List of Employees

To prepare for PAYE Modernisation which goes live on 1st January 2019, Revenue is asking employers to submit a list of employees through their Revenue Online Service (ROS). This list is required by Revenue for data alignment and was due to be submitted by the end of October 2018. Please note, on 2nd November 2018 Revenue issued an eBrief announcing they were extending the deadline and employers still wishing to file the submission can do so.

Revenue's aim is to have knowledge of the correct employment details for as many employees as possible for PAYE Modernisation.

The list required must include:

- employees who are currently in your employment (including directors)

- employees on long term leave such as maternity leave or sick leave

- pensioners in receipt of payments from you

- seasonal or temporary employees for whom you have not completed a P45

- employees on a career break for whom you have not issued a P45

- employees for whom you have received PAYE Exclusion Order.

BrightPay facilitates the preparation of the list of employees in a compatible format (CSV) for upload into ROS.

Before doing so, however, it is important to ensure that you have:

- used the most recent P2C to get the correct PPSN for each of your employees

- followed the P45 process for any employees who have left your employment

- submitted Part 3 of the Form P45 or Form P46 for any employees who have started in your employment.

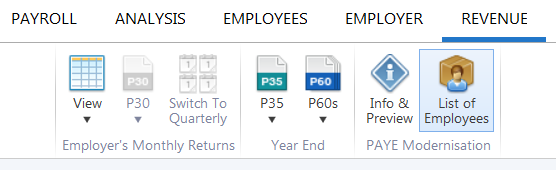

To prepare a list of employees in BrightPay for upload into ROS, go to Revenue > List of Employees:

- Click 'Create CSV File...'

- Save the CSV file to a location of your choice.

Your 'List of Employees' file has now been successfully created, ready for upload into ROS.

To subsequently upload your list of employees into ROS:

- log in to your Revenue Online Service in the normal manner

- go to 'My Services' and click on the ‘List of Employees’ link under ‘Employer Services’

- select the employer registration number for which you are uploading the list of employees and attach your List of Employees file that you have prepared in BrightPay

- your file will now be validated. - once validation is complete, click the 'Submit' button

- sign and submit the file to complete the submission

- an acknowledgement will subsequently be displayed on screen and you will receive a ROS Inbox message to confirm completion.

Points to Note

- Only one submission can be made - Revenue will not accept an amended submission. Hence the importance of ensuring employee data is accurate before the submission process is performed

- Only employees with a PPSN will be included in the submission, therefore employers should ensure they have a PPSN for all employees on the payroll before submitting

- Should an employee start or leave after the list of employees has been submitted, simply follow the current process of registering a new employee/ issuing a P45.

Need help? Support is available at 01 8352074 or brightpayirelandsupport@brightsg.com.