Sep 2017

22

Public Holiday Pay Entitlement

There can often be some confusion surrounding an employee's entitlement to pay for a public holiday particularly where the employee may be part-time or the public holiday falls on a day that the employee does not normally work.

It is also worth noting that not every bank holiday is a public holiday though in most cases they coincide. Good Friday is a bank holiday but it is not a public holiday. The following dates are the official public holidays in Ireland.

- New Year's Day (1 January)

- St. Patrick's Day (17 March)

- Easter Monday

- First Monday in May, June, August

- Last Monday in October

- Christmas Day (25 December)

- St. Stephen's Day (26 December)

Employees who qualify for public holiday benefit will be entitled to one of the following:

- A paid day off on the public holiday

- An additional day of annual leave

- An additional day's pay

- A paid day off within a month of the public holiday

So, who is entitled to a payment?

- Part-time employees qualify for public holiday entitlement if they have worked at least 40 hours in the 5 weeks ending the day before the public holiday.

- Full time employees are not required to have worked up a minimum number of hours.

How to calculate the amount to be paid?

If the public holiday falls on a day which the employee would normally work:

- Full-time employees are entitled to one of the above four options at the employer’s discretion.

- Part-time employees have the same entitlement, so where the employee’s pay is a fixed amount the normal daily rate can be used. If the pay varies, the daily rate should be calculated over the 13 weeks immediately before the public holiday in question.

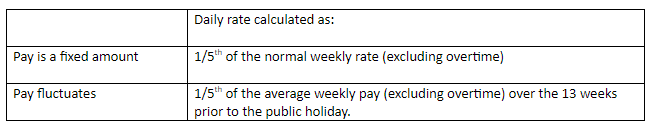

If the public holiday falls on a day which the employee does not normally work:

Further information can be found at Organisation of Working Time Act 1997.