Apr 2022

27

Offer payments as a service and increase profits

Up until now, calculating the payroll and settling the payroll have always been separate tasks from one another. On top of that, the time it takes to manually upload bank files, submit paperwork to Revenue, and make any last-minute changes to your payment files, can become overwhelming. Imagine if it could be done all in one central location, streamlining the entire payment process for you?

This is all now possible thanks to BrightPay’s integration with Modulr, the direct payments platform. With this integration, you can save time, reduce payment errors and maximise the efficiency of your business.

Please note: to use this integration, users must set up a Modulr account.

Who are Modulr?

Modulr is a direct payments platform that is transforming the way companies do business, by focusing on automating end-to-end payment flows. This allows their partners to embed payment functionality into their software so that customers can have a seamless workflow experience.

Here are three features that BrightPay’s integration with Modulr can offer to bureaus:

1. Pay employees on the same day

With Modulr’s integration, employees can receive payments on the same day, when processed before 2 pm. This is all done within BrightPay itself, by selecting ‘pay by Modulr’ and sending payments instructions straight to Modulr. This instantly eliminates the hassle of more traditional methods of manually uploading bank files and using outdated payment methods that can take up to three business days to land in employees’ bank accounts. To learn more, watch this short four-minute video on how the payment process works when using Modulr within BrightPay.

2. Payment flexibility

Modulr allows you to schedule payments in advance, meaning you can have payments land in employees’ bank accounts on a day of your choosing. Say goodbye to the panic associated with distributing payments and hello to a more flexible payment approach. The integration grants you the flexibility to make any last-minute changes to your payments if needed, rather than spending hours on the phone to the bank trying to rectify them, taking a serious weight off your shoulders.

3. More secure payments

Not only are you saving an incredible amount of time by incorporating Modulr into your payroll workflow, but you’re also improving the security of your clients’ payments. With Modulr, the network is completely secure and encrypted. You don’t have to leave BrightPay to pay employees either –log in to Modulr directly through the payroll software, and payment details are sent straight to Modulr. This removes risks such as file transfer errors and data duplication.

Once the payments are finalised, the person in the business who authorises payments must log in to the Authy mobile app to approve the payments, before they’re distributed. This login comes with secure two-factor authentication via the authorisation app, Authy, providing an added layer of protection to your payments and ensuring all information is accurate before landing in employees’ bank accounts.

Can I offer this to my clients?

This innovative payment integration with Modulr provides you the opportunity to offer payments as a service to your clients. Learn more about Modulr's payment process in our step-by-step guide here. Interested in learning more about BrightPay? Book a free online 15-minute demo today to see how our award-winning payroll software can enhance your bureau.

Nov 2020

17

National Minimum Wage to increase by 10c per hour

The National Minimum Wage is going to increase from €10.10 per hour to the new rate of €10.20 per hour and this comes into effect from 1st January 2021. This increase will affect around 122,000 employees, increasing their national minimum wage by 0.9%. An employee working 40 hours a week will see their gross wages increase by €4.00 per week.

Minister for Social Protection, Heather Humphreys advised the minimum wage has increased by approximately 18% from the rate of €8.65 per hour in 2016 to the new rate of €10.20 per hour for 2021. She also assured that the PRSI thresholds would be changed in order to reflect the increase in the Minimum Wage.

Heather Humphreys stated that:

“I also want to ensure that the increase in the minimum wage does not result in employers having to pay a higher level of PRSI charge solely due to this increase. I will make regulations that will increase the employer PRSI threshold from €395 currently to €398 from 1st January 2021.”

The General Secretary of the retail union Mandate, Gerry Light, and the General Secretary of the Irish Congress of Trade Unions, Patricia King, resigned from their positions in the Low Pay Commission as they felt the 10c increase in the National Minimum Wage was not sufficient in meeting the needs of the minimum wage employees.

Make sure you keep up-to-date with the latest legislation changes. Subscribe to our newsletter today.

Sep 2018

12

National Minimum Wage - Increasing Jan 19

Currently, the national minimum wage is €9.55 per hour, which increased on 1st January 2018. The Low Pay Commission has recommended that the national minimum wage be increased by 25 cent to €9.80 per hour. The Government has accepted this recommendation and this increase is due to be introduced in January 2019.

This is the fifth increase of the national minimum wage since 2011. This increase could benefit up to 120,000 employees, increasing their hourly rate by 2.6%. An employee working 40 hours per week will see their gross pay increase by €10.00.

The new minimum hourly rates will be:

- Experienced adult worker – €9.80

- Under age 18 – €6.86

- In the first year after the date of first employment over age 18 - €7.84

- In the second year after the date of first employment over age 18 - €8.82

- In a course of training or study over age 18, undertaken in normal working hours-1st one third period: €7.35; 2nd one third period: €7.84; 3rd one third period: €8.82

The Taoiseach, Leo Varadkar said “this increase will put us in the top five in the world for our national minimum wage in cash terms and purchasing power.”

Related Articles:

- GDPR & Payroll Processing: Do I need consent from my client’s employees?

- PAYE Modernisation - List of Employees

- PAYE Modernisation: What you need to know

- What happens if I don’t comply with the GDPR ?

Are you missing out on our newsletter? We will not be able to email you without you subscribing to our mailing list. You will be able to unsubscribe at any time. Don’t miss out - subscribe today!

Jan 2018

2

Increase to Minimum Wage from January 2018

The National Minimum Wage for an experienced adult worker is increasing to €9.55 per hour from January 1st 2018. This is the third year in a row that the NMW has been increased but this is by far the largest with an increase of .30c

The National Minimum Wage Act, 2000 provides for a minimum hourly rate of pay for all workers.

All workers, including full time, part time, casual and temporary will be deemed to be covered by the act with only 2 exceptions; close relatives of the employer and certain industry specific apprentices.

Workers can be broken down into 5 different categories; experienced adult workers in employment more than 2 years and over the age of 18, a worker under the age of 18, workers in their first and second year of employment who are over the age of 18 and trainees’ who are undergoing a course that satisfies certain conditions set out in the Act.

The new minimum hourly rates are:

- Experienced adult worker – €9.55

- Under age 18 – €6.69

- In the first year after the date of first employment over age 18 - €7.64 per hour

- In the second year after the date of first employment over age 18 - €8.60

- In a course of training or study over age 18, undertaken in normal working hours-1st one third period: €7.17 per hour; 2nd one third period: €7.64; 3rd one third period: €8.60 per hour.

Breaches of the act are deemed to be criminal offences and are punishable with hefty fines and even imprisonment.

Thesaurus Payroll Manager | BrightPay Payroll Software

Related Articles:

Sep 2017

27

What do you mean…. “Do I have a backup?”

One of the most common calls I get on the support line is from a distressed customer who tells me they have lost their payroll information. Reasons for the loss of this information are varied and could be anything from a laptop being stolen, a virus attacking the computer, holding files to ransom or fire or water damage to the computers in the office.

The first question I’ll ask on a call of this type will be “do you have a backup?”. Honestly, I can’t tell you the number of people that say “No” to this. People are also mistakenly under the impression that we have a copy of their payroll data. Unfortunately this is never the case, we do not have access to the employer’s payroll information so this can add to the customer's stress levels as you can imagine!

We would always stress the importance of taking a backup of your payroll information. You would have your computers and office equipment insured against anything happening so why would you not do the same for your data? Think of your backup as your information’s insurance policy, after all it is almost irreplaceable or at the very least a major inconvenience to try and rebuild your payroll.

In a lot of cases, the call to our customer support line comes too late for us to be of any real assistance and the only advice we have to give is to start over and process payroll from the beginning again.

We never think anything like this will happen to us, but take it from me, it does, so go ahead and take out that insurance policy and backup before it is too late!

The following links will guide you to taking a backup in your software or book a demo of BrightPay Connect our latest cloud add on that offers an automated online backup feature:

- BrightPay UK: https://www.brightpay.co.uk/docs/17-18/backing-up-restoring-your-payroll/

- BrightPay Ireland: https://www.brightpay.ie/docs/2017/backing-up-restoring-data-files/backing-up-your-payroll-data/

- Thesaurus Payroll Manager: https://www.thesaurus.ie/docs/2017/processing-payroll/backup-data-files/

Sep 2017

22

Public Holiday Pay Entitlement

There can often be some confusion surrounding an employee's entitlement to pay for a public holiday particularly where the employee may be part-time or the public holiday falls on a day that the employee does not normally work.

It is also worth noting that not every bank holiday is a public holiday though in most cases they coincide. Good Friday is a bank holiday but it is not a public holiday. The following dates are the official public holidays in Ireland.

- New Year's Day (1 January)

- St. Patrick's Day (17 March)

- Easter Monday

- First Monday in May, June, August

- Last Monday in October

- Christmas Day (25 December)

- St. Stephen's Day (26 December)

Employees who qualify for public holiday benefit will be entitled to one of the following:

- A paid day off on the public holiday

- An additional day of annual leave

- An additional day's pay

- A paid day off within a month of the public holiday

So, who is entitled to a payment?

- Part-time employees qualify for public holiday entitlement if they have worked at least 40 hours in the 5 weeks ending the day before the public holiday.

- Full time employees are not required to have worked up a minimum number of hours.

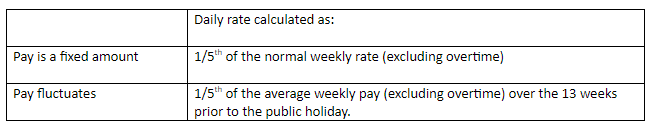

How to calculate the amount to be paid?

If the public holiday falls on a day which the employee would normally work:

- Full-time employees are entitled to one of the above four options at the employer’s discretion.

- Part-time employees have the same entitlement, so where the employee’s pay is a fixed amount the normal daily rate can be used. If the pay varies, the daily rate should be calculated over the 13 weeks immediately before the public holiday in question.

If the public holiday falls on a day which the employee does not normally work:

Further information can be found at Organisation of Working Time Act 1997.

Jul 2017

6

Living Wage increased by 20 cent

The 2017 Living Wage has been set at €11.70 per hour, up from €11.50 last year. The new figure represents an increase of 20 cent per hour on the previous rate. The recommended living wage rate is now nearly a third higher than the legally required minimum wage, which is set at €9.25 an hour.

The 20 cent increase in the Living Wage was arrived at upon consideration of a number of changes in the cost of living and the taxation regime in the last year. The Living Wage for the Republic of Ireland was established in 2014, and is updated in July of each year. It is part of a growing international trend to establish an evidence-based hourly income that a full-time worker needs so that they can experience a socially acceptable minimum standard of living.

Mar 2017

31

Important Information for Employers - Changes to Civil Service Travel Rates

Where employees use their own private cars or motorcycles for business purposes, reimbursement in respect of allowable motoring expenses can be effected by way of flat-rate mileage allowances.

There are two types of mileage allowance schemes which are acceptable for tax purposes if an employee bears all the motoring expenses:

- The prevailing schedule of Civil Service rates; or

- Any other schedule with rates not greater than the Civil Service rates

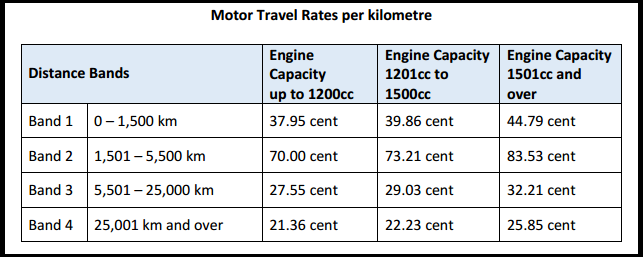

The Department of Public Expenditure and Reform has recently published circulars with new Civil Service Travel Rates, the revised rates are effective from 1st April 2017. The distance bands have increased from two to four with a lower recoupment rate for the first 1,500 kilometres.

Business travel carried out between 1st January and 31st March 2017 will not be affected by these new bands and rates, business travel to date from 1st January 2017 will count towards the cumulative business travel for the year.

Motor Travel Rates - Effective from 1st April 2017

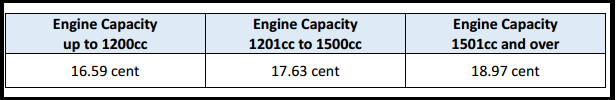

Reduced Motor Travel Rates per kilometre

The reduced rates are payable to Civil Service employees who undertake a journey associated with their job but not solely related to the performance of their duties, such as:

- Attendance at confined promotion competitions

- Attendance at approved courses of education

- Attendance at courses or conferences

- Return visits home at weekends during a period of temporary transfer

The Motor Travel Rates for motorcycles and bicycles remain unchanged as follows:

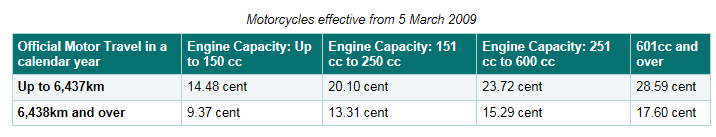

Motorcycle:

Bicycle: 8 cent per km

Please note, there are changes to subsistence rates which are also effective from 1st April 2017.

Please click here for the circular on Motor Travel Rates, and here for the circular on Subsistence

Mar 2017

20

New Illness, Maternity and Paternity Benefits rates in effect

Almost all welfare benefits and state pensions are to be increased in 2017.

The maximum weekly Illness Benefit payment will increase by €5.00 from €188 to €193 per week from week commencing 13 March 2017.

Illness benefit is considered as income for tax purposes and thus needs to be taken into account for PAYE purposes by an employer. It remains exempt from USC & PRSI.

No payment is made for the first six days of illness and for any Sunday.

Thesaurus Payroll Manager will automatically apply the increased rate of €193 per week as soon as Week 12 is reached in the software, which users should be aware of. Further information on how to process illness benefit in Payroll Manager can be found here:

In addition, standard Maternity and Paternity payments will increase from €230 to €235 per week from 13 March 2017. These are both taxable sources of income but aren’t liable to USC or PRSI. Unlike illness benefit, however, an employer must not tax these benefits through payroll. Instead, the Revenue will tax Maternity and Paternity Benefit via the employee’s tax credit Certificate by reducing the employee's SRCOP and tax credit on receipt of information from the Department of Social Protection.

Jan 2016

1

New Irish national minimum wage rate takes effect from 1 January 2016

The new hourly rate represents an increase of 50c on the previous figure and is the second increase to the minimum wage since 2011. Alongside the hourly pay increase, employer PRSI thresholds are being adjusted from 1 January to ensure that an increased PRSI burden does not fall on minimum wage employers.

- Experienced adult worker €9.15 per hour (was €8.65 )

- Over 19 and in 2nd year of first job €8.24 (was €7.79)

- Over 18 and in first year of first job €7.32 ( was €6.92)

- Aged under 18 €6.41 (was €6.06)

Minimum Wage for Trainees:

Employee aged over 18, in structured training during working hours

- 1st one third of course €6.86 (was €6.49 )

- 2nd third of course €7.32 (was €6.92 )

- 3rd part of course €8.24 (was €7.79)