PAYE Modernisation has introduced two new processes - the automated retrieval of Revenue Payroll Notifications for each of your employees from Revenue and the submission of your payroll data each payroll run to Revenue.

For this two-way communication to take place between BrightPay and Revenue’s systems, your ROS digital certificate will be used.

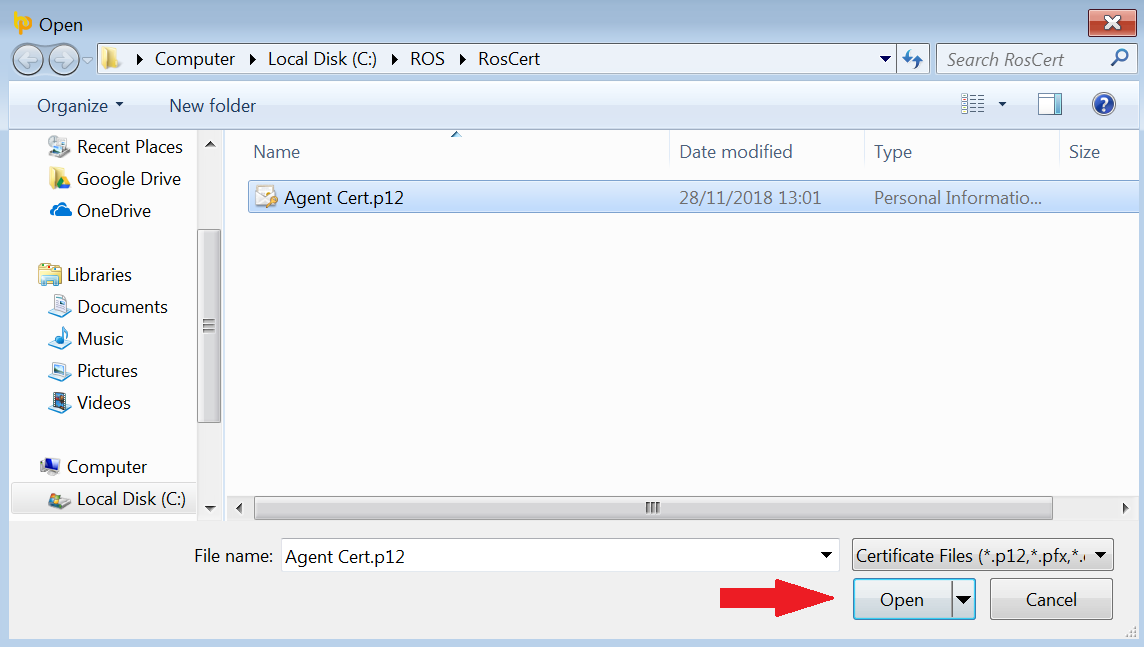

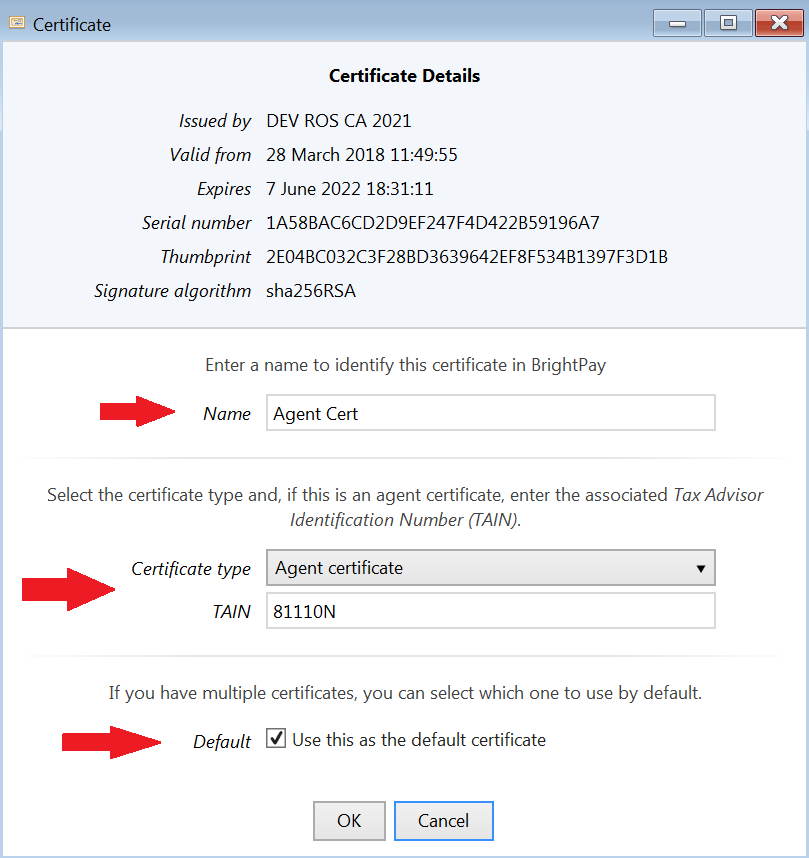

If you process payroll on behalf of clients and hold an agent certificate, your agent certificate will need to be added into the software before you can commence processing payroll for any of your clients.

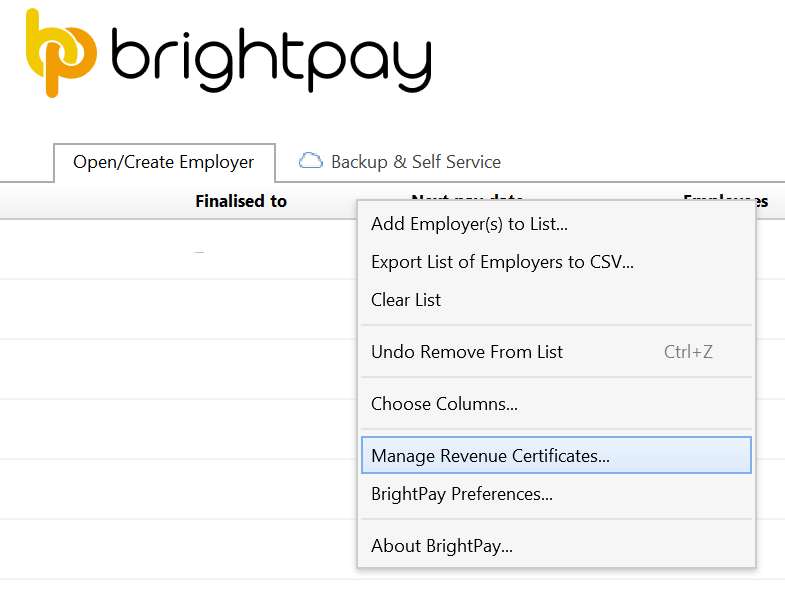

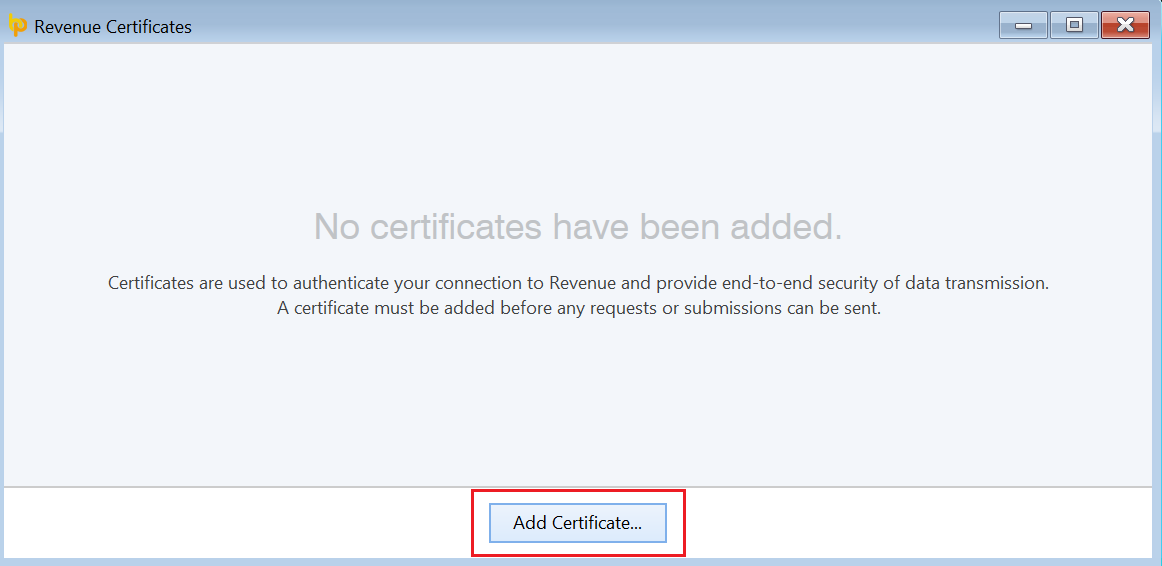

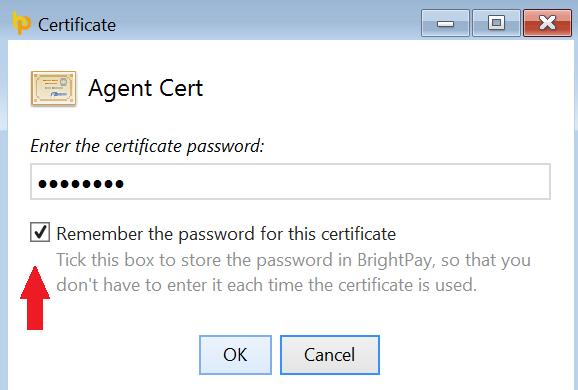

To add an agent digital certificate into the software:

Your Agent Certificate will now be added into the BrightPay software.

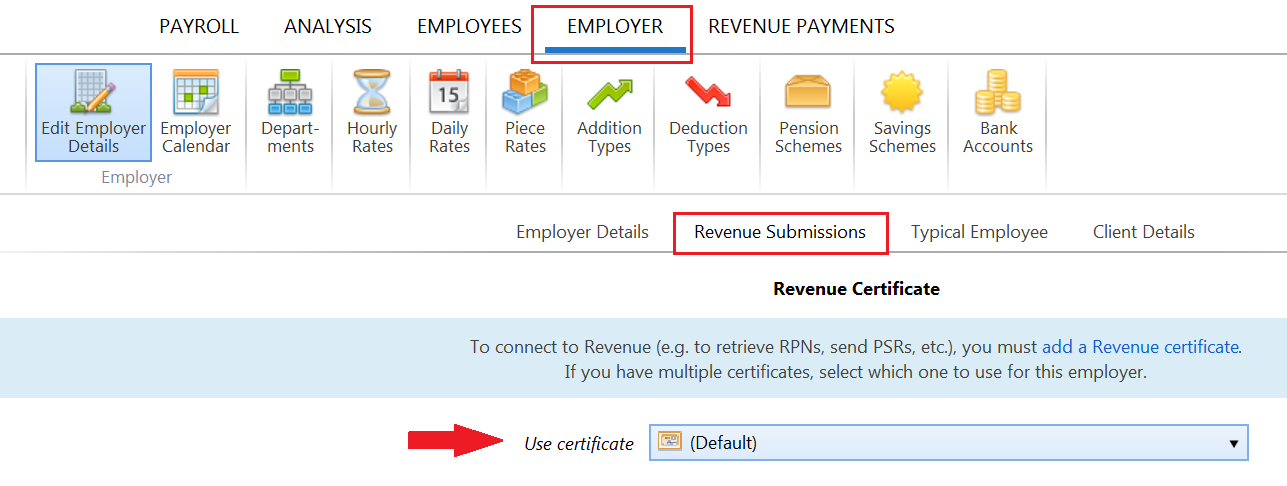

By default, each employer file will use the default agent certificate you have added to the software for retrieving RPNs and sending payroll submissions to Revenue.

This can be checked at any time by opening an employer file and accessing the 'Revenue Submissions' section within the Employer utility:

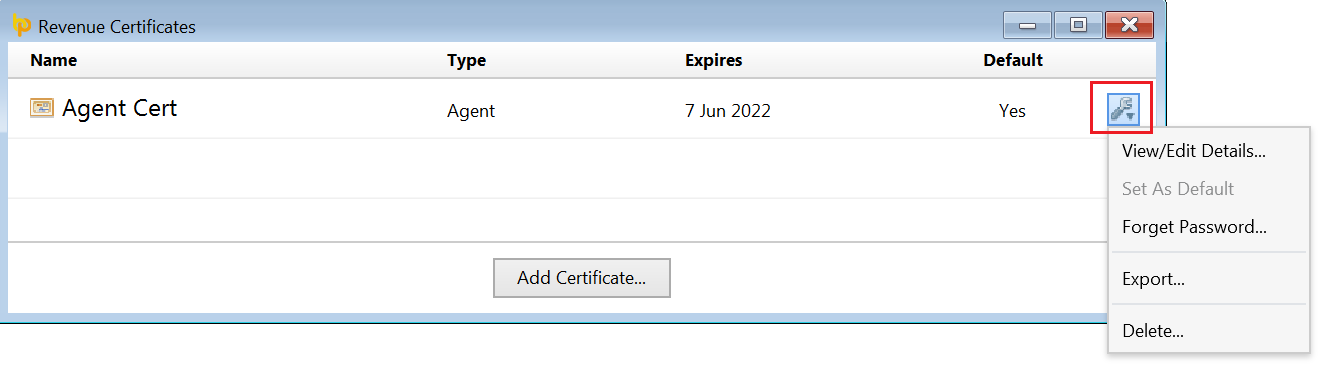

Once your certificate has been added, further functionality can be accessed at any time by going to 'File > Manage Revenue Certificates' and clicking the Edit button.

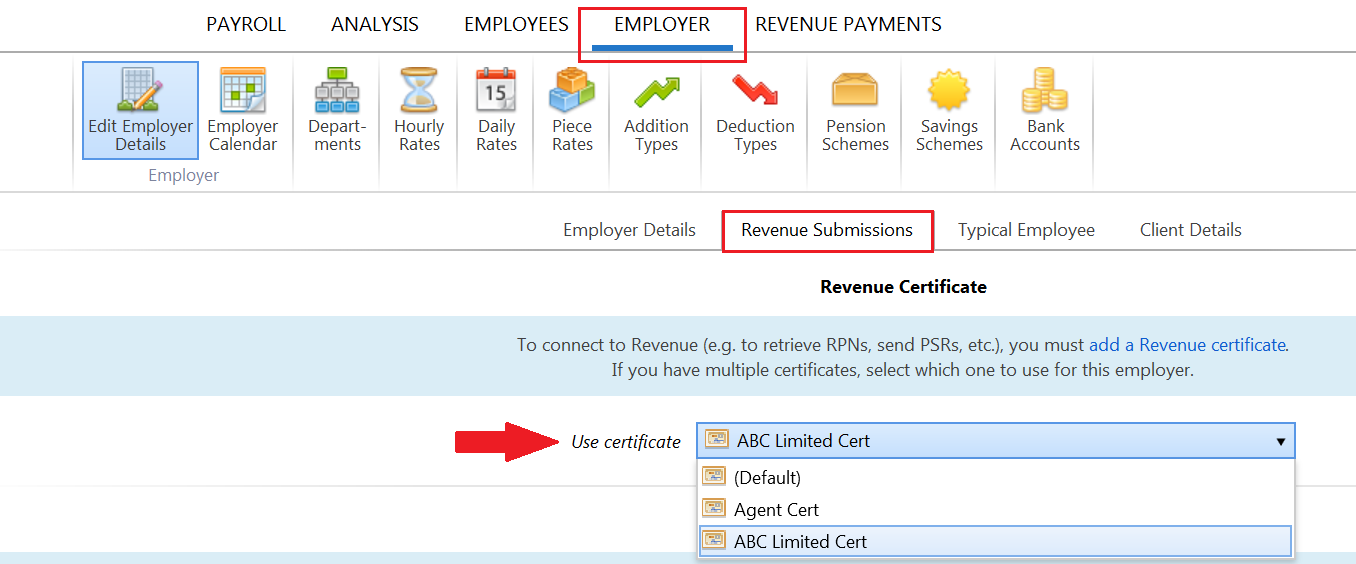

In the event you need to add an additional agent certificate to the software, or you have an employer file set up which is not linked to any agent certificate but for whom you have an employer certificate instead, repeat the steps above for adding your additional certificate(s) into the software.

Once you have added your additional certificate(s) to the software, you will now be able to link the relevant employer file to its correct certificate.

To do so:

Need help? Support is available at 01 8352074 or [email protected].