Dec 2018

18

What's New in BrightPay 2019?

BrightPay 2019 is now available (for new customers and existing customers). Here’s a quick overview of what’s new:

2019 Tax Year Updates

2019 rates, thresholds and calculations for PAYE, USC, PRSI, LPT and ASC (previously PRD).

PAYE Modernisation

From 1st January 2019, in the most significant reform of the PAYE system in Ireland since its introduction, employers no longer submit end-of-year payroll returns, but are rather required to report their employees' pay and deductions to Revenue each time they are paid. BrightPay not only ensures you are kept fully compliant with the new requirements, but makes it really clear and easy.

- Easily import your Revenue certificate (required to authenticate your submissions to Revenue).

- Check for Revenue Payroll Notifications (RPN) each pay period, and keep your employees up to date in line with Revenue's instructions. Where RPN updates are detected, they can be previewed and applied with a single click.

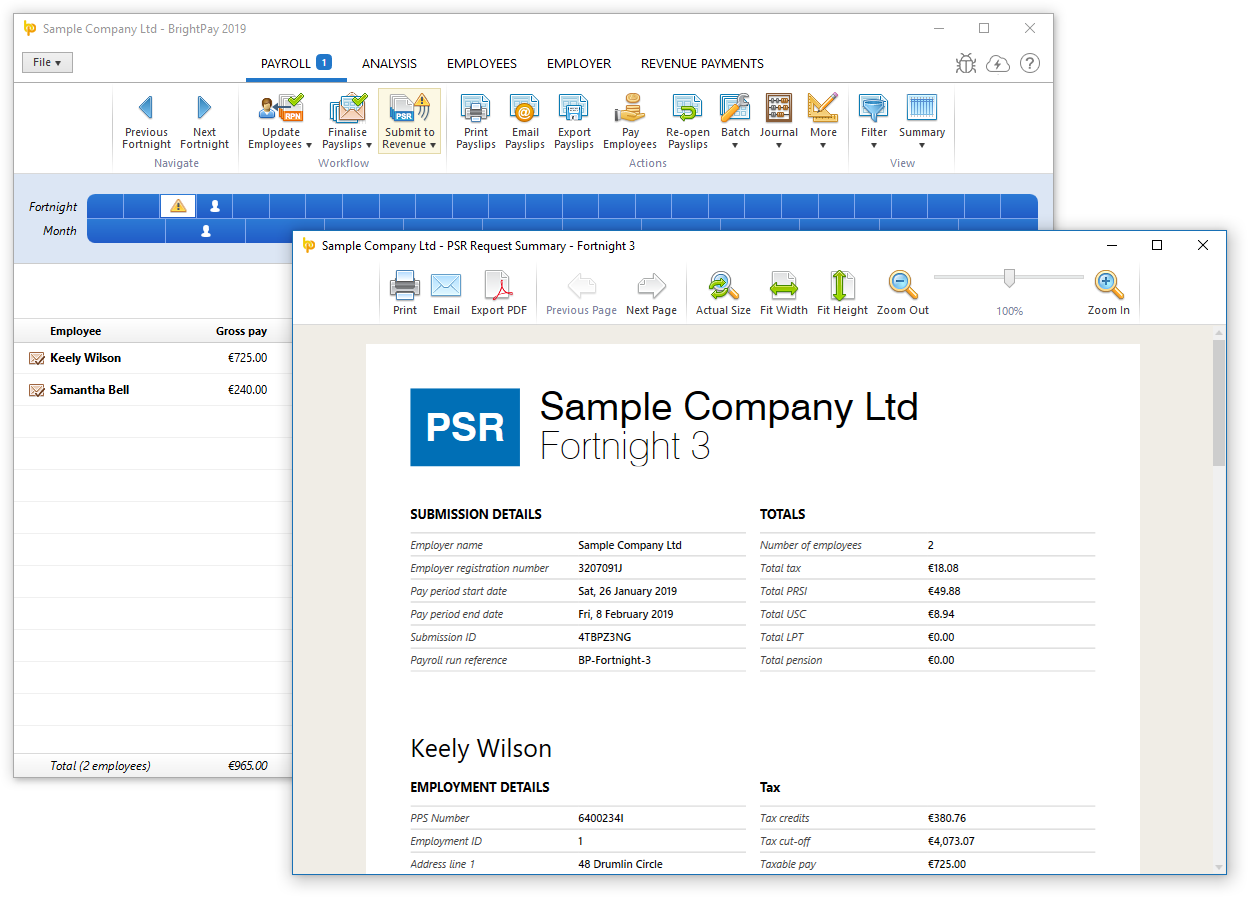

- Send a Payroll Submission Request (PSR) for each employee payment. BrightPay provides a full print/email-friendly preview of PSR content, and walks you through the process of sending to Revenue.

- BrightPay tracks the state of all your employees each pay period, and alerts you where RPNs need to be checked for or updated from as well as where PSRs need to be sent (or re-sent).

- At a glance comparison and reconciliation of the tax liabilities recorded in BrightPay against the tax liabilities as reported by Revenue.

- BrightPay stores all Revenue communication logs for your reference, and relays any submission errors back to you in a clear, user-friendly format.

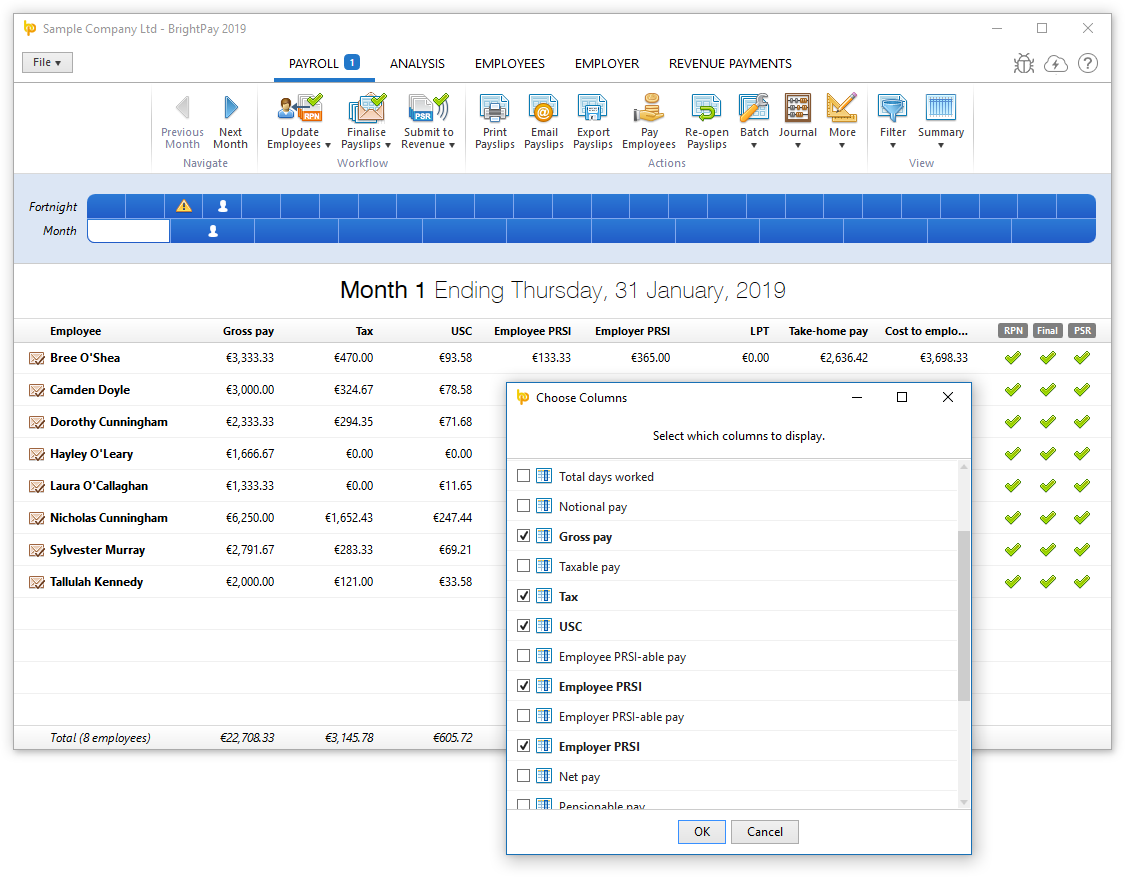

Ability to Edit the Columns of the Period Summary View

A popular customer request has been to show columns for number of hours worked and pension contributions on the BrightPay period summary view. In BrightPay 2019, you can now easily include these, as well as many more additional column options.

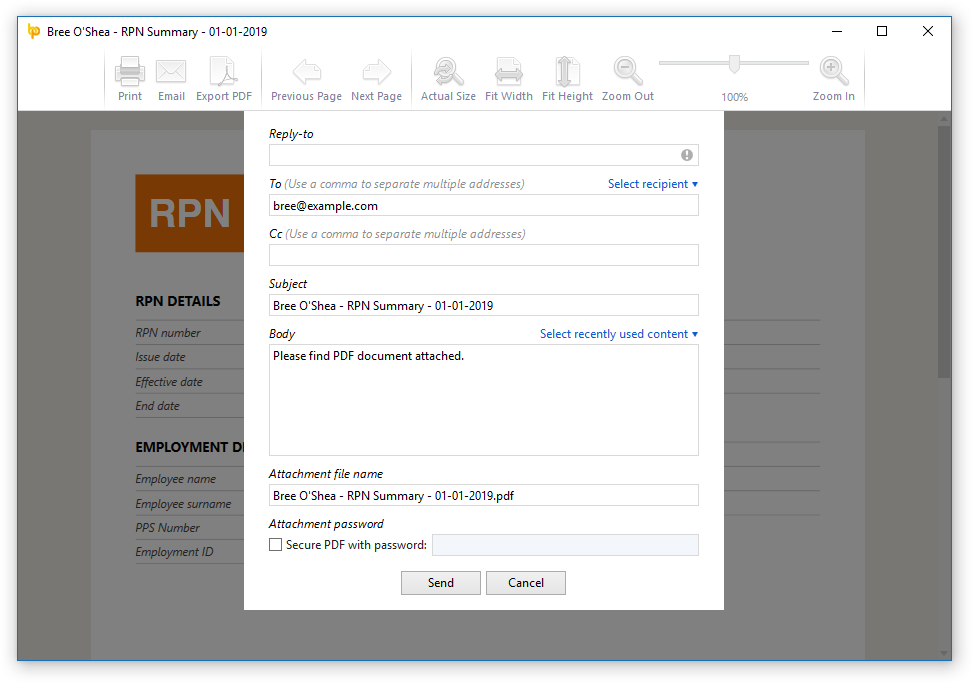

Ability to Quickly Email any Document/Report

There is a new Email button in the print preview of documents and reports in BrightPay which allows you to easily send it as a PDF attachment in an email. Where and when applicable, BrightPay makes it easy and quick to select the relevant employee, client or previously used recipient.

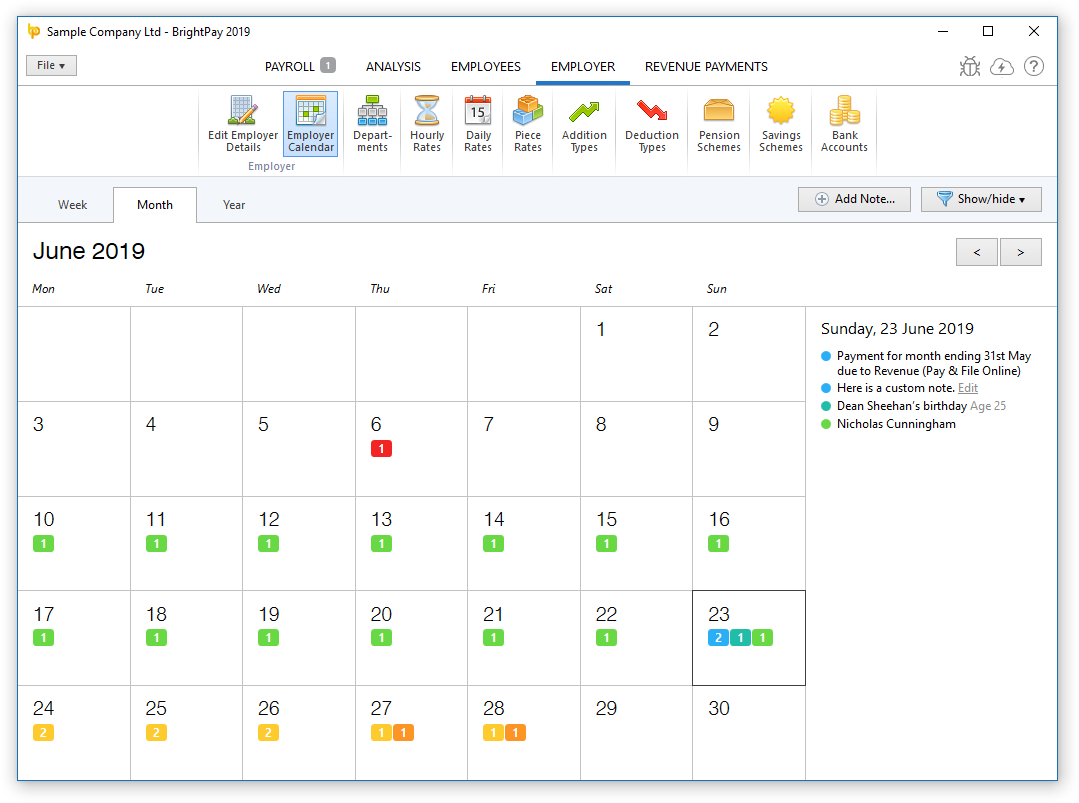

New Feature: Employer Calendar

There is a new employer-wide calendar in the EMPLOYER section of BrightPay which amalgamates all the employee events along with other key payroll dates into a single view:

- Switch between Year, Month or Week view.

- Shows combined events for all employees (i.e. those entered on the employee calendar, as well as birthdays)

- Includes general tax year events and deadlines.

- Ability to filter which kinds of events are displayed on calendar and in the day event list.

- Ability to add/edit/delete your own notes.

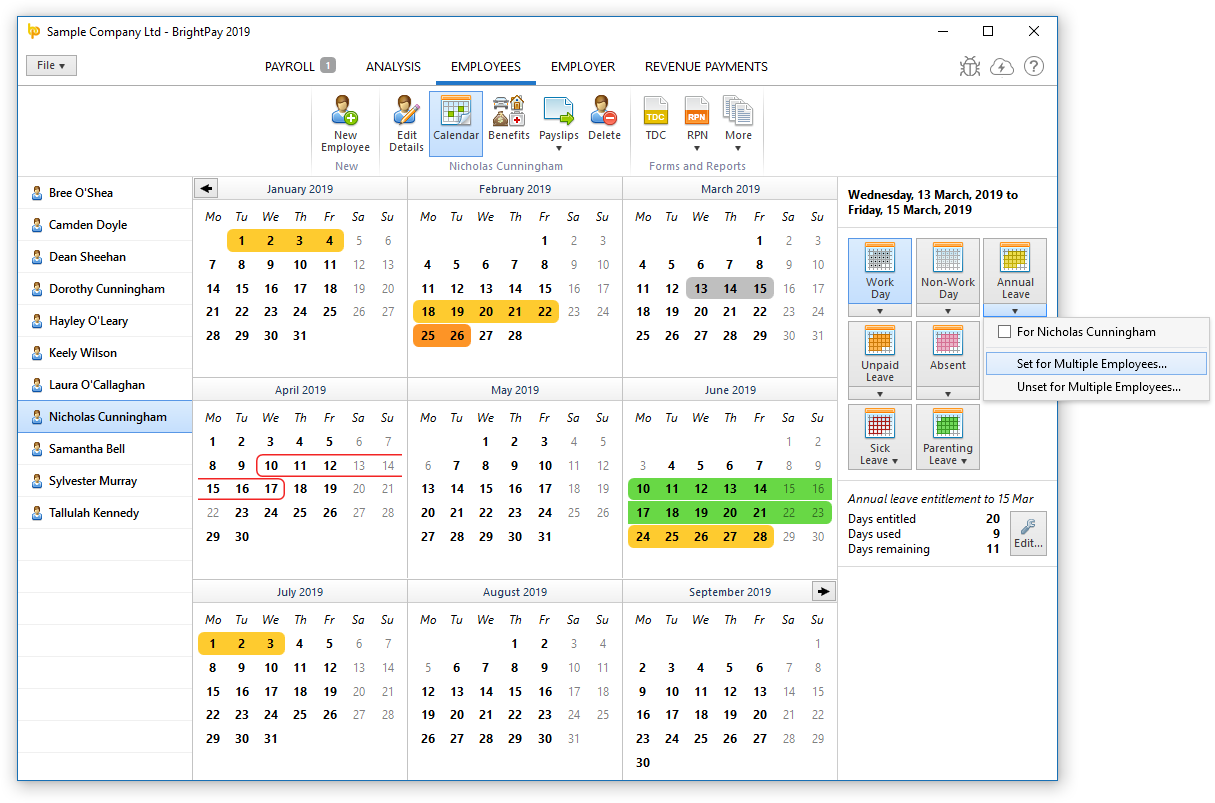

Employee Calendar Improvements

- Ability to batch set working days, non-working days and leave days for multiple employees at once.

- Holding the Ctrl key allows you to select (or unselect) multiple arbitrary days on the calendar.

Other 2019 Changes in BrightPay

- When a text input field receives focus via keyboard tabbing, its content is all selected automatically.

- Adds several more customisability options for payslip production.

- When zero-ising payslips, you can now choose to zero-ise only the overtime (or non-overtime)hourly/daily payments.

- Enables specific period payments, daily payments, hourly payments, piece payments, additions and deductions to be explicitly hidden on printed payslip.

- Enables specific period payments, daily payments, hourly payments, piece payments, additions and deductions to be given a custom description to appear on printed payslip.

- Ability to set whether or not an hourly rate/payment should accrue hour-based annual leave entitlement.

- For 'accrued' annual leave days/hours, ability to manually specify additional accrued days/hours not accounted for in payroll (i.e. an adjustment).

- Annual leave accrual is now calculated up to end of the currently open pay period (rather than up to the end of the last finalised pay period).

- Net to gross functionality can now do ‘Take-home pay to gross’ and ‘Cost-to-employer to gross’.

- Printing page setup is now centralised into the File menu of BrightPay.

- Ability to control whether or not the PDF export settings are remembered between usages.

- Lots of minor improvements throughout the entire BrightPay user interface, as well as the latest bug fixes.

What's Next?

We're continually at work on the next version of BrightPay, developing new features and making any required fixes and improvements. See our release notes to keep track of what has been changed to date at any time.

Nov 2018

22

PAYE Modernisation for Employees

PAYE Modernisation is coming on January 1st 2019. Ultimately, this means that employers will be obliged to report their employees’ pay and deductions to Revenue when or before they pay them.

There are many benefits for you, as an employee:

- The availability of real-time data that is accurate and accessible through Revenue’s online systems

- The ability to maximise the use of your entitlements

- The ability to access clear information about the deductions being reported to Revenue on your behalf

Will PAYE Modernisation affect your pay?

No, there will be no change to how your employer pays you and they will still provide you with a payslip.

However, your employer will now need to connect to ROS before calculating your pay and deductions to ensure they are using your most up-to-date tax credits and cut off points. They will also have to report these deductions to Revenue every time you are paid. You will be able to view pay and deductions on myAccount on the Revenue website.

You will receive your last P60 at the end of 2018. After that, you will no longer receive a P60, as Revenue will issue you with an End of Year Statement.

Thesaurus Payroll Manager | BrightPay Ireland

Related Articles:

- PAYE Modernisation for Payroll Bureaus- The ins and outs of increasing fees without losing clients

- Which is really better - the existing PAYE system or PAYE Modernisation?

- The Death of PAYE ‘P Forms’

Nov 2018

9

Manually Processing Payroll with PAYE Modernisation

PAYE Modernisation is the most significant change ever to happen to the Irish PAYE system. The new legislation will be a big change for all employers, especially those with little payroll experience. With the added workload required to process PAYE Modernisation, it is important that all employers prepare for PAYE Modernisation. From the very beginning of the year, employers must be ready to start reporting their payroll information to Revenue in real time.

Revenue estimates that a large number of employers still calculate their payroll manually. With PAYE Modernisation, these employers can still process their payroll using a manual, spreadsheet or paper-based system, but this outdated process will be time-consuming, cumbersome and prone to errors. Failing to comply with PAYE Modernisation will result in penalties or fines being imposed from Revenue.

Employers who process payroll manually will need to login to the ROS portal each pay period, be it weekly or monthly, and manually enter the required details for each of their employees, a bit like manually completing a P35 each pay period. Also, before processing the payroll in any week, manual users will need to login to ROS to get details of tax credits and cut off points.

Many business owners believe that a manual payroll system is a relatively easy way to manage their payroll and can seem like the most cost-effective option. However, along with the additional time required to process payroll, a manual system can result in inaccurate payroll processing as it does not have built-in processes to catch mistakes or notify you of payroll changes. Manual records are also very difficult to maintain, store securely under GDPR and are subject to greater human error. It is important to note that late periodic submissions or a constant pattern of correction submissions will potentially result in non-compliance penalties and fines.

PAYE Modernisation with Payroll Software

Revenue has strongly advised employers to review their payroll processes and systems to ensure they meet the new PAYE Modernisation requirements for January 2019. Payroll software which caters for PAYE Modernisation will improve and simplify communications between employers and Revenue.

If you have the correct payroll software tools in place, the ongoing reporting to Revenue will be seamless, ultimately saving time and reducing the risk of errors each pay period. Employers using payroll software that is Revenue compliant will be able to create and send the periodic PSR submission directly to Revenue from the payroll software at the click of a button. This integration with Revenue will also allow employers to automatically retrieve RPNs for employees from within the payroll software. Changes to an employees tax credits and cut-offs can then be updated in the payroll software with just one click.

Free Online Training

Thesaurus Software and Revenue have teamed up to bring you free PAYE Modernisation training webinars. We have put together a series of webinars aimed specifically at employers who are currently processing their payroll manually. During the webinars, we will look at the advantages and disadvantages of manually processing your payroll for PAYE Modernisation. Places are limited - Click here to book your place now.

Thesaurus Software is at the forefront when it comes to PAYE Modernisation complaint payroll software. With two different payroll packages to choose from - Thesaurus Payroll Manager and BrightPay - customers will be guaranteed leading-edge software and expertise. To help single-employee companies with their PAYE Modernisation duties, we are offering a free BrightPay employer licence for 2019. This free licence includes free email support and full functionality for PAYE Modernisation.

Related Articled:

- How do you submit payroll information with PAYE Modernisation?

- Manually processing payroll? It's time to modernise your payroll processing!

- How to master PAYE Modernisation

Thesaurus & BrightPay Newsletter - Are you missing out?

We will not be able to email you about webinar events, special offers, legislation changes, other group products and payroll related news without you subscribing to our newsletter. You will be able to unsubscribe at anytime. Don’t miss out - sign up to our newsletter today!

Thesaurus Payroll Software | BrightPay Payroll Software

Oct 2018

12

How to Master PAYE Modernisation

In January 2019 Revenue will begin to enforce a new Pay As You Earn system that will introduce real-time reporting of employee’s tax and other deductions directly to Revenue every time an employee is paid. This new system will be known as PAYE Modernisation.

Although the new system is expected to cause a lot of confusion, particularly for small and micro employers, PAYE Modernisation will seek to provide a much more accurate solution to the current PAYE system and ultimately benefit all employers and employees.

For over two decades, Thesaurus payroll software has supported businesses both large and small to pay hundreds of thousands of employees every month. At Thesaurus and BrightPay we are working directly with Revenue to make sure we’re ready for PAYE Modernisation. Our aim is to ensure the new PAYE process is a seamless and smooth process for our users.

Our development team have already experienced what it is like to implement real time processing and reporting in the UK. Our understanding and knowledge coupled with the reliability and maturity of Thesaurus payroll software will guarantee a user-friendly PAYE Modernisation experience.

We understand how stressful this change is going to be for payroll professionals and as a result, to help you get it right, Thesaurus have teamed up with a Revenue representative to bring you a series of webinars where you’ll gain the knowledge needed to comply with and master the new PAYE changes. Places are limited - secure your place today.

PAYE Modernisation: Key facts you must know to ensure 100% compliance.

Agenda:

- An overview of PAYE Modernisation

- Recent updates and changes to PAYE Modernisation

- Can PAYE Modernisation be processed manually?

- Elimination of the P forms - P30, P60 P35, P46 and P45 forms

- Making corrections in real-time

- The role of payroll software

- How PAYE Modernisation will affect small employers

- The benefits of PAYE Modernisation for you

- 10 step Checklist to PAYE Modernisation

- How Thesaurus Payroll handles PAYE Modernisation

The Panel

Main presenter: Paul Byrne

Guest presenter: Sinead Sweeney

Guest presenter: Sandra Clarke

More information | Secure your place

Read More Like This:

PAYE Modernisation: Meet the experts

PAYE Modernisation: What you need to know

GDPR and Payroll Processing. Do I need consent from my client's employees?

Thesaurus & BrightPay Newsletter - Are you missing out?

We will not be able to email you about webinar events, special offers, legislation changes, other group products and payroll related news without you subscribing to our newsletter. You will be able to unsubscribe at anytime. Don’t miss out - sign up to our newsletter today!

Thesaurus Payroll Software | BrightPay Payroll Software

Sep 2018

21

BrightPay wins ‘Payroll Software of the Year’

BrightPay was announced the winner of ‘Payroll Software of the Year’ at this year’s AccountingWEB’s Software Excellence Awards.

The awards, which took place in London, are held by AccountingWEB - an online community for accounting and finance professionals in the UK. The winner is decided by a public vote, whereby members are asked to rate the software systems they use to determine the best products on the market.

It’s a great achievement for BrightPay to win the prestigious award, especially when you look at the number of larger software companies offering payroll in the UK. BrightPay also has a 99% customer satisfaction rate, and is used to process payroll for over 120,000 businesses across the UK and Ireland.

Marketing Manager at BrightPay, Karen Bennett says: “We’re delighted to win this award; it’s fantastic for BrightPay and our team to be recognised by our customers and the AccountingWEB members, and a massive thank you to everyone who voted for us.”

Paul Byrne, Managing Director, says: “It’s a real pleasure and honour to receive this award. It’s great to see such recognition for all the hard work we have put in. We work hard each year to improve the BrightPay experience for all of our customers, both in terms of the payroll software itself and the customer support that we offer.”

BrightPay in Ireland

In the Irish market, BrightPay is currently preparing for PAYE Modernisation, a real time reporting system that is being introduced on 1st January 2019. Essentially, employers will be required to report pay information to Revenue each pay period. This overhaul of the Irish PAYE system aims to ensure that employers and employees have the most accurate, up-to-date information relating to pay and tax deductions.

A similar system was introduced in the UK in 2013, which was seamlessly integrated into BrightPay UK payroll software. We have the relevant experience to ensure that PAYE Modernisation is just as streamlined in BrightPay Ireland. By switching to BrightPay Ireland, you can be assured that you have PAYE Modernisation compliant payroll software.

Book a demo today to see how BrightPay can help you with PAYE Modernisation.

Are you missing out on our newsletter? We will not be able to email you without you subscribing to our mailing list. You will be able to unsubscribe at anytime. Don’t miss out - subscribe today!

Related Articles:

- Which is really better - the existing PAYE system or PAYE Modernisation?

- Manually calculating payroll with PAYE Modernisation

- PAYE Modernisation: Frequently Asked Questions

- BrightPay Ireland - Customer Survey - The Results are in!

Jun 2018

8

What happens if I don’t comply with GDPR ?

The amount of data currently being processed by businesses was unforeseeable way back in the 1990’s when the current Data Protection Regulation was drawn up. Officials recognised that the current rules just weren’t sufficient to handle the current digital era. An updated reform was agreed and GDPR was born.

From May 25th, the GDPR legislation was enforced by data regulators across Europe. As this deadline is passed, it is important to note that every business that stores and manages personal data will be affected by this change.

To help you with your GDPR preparation we’ve compiled a list of some of the most common questions that we get asked:

What is personal data?

Personal data is anything that allows a person to be identified. Some examples would be; name, address, IP address or photo.

What happens if I don’t comply with the GDPR?

One of the most talked about elements of the GDPR is the consequences for non-compliance. Companies that fail to comply can face fines of up to £20 million or 4% of turnover (whichever is greater).

Will the GDPR affect my business?

In short, yes. GDPR will affect every individual and organisation that holds or processes personal data from any individual in the EU.

Can I still email payslips?

Emailing payslips is still perfectly acceptable under the GDPR. However, it is important to consider the security of the payslip. Payroll software, like BrightPay & Thesaurus, will encrypt payslips and automatically delete payslips that are sent from our servers.

How can BrightPay/ Thesaurus help?

Data Protection has always been a priority for BrightPay & Thesaurus. Like all companies, we’ve had to review how we handle data in preparation for the GDPR. Here is a list of resources we’ve put together to aid you on the voyage to becoming compliant with the GDPR:

1. Free GDPR webinars for payroll bureaus and employers

Join us for our free webinar where we will discuss what GDPR is and why employers need to take it seriously.

2. BrightPay & Thesaurus Connect

The GDPR states that where possible individuals should have access to a secure, self-service remote system which would provide direct access to their personal data. BrightPay Connect is a self-service option which will give employees online remote access to view their payroll information at any time.

3. Free GDPR and The Future of Payroll guide

This guide will specifically look at the impact of GDPR on your payroll processing and highlight the biggest areas of concern. We will walk through some important steps to achieve GDPR compliance.

4. Free template: Data Processor Agreement

Whenever a data controller (e.g. a payroll bureau client) uses a data processor (e.g. payroll bureau) there needs to be a written contract in place. The contract is important so that both parties understand their responsibilities and liabilities.

BrightPay Newsletter - Are you missing out?

GDPR is changing how we communicate with you. From May 2018, we will not be able to email you about webinar events, special offers, legislation changes, other group products and payroll related news without you subscribing to our newsletter. You will be able to unsubscribe at any time. Don’t miss out - sign up to our newsletter today!

Related Articles:

- Thesaurus - June 2018 customer update.

- GDPR: What you need to know.

- Real-time reporting to become part of payroll processing.

Thesaurus Payroll Software | BrightPay Payroll Software.

Apr 2018

19

Real time reporting to become part of payroll processing

In less than a year the current PAYE system is going to change remarkably with the introduction of real time reporting known as PAYE Modernisation. The current payroll system hasn’t been modified since it was first introduced in the 60’s.

The main objective of PAYE Modernisation is to enable clear communication between Revenue and those who are processing payroll. This change will affect most, if not all businesses across Ireland.

Some of the common questions people have asked about PAYE Modernisation are:

- What do I have to do differently for PAYE Modernisation?

PAYE Modernisation will mean that people processing payroll will now how to submit a file to Revenue every pay period as opposed to the current annual ‘P’ forms. Payroll Software will make this a hassle free process, ensuring employers can easily comply with PAYE Modernisation.

- Will PAYE Modernisation be complicated?

PAYE Modernisation will likely cause a significant burden to employers, particularly small employers that do not currently utilise payroll software. BrightPay and Thesaurus Software will be fully equipped to make PAYE Modernisation a seamless process for payroll processors. Our developers have already implemented a similar real time reporting process for our UK payroll software.

- What will PAYE Modernisation cost my business?

As reports will need to be submitted to Revenue every pay period a lot of businesses will be relying on payroll software to do this for them. If you do not have payroll software in place, now is the time to think about purchasing. Luckily, low cost payroll software, like BrightPay and Thesaurus payroll will seamlessly handle PAYE Modernisation.

- Will PAYE Modernisation take up a lot of my time?

For companies still processing payroll manually, PAYE Modernisation will likely impose a significant time burden. For employers utilising payroll software like BrightPay and Thesaurus Software, administrative tasks will be significantly simplified. PAYE Modernisation reports required by Revenue can be sent easily from within the software. Also, the introduction of PAYE Modernisation has meant the elimination of the time consuming annual ‘P’ forms.

Free PAYE Modernisation Webinars

If there is something you’re still unsure of relating to PAYE Modernisation, we have teamed up with Revenue to bring you free online training webinars. These webinars are designed for employers and payroll bureaus to discuss what PAYE Modernisation will mean for your business and to help you prepare for the transition to the new system. You can sign up to our newsletter to get an invitation to our next PAYE Modernisation webinar.

Thesaurus & BrightPay Newsletter

GDPR is changing how we communicate with you. After May 2018, we will not be able to email you about webinar events, special offers, legislation changes, other group products and payroll related news without you subscribing to our newsletter. You will be able to unsubscribe at anytime. Don’t miss out - sign up to our newsletter today!

Thesaurus Payroll Software | BrightPay Payroll Software

Related Articles:

Mar 2018

5

Less than 3 months to go: Are you prepared for GDPR?

The EU’s General Data Protection Regulation (GDPR) will be implemented in Ireland in May 2018 with the aim of protecting all EU citizens from privacy and data breaches in an increasingly data driven world.

Unfortunately, many employers do not realise that 25th May 2018 is a deadline as opposed to a start date. It is important that all employers are ready and GDPR compliant by this date, with potential fines for breaches as high as €20 million or 4% of global turnover.

All employers process large amounts of personal data, especially when it comes to their customers and their employees. Consequently, the GDPR will impact most if not all areas of the business and the impact it will have cannot be overstated.

Organisations need to act now to prepare for the potential changes to their systems and procedures. The introduction of GDPR is just three months away, and by now all businesses should be taking action.

As part of our own preparation, we need your help. After 25th May 2018, we will not be able to email you about webinar events, special offers, legislation changes, payroll related news and other group products without you subscribing to our mailing list. You will be able to unsubscribe at anytime.

Don’t miss out - sign up to our newsletter today!

Free Webinar: GDPR for your Payroll Bureau

BrightPay by Thesaurus Software is hosting a free webinar on 8th March to help payroll bureaus prepare for GDPR. In this webinar, we will peel back the legislation to outline clearly:

- What is GDPR and why is it being implemented?

- Why employers need to take it seriously

- How it will impact payroll bureaus

- How to prepare for GDPR

- How we are working to help you

Places are limited - book your place now!

Jan 2018

22

How will PAYE Modernisation affect your payroll bureau? Only 10 Places Left!!!

Revenue are joining Thesaurus Software for a series of free, CPD accredited webinars detailing what you need to know about PAYE Modernisation.

How will PAYE Modernisation affect your payroll bureau?

There are just 10 places left for our next webinar which takes place this Thursday! With almost 1,000 accountants and payroll bureaus already registered, this is your last chance to register.

Agenda

- An introduction to PAYE Modernisation including recent changes

- What direct effect will this have on employers?

- What direct effect will this have on employees?

- What are the possible downsides for employers?

- Revenue’s delivery schedule

- The role out of PAYE Modernisation in the UK

- Processing manually or using payroll software?

- The letter of engagement

- How will PAYE Modernisation affect your payroll service

- Communicating these changes to your clients.

Don’t miss out - book your place now!!

Payroll Bureaus: Getting Ready for PAYE Modernisation

The next webinar in the series takes place in March where there will be a key focus on what payroll bureaus need to do to prepare for PAYE Modernisation.

Subscribe to our Newsletter

We have lots more webinars scheduled over the coming months. Don’t miss out - make sure to sign up to our newsletter today! You will have the option to unsubscribe at any time.

Thesaurus Payroll Manager | BrightPay Payroll Software

Related Articles:

Dec 2017

20

What's New in BrightPay 2018?

BrightPay 2018 is now available (for new customers and existing customers). Here’s a quick overview of what’s new:

2018 Tax Year Updates

- 2018 rates, thresholds and calculations for PAYE, USC, PRSI, LPT and PRD.

- From 1st January 2018, Revenue will tax Illness Benefit by adjusting employee's tax credits and cut off points. As a result of this change, there will be more frequent P2Cs issued for employees.

Payroll Journal

BrightPay 2018 enables you to produce a CSV payroll journal for import into your accounting software. This feature is accessed via the new Journal button on the payroll toolbar, and provides the following:

- The file formats and default nominal ledger code mappings are included for Quickbooks, Sage and Xero. These built-in mappings can be tailored to meet your own requirements, or you can create your own nominal ledger mapping from scratch if need be.

- Specify the journal date range – payslips finalised with a pay date in the range you select are included.

- Include individual journal records for each employee, or merge the employee records into rolled up records for each unique payment date.

- If required, you can use alternate nominal codes for payroll items relating to directors.

- Use a specific nominal code for any custom employer-wide item you have set up in BrightPay (i.e. addition/deduction types, hourly/daily/piece rates, pension schemes, savings schemes, etc.)

- Preview journal on screen, export preview to PDF, or print.

- Export journal CSV file for import into your accounting software.

Several accounting software providers can accept a direct upload of a payroll journal via an API, negating the need to export/import a CSV file. We plan to add this functionality for supporting providers soon.

Please get in touch if you'd like to see built-in support for any other accounting software providers.

Bureau Features

BrightPay 2018 includes several new features specifically targeted at accountants, bookkeepers, or other payroll bureau service providers. These bureau features are exclusive to the bureau version of BrightPay.

Improvements to BrightPay Startup Window

The columns on the BrightPay startup window can now be customised, and you can order the list of employers on the startup screen by any column. To help make this personalisation more useful, the size and position of the startup window will now be remembered between launches.

The data on the startup window now more reliably updates by itself - you no longer have to open a file to get it to do so.

Client Details

You can now record the following client information for each employer in BrightPay:

- Contact name, email address and phone number

- Status

- Due date

- Notes

- Label colour

This information can be edited directly from the startup window by right-clicking on an employer and selecting the new View/Edit Client Details menu option (this menu also includes a quick one-click link to set a label colour), or it can be entered via the new Client Details tab in Edit Employer Details when a file is opened in BrightPay.

Perhaps most usefully, these client details can be shown as columns on the BrightPay startup window, enabling you to more effectively manage your client workflows as an individual or across a team.

BrightPay Connect

In case you missed it, we launched "BrightPay Cloud" with BrightPay 2017. We have now rebranded this as BrightPay Connect. It works exactly as it has to date, including some further refinements and new features for 2018.

We have a detailed web page about BrightPay Connect here. Here's a quick overview of what it's all about:

- BrightPay Connect provides a secure, automated and user-friendly way to backup and restore your payroll data on your PC to and from the cloud.

- BrightPay Connect provides a web/mobile based self service dashboard for your employees, enabling them to:

- View/download their payslips and other payroll documents

- View their calendar, and make requests for annual leave.

- View and edit their personal details.

- BrightPay Connect provides a web/mobile based self service dashboard for employers and clients of payroll bureaux, enabling them to:

- Access the payroll documents and data for each of their employees.

- View an employer-wide payroll calendar.

- View payroll reports exactly as you have set them up in BrightPay.

- View the schedule of Revenue payments, outstanding amounts, and access the P30 for each tax period.

BrightPay Connect is built for security, reliability and stability, and costs just €59 per employer. Bulk pricing is available for bureaus.

Other 2018 Changes and New Features in BrightPay

- The foundational technology of BrightPay has been updated to the latest version, which immediately brings many performance, reliability and security improvements (and opens up new possibilities to our development team!). A side effect of this update, however, is that BrightPay 2018 cannot be run on Windows XP. We've attempted to make all customers aware of this change several times over the past year, and our telemetry now shows that less than 1% of our customers still run on Windows XP. So while we do apologise for any inconvenience this causes, with the improvements gained it is unquestionably the best decision for our customers as whole.

- Import from Sage MicroPay and Big Red Book.

- Import/export employer from/to CSV file.

- Improves how pay dates are entered when finalising payslips – you can now set a different pay date for individual employees if need be. When re-opening and re-finalising payslips, the previously used pay date is remembered.

- When finalising one or more previously re-opened payslips, you can now choose to either remember all the pay items and settings going forward (e.g. if re-opening to make a one-off correction), or to reset the payroll going forward (e.g. if re-opening to redo from that point onward). When re-opening back more than one pay period, you now also have the option to fast-forward re-finalise back to where you were.

- Ability to view/print log of P2C updates.

- Ability to set a custom multiplier for hourly/daily payments.

- Ability to override a named employer daily/hourly rate with an employee-specific rate.

- Support for Paternity Leave and Paternity Benefit.

- Net to gross now works for net, take-home and cost to employer.

- Employee count report.

- Create employee address labels.

- Ability to send support requests directly from within BrightPay (accessed via Help menu).

- The Export PDF dialog now remembers its settings between usages (password usage, auto-open)

- Optimisations to data file size and installation package size.

- Lots of minor improvements throughout the entire BrightPay user interface, as well as the latest bug fixes.