EWSS - Overview

Please note: the Employment Wage Subsidy Scheme (EWSS) has now ended.

The Employment Wage Subsidy Scheme (EWSS) has replaced the Temporary Wage Subsidy Scheme (TWSS) from September 1st 2020.

Comprehensive Revenue guidance has been published with regard to the operation of the Employment Wage Subsidy Scheme which can be accessed here.

Please find below an overview with regard to how the scheme operates and to help you prepare for it should you choose to avail of it.

Employment Wage Subsidy Scheme - Overview

- The scheme provides a flat-rate subsidy to qualifying employers based on the number of paid and eligible employees on the employer’s payroll.

- It has been announced that the scheme is currently extended until 30th April 2022.

- Eligible employers are required to register for the EWSS via ROS.

- Employers must hold up to date tax clearance to register for the scheme and receive the subsidy payments.

- Employers must ensure they meet the eligibility criteria for EWSS.

Further information on the qualifying criteria can be found on the Revenue website .

In addition, Revenue have published guidelines on eligibility for the Employment Wage Subsidy Scheme from 1 July 2021 which can be accessed here

- Employers must undertake a review of their eligibility for the scheme on the last day of every month (other than the final month of the scheme) to be satisfied whether they continue to meet the eligibility criteria and to take the necessary action of withdrawing from the scheme where they do not.

To assist employers in ensuring continued eligibility for the scheme, from 30 June 2021, all employers are required to complete and submit through ROS an online monthly EWSS Eligibility Review Form. Comprehensive guidance regarding this requirement can be found in Revenue's published guidelines which can be accessed here.

Subsidy Payment:

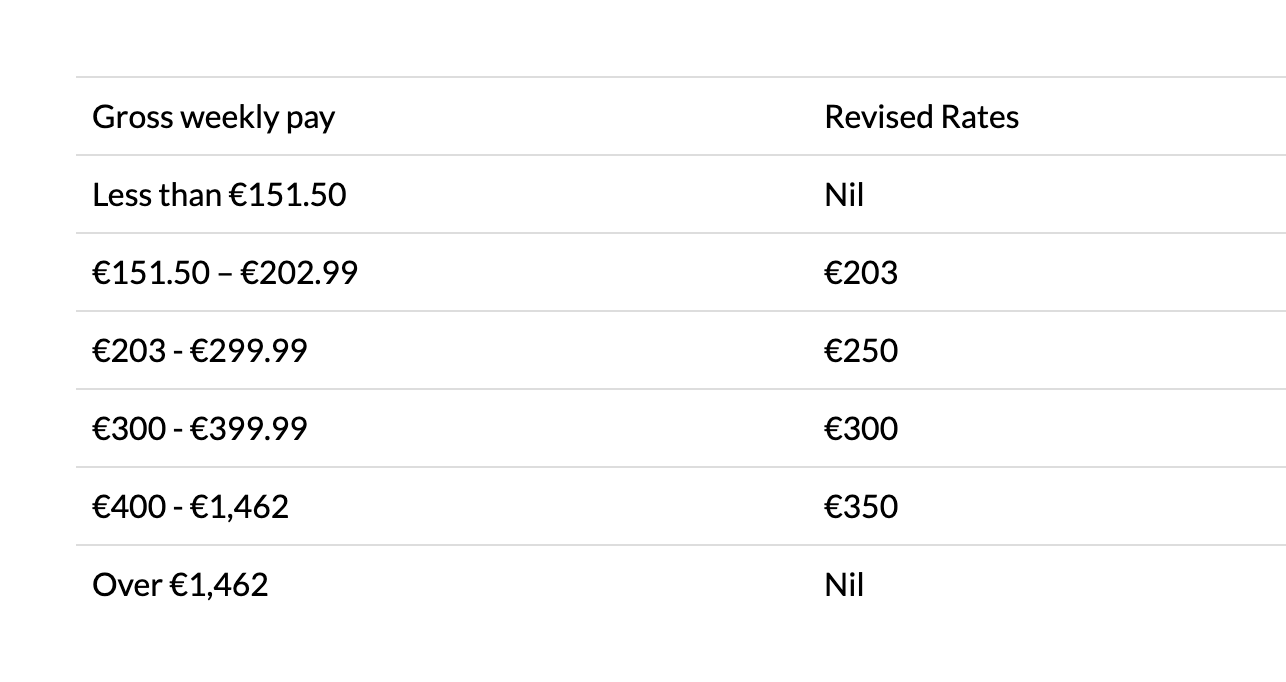

The following rates are effective until 31st January 2022:

Please note: gross pay includes notional pay and is before any deductions for pension, salary sacrifice etc.

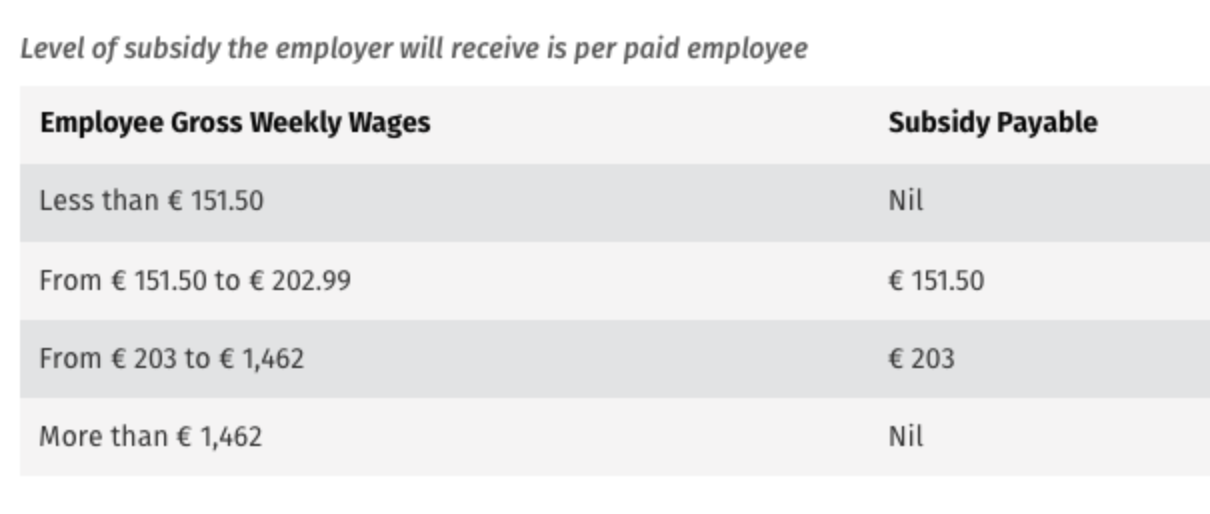

A two-rate structure of €151.50 and €203 applies for February 2022:

A flat rate subsidy of €100 will apply for March and April 2022.

For businesses that were directly impacted by the public health restrictions in December 2021 and who are eligible for the extension, please click here for guidance on how to operate this in BrightPay.

Payroll:

- Under the EWSS, employers are required to pay employees in the normal manner i.e. calculating and deducting Income Tax, USC and employee PRSI through the payroll.

- EWSS is a subsidy paid to an employer, it will not show on payslips or in myAccount.

Employer PRSI:

A 0.5% rate of employers PRSI will apply to employments that are eligible for the subsidy until the end of February 2022. This operates as follows:

- PRSI is to be calculated as normal via payroll e.g. on PRSI class A1.

- Revenue will then calculate a PRSI credit* by calculating the difference between the rate on the normal class and the 0.5%.

- The credit will show on the Statement of Account to reduce the employer’s liability to Revenue.

*Please note: the PRSI credit will not apply for March and April 2022.

Need help? Support is available at 01 8352074 or brightpayirelandsupport@brightsg.com.