deductions can more easily be imported under an employer-wide addition/deduction type

BrightPay Connect

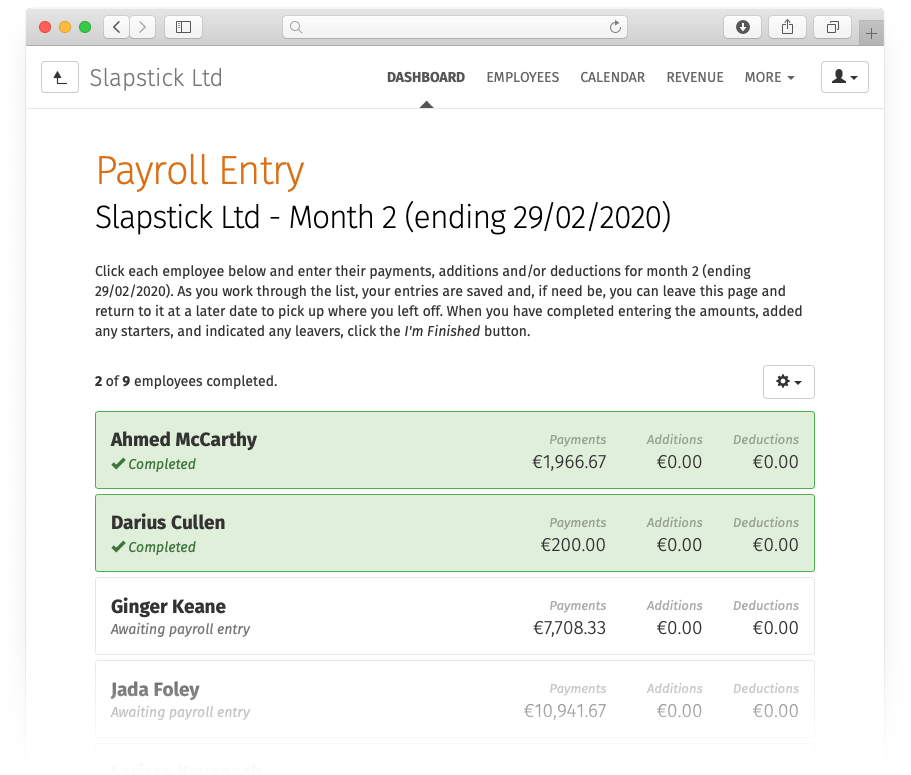

In late 2019 we introduced a powerful new feature for Bureau customers of BrightPay Connect: the ability to request client payroll entry and/or approval for a payroll run, which is then automatically facilitated though a secure, GDPR-compliant process within the BrightPay Connect dashboard.

Sign in to your BrightPay Connect account and click the Requests header link to find out more.

Other Connect updates in BrightPay 2020 include:

- The Connect tab on the start-up window now directly shows your sign-in status.

- The list of employers (in the Open/Create Employer tab of start-up window) now shows cloud icons for employers that are linked to the signed-in BrightPay account.

- Ability to download and import a 2019 Connect backup into BrightPay 2020 (only applies for employers which have not yet been linked and synchronised for 2020).

- When an employer is opened in BrightPay 2020 that is not linked to Connect, but it is known that the 2019 version of that file was linked to Connect, BrightPay will now automatically prompt you to link the 2020 file to Connect.

Other 2020 Updates in BrightPay

- Ability to quickly create a new/additional employment for a previous/existing employee.

- Ability to print/export/email 'DRAFT' payslips.

- New period summary column options to see amounts in previous period.

- When selecting which analysis columns to include in a report, they are now grouped by category.

- New A4 payslip template, designed to be used where there are too many items to fit on the A5 template.

- New Bureau statistics report.

- As part of our new licensing model, Bureau customers can now view/edit the list of employers for which they have access.

- Lots of minor improvements throughout the entire BrightPay user interface, as well as the latest bug fixes.

What's Next?

We're continually at work on the next version of BrightPay, developing new features and making any required fixes and improvements. See our release notes to keep track of what has been changed to date at any time.

Dec 2018

18

What's New in BrightPay 2019?

BrightPay 2019 is now available (for new customers and existing customers). Here’s a quick overview of what’s new:

2019 Tax Year Updates

2019 rates, thresholds and calculations for PAYE, USC, PRSI, LPT and ASC (previously PRD).

PAYE Modernisation

From 1st January 2019, in the most significant reform of the PAYE system in Ireland since its introduction, employers no longer submit end-of-year payroll returns, but are rather required to report their employees' pay and deductions to Revenue each time they are paid. BrightPay not only ensures you are kept fully compliant with the new requirements, but makes it really clear and easy.

- Easily import your Revenue certificate (required to authenticate your submissions to Revenue).

- Check for Revenue Payroll Notifications (RPN) each pay period, and keep your employees up to date in line with Revenue's instructions. Where RPN updates are detected, they can be previewed and applied with a single click.

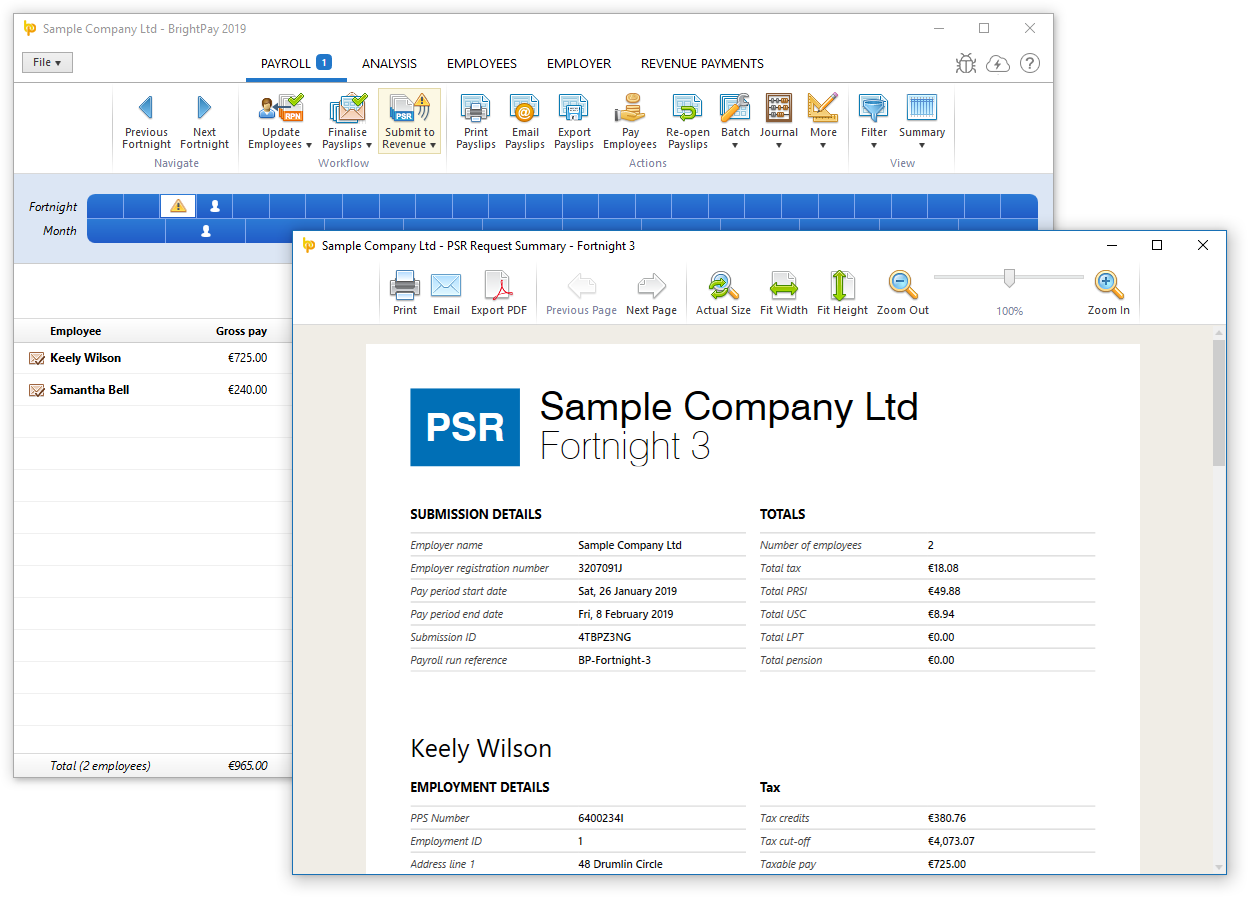

- Send a Payroll Submission Request (PSR) for each employee payment. BrightPay provides a full print/email-friendly preview of PSR content, and walks you through the process of sending to Revenue.

- BrightPay tracks the state of all your employees each pay period, and alerts you where RPNs need to be checked for or updated from as well as where PSRs need to be sent (or re-sent).

- At a glance comparison and reconciliation of the tax liabilities recorded in BrightPay against the tax liabilities as reported by Revenue.

- BrightPay stores all Revenue communication logs for your reference, and relays any submission errors back to you in a clear, user-friendly format.

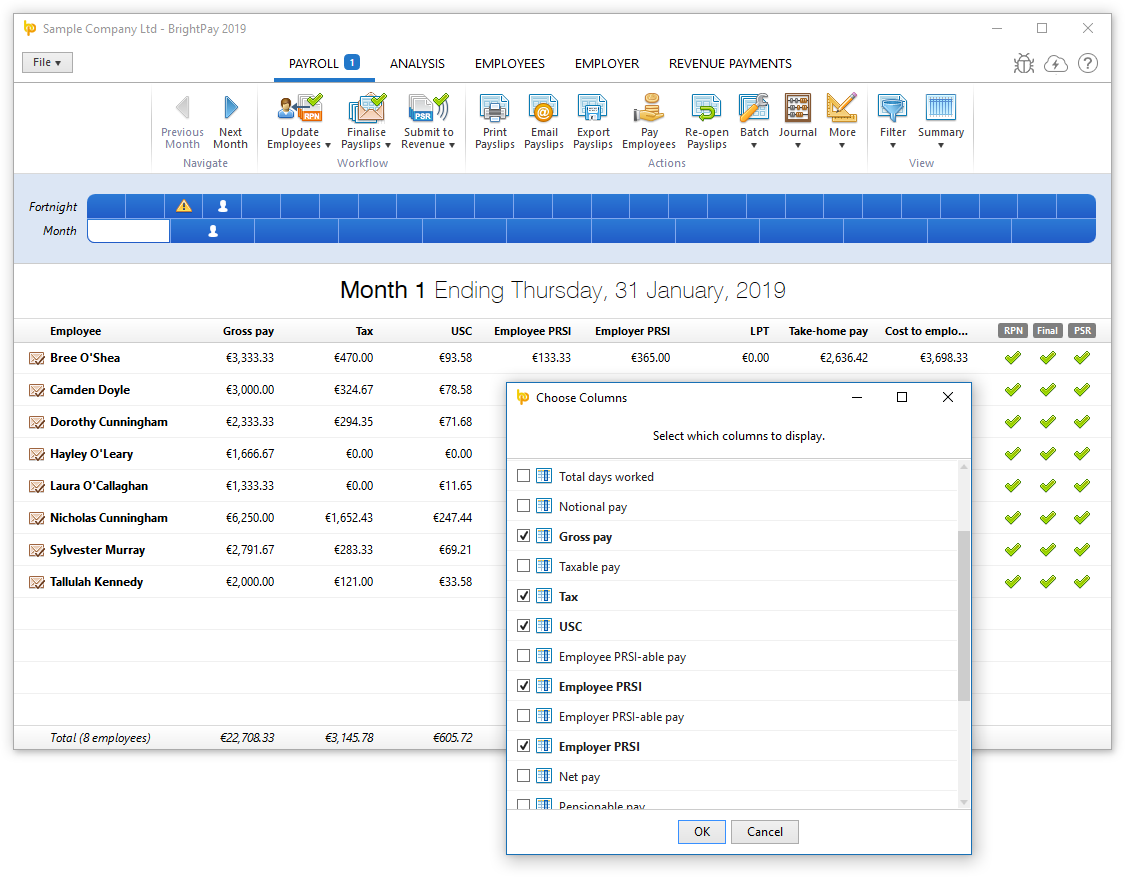

Ability to Edit the Columns of the Period Summary View

A popular customer request has been to show columns for number of hours worked and pension contributions on the BrightPay period summary view. In BrightPay 2019, you can now easily include these, as well as many more additional column options.

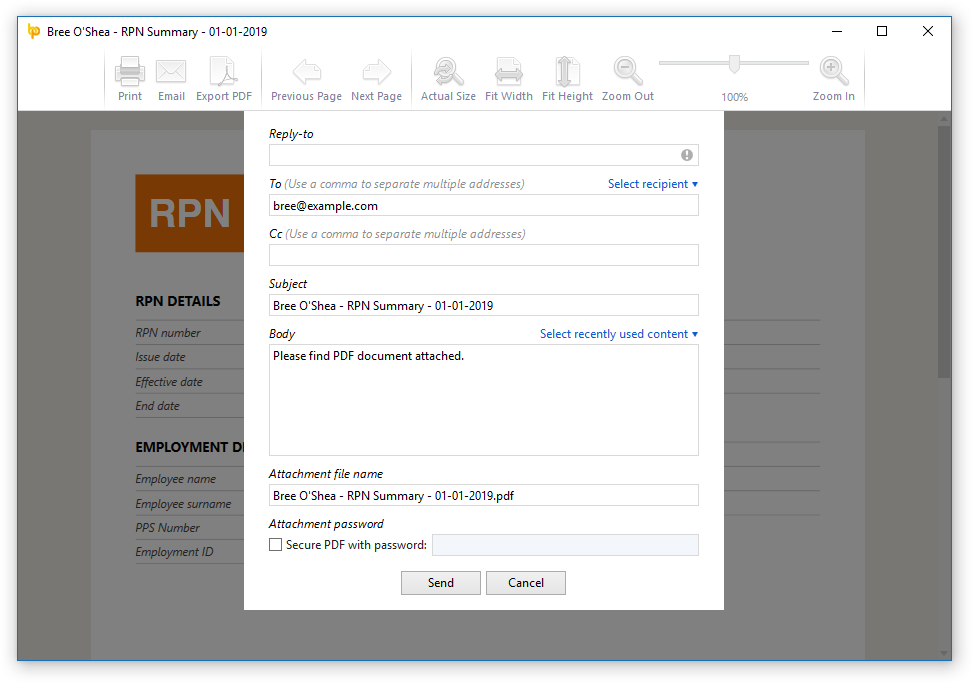

Ability to Quickly Email any Document/Report

There is a new Email button in the print preview of documents and reports in BrightPay which allows you to easily send it as a PDF attachment in an email. Where and when applicable, BrightPay makes it easy and quick to select the relevant employee, client or previously used recipient.

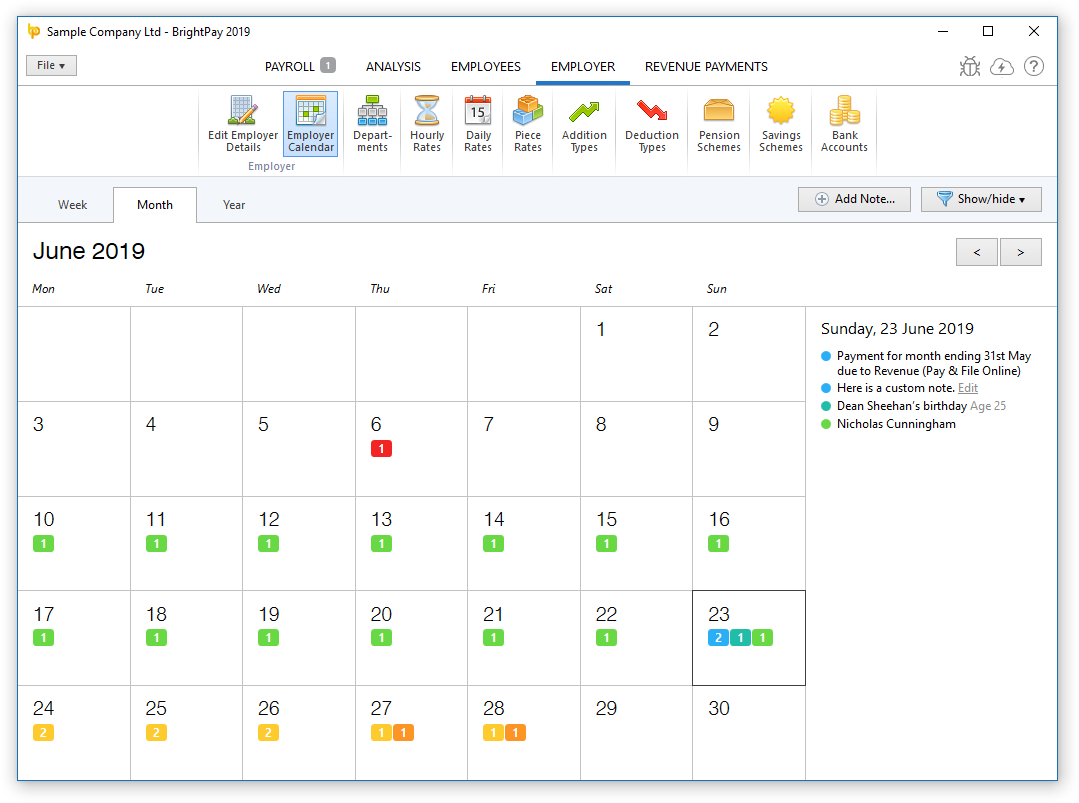

New Feature: Employer Calendar

There is a new employer-wide calendar in the EMPLOYER section of BrightPay which amalgamates all the employee events along with other key payroll dates into a single view:

- Switch between Year, Month or Week view.

- Shows combined events for all employees (i.e. those entered on the employee calendar, as well as birthdays)

- Includes general tax year events and deadlines.

- Ability to filter which kinds of events are displayed on calendar and in the day event list.

- Ability to add/edit/delete your own notes.

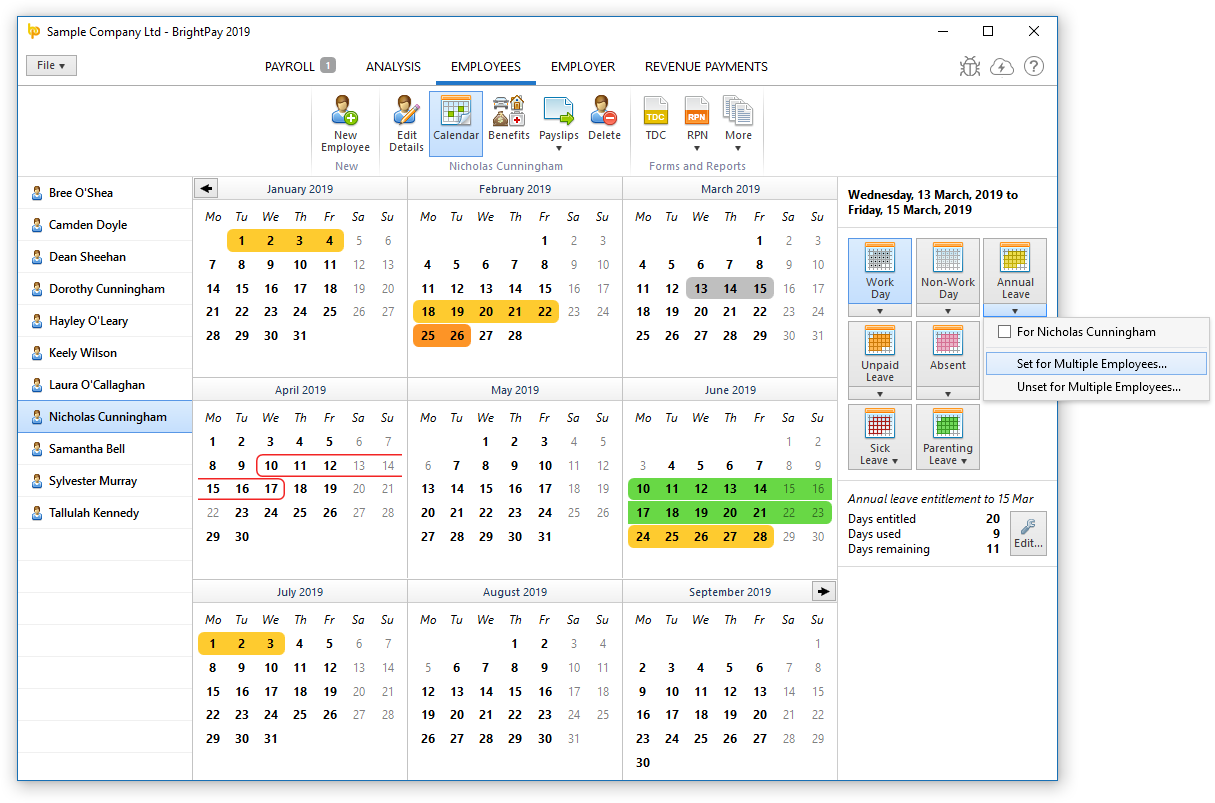

Employee Calendar Improvements

- Ability to batch set working days, non-working days and leave days for multiple employees at once.

- Holding the Ctrl key allows you to select (or unselect) multiple arbitrary days on the calendar.

Other 2019 Changes in BrightPay

- When a text input field receives focus via keyboard tabbing, its content is all selected automatically.

- Adds several more customisability options for payslip production.

- When zero-ising payslips, you can now choose to zero-ise only the overtime (or non-overtime)hourly/daily payments.

- Enables specific period payments, daily payments, hourly payments, piece payments, additions and deductions to be explicitly hidden on printed payslip.

- Enables specific period payments, daily payments, hourly payments, piece payments, additions and deductions to be given a custom description to appear on printed payslip.

- Ability to set whether or not an hourly rate/payment should accrue hour-based annual leave entitlement.

- For 'accrued' annual leave days/hours, ability to manually specify additional accrued days/hours not accounted for in payroll (i.e. an adjustment).

- Annual leave accrual is now calculated up to end of the currently open pay period (rather than up to the end of the last finalised pay period).

- Net to gross functionality can now do ‘Take-home pay to gross’ and ‘Cost-to-employer to gross’.

- Printing page setup is now centralised into the File menu of BrightPay.

- Ability to control whether or not the PDF export settings are remembered between usages.

- Lots of minor improvements throughout the entire BrightPay user interface, as well as the latest bug fixes.

What's Next?

We're continually at work on the next version of BrightPay, developing new features and making any required fixes and improvements. See our release notes to keep track of what has been changed to date at any time.

Dec 2017

20

What's New in BrightPay 2018?

BrightPay 2018 is now available (for new customers and existing customers). Here’s a quick overview of what’s new:

2018 Tax Year Updates

- 2018 rates, thresholds and calculations for PAYE, USC, PRSI, LPT and PRD.

- From 1st January 2018, Revenue will tax Illness Benefit by adjusting employee's tax credits and cut off points. As a result of this change, there will be more frequent P2Cs issued for employees.

Payroll Journal

BrightPay 2018 enables you to produce a CSV payroll journal for import into your accounting software. This feature is accessed via the new Journal button on the payroll toolbar, and provides the following:

- The file formats and default nominal ledger code mappings are included for Quickbooks, Sage and Xero. These built-in mappings can be tailored to meet your own requirements, or you can create your own nominal ledger mapping from scratch if need be.

- Specify the journal date range – payslips finalised with a pay date in the range you select are included.

- Include individual journal records for each employee, or merge the employee records into rolled up records for each unique payment date.

- If required, you can use alternate nominal codes for payroll items relating to directors.

- Use a specific nominal code for any custom employer-wide item you have set up in BrightPay (i.e. addition/deduction types, hourly/daily/piece rates, pension schemes, savings schemes, etc.)

- Preview journal on screen, export preview to PDF, or print.

- Export journal CSV file for import into your accounting software.

Several accounting software providers can accept a direct upload of a payroll journal via an API, negating the need to export/import a CSV file. We plan to add this functionality for supporting providers soon.

Please get in touch if you'd like to see built-in support for any other accounting software providers.

Bureau Features

BrightPay 2018 includes several new features specifically targeted at accountants, bookkeepers, or other payroll bureau service providers. These bureau features are exclusive to the bureau version of BrightPay.

Improvements to BrightPay Startup Window

The columns on the BrightPay startup window can now be customised, and you can order the list of employers on the startup screen by any column. To help make this personalisation more useful, the size and position of the startup window will now be remembered between launches.

The data on the startup window now more reliably updates by itself - you no longer have to open a file to get it to do so.

Client Details

You can now record the following client information for each employer in BrightPay:

- Contact name, email address and phone number

- Status

- Due date

- Notes

- Label colour

This information can be edited directly from the startup window by right-clicking on an employer and selecting the new View/Edit Client Details menu option (this menu also includes a quick one-click link to set a label colour), or it can be entered via the new Client Details tab in Edit Employer Details when a file is opened in BrightPay.

Perhaps most usefully, these client details can be shown as columns on the BrightPay startup window, enabling you to more effectively manage your client workflows as an individual or across a team.

BrightPay Connect

In case you missed it, we launched "BrightPay Cloud" with BrightPay 2017. We have now rebranded this as BrightPay Connect. It works exactly as it has to date, including some further refinements and new features for 2018.

We have a detailed web page about BrightPay Connect here. Here's a quick overview of what it's all about:

- BrightPay Connect provides a secure, automated and user-friendly way to backup and restore your payroll data on your PC to and from the cloud.

- BrightPay Connect provides a web/mobile based self service dashboard for your employees, enabling them to:

- View/download their payslips and other payroll documents

- View their calendar, and make requests for annual leave.

- View and edit their personal details.

- BrightPay Connect provides a web/mobile based self service dashboard for employers and clients of payroll bureaux, enabling them to:

- Access the payroll documents and data for each of their employees.

- View an employer-wide payroll calendar.

- View payroll reports exactly as you have set them up in BrightPay.

- View the schedule of Revenue payments, outstanding amounts, and access the P30 for each tax period.

BrightPay Connect is built for security, reliability and stability, and costs just €59 per employer. Bulk pricing is available for bureaus.

Other 2018 Changes and New Features in BrightPay

- The foundational technology of BrightPay has been updated to the latest version, which immediately brings many performance, reliability and security improvements (and opens up new possibilities to our development team!). A side effect of this update, however, is that BrightPay 2018 cannot be run on Windows XP. We've attempted to make all customers aware of this change several times over the past year, and our telemetry now shows that less than 1% of our customers still run on Windows XP. So while we do apologise for any inconvenience this causes, with the improvements gained it is unquestionably the best decision for our customers as whole.

- Import from Sage MicroPay and Big Red Book.

- Import/export employer from/to CSV file.

- Improves how pay dates are entered when finalising payslips – you can now set a different pay date for individual employees if need be. When re-opening and re-finalising payslips, the previously used pay date is remembered.

- When finalising one or more previously re-opened payslips, you can now choose to either remember all the pay items and settings going forward (e.g. if re-opening to make a one-off correction), or to reset the payroll going forward (e.g. if re-opening to redo from that point onward). When re-opening back more than one pay period, you now also have the option to fast-forward re-finalise back to where you were.

- Ability to view/print log of P2C updates.

- Ability to set a custom multiplier for hourly/daily payments.

- Ability to override a named employer daily/hourly rate with an employee-specific rate.

- Support for Paternity Leave and Paternity Benefit.

- Net to gross now works for net, take-home and cost to employer.

- Employee count report.

- Create employee address labels.

- Ability to send support requests directly from within BrightPay (accessed via Help menu).

- The Export PDF dialog now remembers its settings between usages (password usage, auto-open)

- Optimisations to data file size and installation package size.

- Lots of minor improvements throughout the entire BrightPay user interface, as well as the latest bug fixes.

May 2017

23

BrightPay to discontinue Windows XP support

The technology that BrightPay utilises will be updated and improved from January 2018. As a result of this improvement, BrightPay will no longer be able to run on Windows XP operating systems. This technological enhancement will bring many performance, reliability and security improvements, while also opening up new possibilities for our development team to add further functionality. Users will not notice any obvious difference using BrightPay 2018 compared to previous versions as all the changes will be operating in the background.

Microsoft discontinued support for Windows XP in April 2014. This means that Microsoft are no longer releasing upgrades for these systems. Although Windows XP machines may still work normally, it does mean that these PCs are more vulnerable to security risks and viruses.

If you are still using Windows XP, you should consider upgrading to a newer PC or operating system. Due to the greater security risks, more and more programmes and applications are discontinuing support for Windows XP. Internet Explorer 8 is also no longer supported. If your Windows XP PC is connected to the Internet and you use Internet Explorer 8 to surf the web, you might be exposing your PC to additional threats.

These security threats became a reality for many Windows XP users in recent weeks with more than 200,000 organisations becoming victims of the widespread ransomware attack, WannaCry. This cyber attack affected organisations across the globe, including hospitals, banks and government agencies. The majority of these victims were using outdated or older Windows operating systems, such as Windows XP and Windows Vista.

While we do apologise for any inconvenience this change may cause, it is the best decision for our customers’ security and user experience.

Useful links:

Apr 2013

25

What you as an employer need to know about LPT (Local Property Tax)

An employee may opt with Revenue for their LPT liability to be collected by deduction from their salary/wages.

Revenue will communicate to you how much you should deduct from employees in the P2C file (details of tax credits and cut off points) which will be sent to your ROS inbox in June 2013. The LPT field is a new field within the P2C file and BrightPay will detect it automatically once imported into the software. Paper tax credit certificates will also contain this new LPT field and BrightPay will have a new field for inputting the LPT amount manually.

LPT deductions commence for pay dates from 1st July 2013 and, in accordance with Revenue guidelines, BrightPay will deduct the LPT amount evenly over the remainder of the 2013 year. Where, in any pay period, there is insufficient pay to enable deduction of LPT, the balance remaining will be spread evenly over the remaining pay periods.

The LPT deduction, the amount deducted to date and the balance of LPT still to be deducted will be shown on payslips.

The amount you pay to the Collector General by way of a P30 (monthly or quarterly) will include the LPT amount that you have collected. P45s and P60s will also include a new LPT field.

We will be releasing an upgrade in June to handle all of the above.

As with all other statutory deductions, you will be obliged to deduct LPT in accordance with the P2C instruction from Revenue. If an employee has an issue, they must contact Revenue directly. You, as employer, have no discretion in the matter! Revenue can pursue you as employer for any amounts you fail to deduct, charge interest on late payment and fine you for non-compliance.

Bright Contracts – Employment contracts and handbooks.

BrightPay – Payroll Software