EWSS - Subsidy Payments from 1st February 2022

Please note: the Employment Wage Subsidy Scheme (EWSS) has now ended.

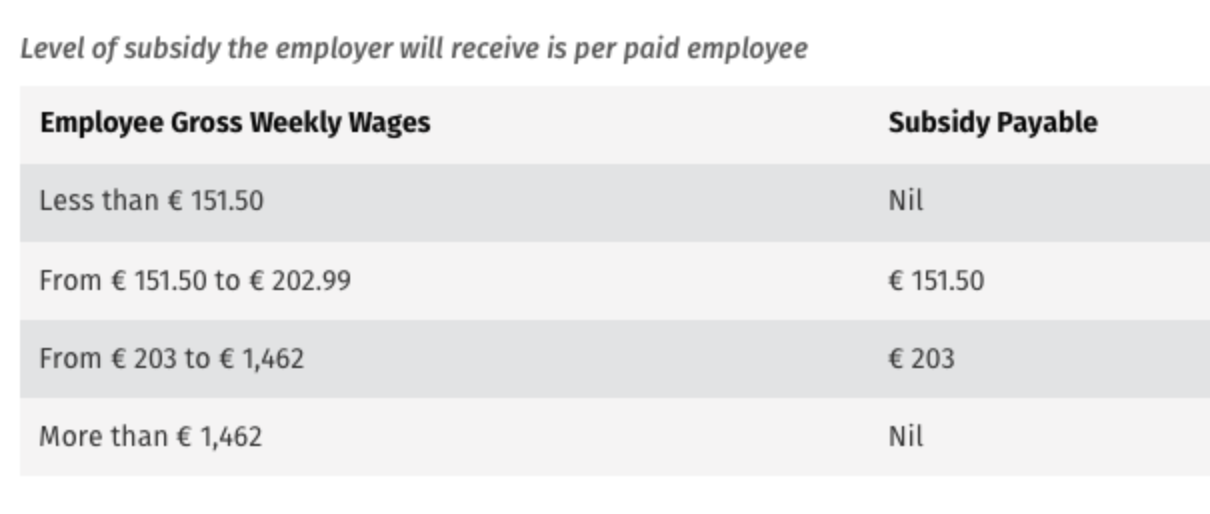

From 1 February 2022, businesses that were not directly impacted by the public health restrictions in December 2021, will move to a two-rate structure of €151.50 and €203 for February 2022 as follows:

A flat rate subsidy of €100 will then apply for March and April 2022.

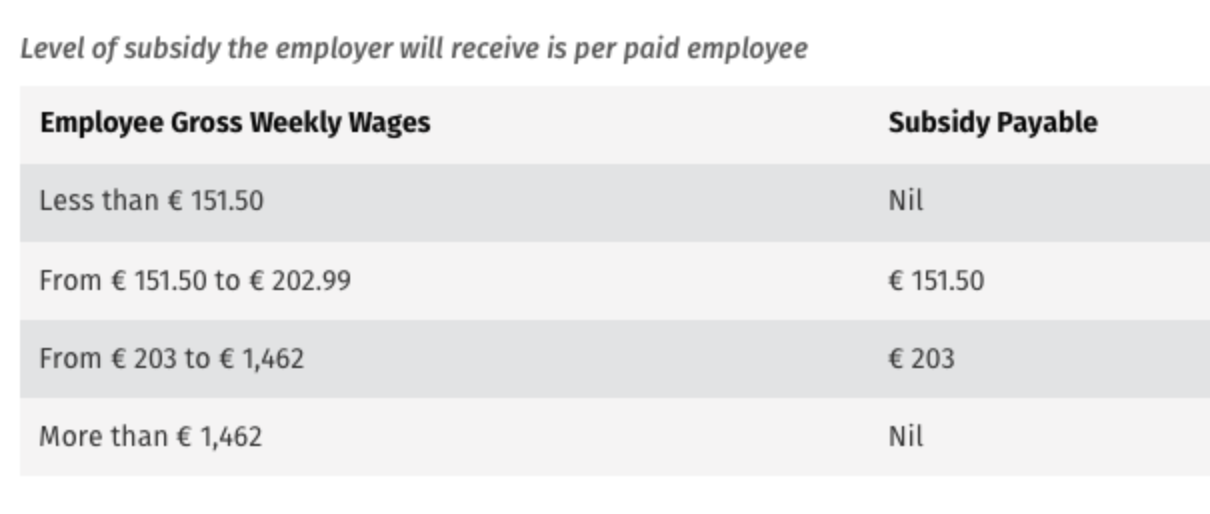

For those businesses that were directly impacted by the public health restrictions in December 2021, they will continue to receive the enhanced rates of subsidy for February 2022 as follows:

Such businesses will then move to the two-rate structure of €151.50 and €203 for March 2022:

A flat rate subsidy of €100 will then apply for April and May 2022.

Employer PRSI:

A 0.5% rate of employers PRSI will apply to employments that are eligible for the subsidy until the end of February 2022.

This operates as follows:

- PRSI is to be calculated as normal via payroll e.g. on PRSI class A1.

- Revenue will then calculate a PRSI credit* by calculating the difference between the rate on the normal class and the 0.5%.

- The credit will show on the Statement of Account to reduce the employer’s liability to Revenue.

*Please note: the PRSI credit will not apply for March, April or May 2022.

Need help? Support is available at 01 8352074 or brightpayirelandsupport@brightsg.com.