Oct 2019

25

Cloud HR Platforms – Making Compliance as simple as 1,2,3

As an employer, when it comes to your new employees, you must give a written statement of 5 core terms of employment within 5 days of starting employment (also known as a Day 5 Statement).

These 5 terms are:

- The full name of employer and employee

- The address of the employer

- The expected duration of the employment contract

- The method of calculating or rate of pay

- The expected normal working day and week

Employees must receive the remaining terms in writing within 2 months of starting work. Penalties for non-compliance are up to €5,000 fine and in extreme cases a potential prison sentence!

Nowadays, you don’t have to worry about how to get documents to your new employees. There is an easier, more powerful way to share your employee contracts. Thanks to Cloud HR Platforms, compliance is as easy as 1,2,3!

- Create a contract of employment for your new employee, making sure to include the core terms of employment.

- Ensure that your new employee has access to the employee portal for your company’s Cloud HR Platform

- Upload their completed contract to the Cloud and move on to getting to know your new hire!

That’s it! You are now fully compliant, following best practice recommendations and safe in the knowledge that your employees have received the information you need them to have!

With BrightPay Connect, employers can securely and seamlessly distribute documents to employees via their employee self-service app. Book a demo today to discover more ways that BrightPay Connect can keep you compliant.

Feb 2019

19

What are “banded hours”?

The Employment Act 2018 creates a new right for employees whose employment contract does not accurately reflect the reality of the hours they work on a consistent basis. After a reference period of 12 months, employees will be able to request in writing to be placed in a band of hours that better reflect their average weekly hours worked. In response, employers are obliged to place the employee in the appropriate band and should do so within four weeks of receiving the employee’s request.

The appropriate band is determined by the employer on the basis of the average number of hours worked by the employee per week during the reference period.

The appropriate bands are laid down in law as set out in the below table.

| Band A: | 3 to 6 hours |

| Band B: | 6 to 11 hours |

| Band C: | 11 to 16 hours |

| Band D: | 16 to 21 hours |

| Band E: | 21 to 26 hours |

| Band F: | 26 to 31 hours |

| Band G: | 31 to 36 hours |

| Band H: | over 36 hours |

An employer may refuse to place an employee in a band in one of the following circumstances:

- Where there is no evidence to support the employee’s claim

- Where there have been significant adverse changes to the business during or after the reference period

- Due to exceptional circumstances, an emergency or unforeseeable circumstances beyond the employer’s control

- Where the average hours worked by the employee were affected by a temporary situation that no longer exists

In determining the 12 month reference period, a continuous period of employment immediately before the legislation is to be enacted on 4th March 2019 will be reckonable towards the 12 month reference period. Please visit Brightcontracts.ie for more information on the new Employment Bill which has been in the pipeline now for a number of years.

The Bill is being introduced to ‘improve the security of working hours for employees on insecure contracts and those working variable hours’, common in (but not exclusive to) service industries such as hospitality, tourism and retail. These industries often rely on flexibility in the employment contract and therefore the introduction of this new Bill will require them to take note.

To keep up with the latest payroll news, check out our new Bright website. There, you'll be able to register for any of our upcoming payroll webinars and download our payroll guides.

BrightPay Payroll Software | Thesaurus Payroll Manager | Bright Contracts

Mar 2014

3

How to Roll out Contracts & Handbooks to Existing Staff

Introducing a contract of employment or a handbook for the first time to current employees, can be a difficult, tricky matter for many employers.

It is an area that many employers put on the long finger, or avoid doing until they have to.

Common reasons for not implementing employee documentation include:

• Lack of time

• Fear that employees will refute the terms of the documents and refuse to sign

• Anxiety that documentation will harm the relationship between management and staff, if the employees feel a new set of rules are being entrust upon then

• A false belief that it will restrict how management deal with employees

However, this does not have to be the case. It is possible to introduce new documentation without spending huge amounts of time, alienating your work force, or causing disruption.

The answer lies in good communications.

To help employers introduce employee documentation, we’ve created a short video outlining our four step guide to rolling out contracts and handbooks.

Alternatively, read our guide to Introducing Contracts & Handbooks to Existing Staff available here http://www.brightcontracts.ie/docs/introducing-contracts-handbooks-to-existing-staff/

Oct 2013

4

CPA Ireland – Practitioners’ Conference 2013

CPA Ireland held their Practitioners Conference in Carton House Friday 20th & Saturday 21st September 2013. Laura Murphy and Audrey Mooney from Thesaurus Software attended the conference. Laura and Audrey enjoyed meeting existing Thesaurus Payroll Manger and Solutions Plus customers – getting their feedback and comments.

It was also an opportunity to show Bright Contracts and our new payroll product BrightPay.

- Bright Contracts is an innovative software package that has everything you need to create and manage your staff handbook and and employment contracts.

- BrightPay is simple to use yet powerful and flexible, it will be offered alongside Thesaurus Payroll Manager giving customers a choice of payroll products.

Laura Murphy (left) and Audrey Mooney at the recent CPA conference

Sep 2013

24

What our customers say!

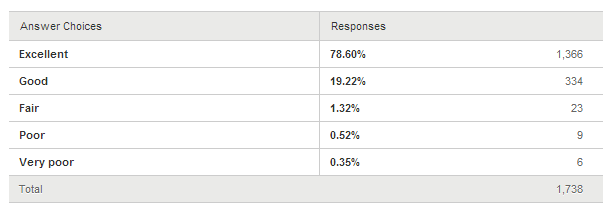

In a recent customer survey, 97.82% of respondents ranked the quality of our customer support as Excellent or Good.

This customer support covers our payroll software (Thesaurus Payroll Manager and BrightPay), our employment contracts software (Bright Contracts) and our accounts software (Solutions Plus) and is free to all registered users.

While the excellent/good percentage achieved would be way ahead of industry standards, we hope to reduce the 2.18% who ranked our support as fair or poor!

Aug 2013

30

Whistleblowing Legislation – Be Prepared

This July the Government published the Protected Disclosures Bill 2013, commonly known as the “Whistleblowing Bill”. The aim of the bill is to combat corruption and promote a culture of public accountability and transparency. The Bill encourages workers to disclose information relating to wrongdoing in the workplace by offering protection against penalisation should they make a protected disclosure / blow the whistle.

When the Bill is enacted, likely to be later this Autumn, a whistleblower’s protection will include protection from dismissal or any form of penalisation by their employer. If an employee is found to have been dismissed unfairly for having made a protected disclosure, employers could be faced with compensation payments of up to 5 years remuneration. The usual service level of 1 year for cases of unfair dismissal will not apply to Whistleblowing cases.

In preparation of this new legislation, employers are advised to start reviewing their internal policies and procedures and to start considering establishing a robust whistleblowing policy to suit their business. Should you require assistance, Bright Contracts will be providing template policies and guidance on how deal with whistleblowing complaints.

Bright Contracts – Employment contracts and handbooks

BrightPay – Payroll Software

Aug 2013

23

Employer’s Checklist for NERA Inspections

Below you will find a handy employer’s checklist for a NERA (National Employment Rights Authority) inspection:

1. Do you have your employer’s registration number with the Revenue Commissioners?

2. Have you a list of all your employees together with their PPS numbers and addresses?

3. Have you the dates of commencement of employment for all employees? (And dates of termination if applicable?)

4. Have you given all your employees a written statement of terms and conditions of employment?

5. Have you the employees’ job classification?

6. Have you a record of their annual leave and public holidays taken by each employee?

7. Have you a record of hours worked for all employees?

8. Have you a record of all payroll details?

9. Can you prove that you provide your employees with a written statement of pay?

10. Have you a record or register of all employees under the age of 18?

11. Have you employment permits where applicable?

12. Have you filled out the template letter details that you will receive from NERA advising you of the inspection?

Bright Contracts – Employment contracts and handbooks

BrightPay – Payroll Software

Aug 2013

19

Can Employees Be Paid Less Than The Minimum Wage?

The National Minimum Wage Act, 2000 states that the NMW is €8.65 per hour, there are some exceptions to this.

Where employees are under the age of 18 or within the first 2 years after the date of their first employment over the age of 18, the rate is €6.06 per hour

In the first 2 years after the date of first employment over the age of 18, the rate is €6.92 per hour in the first year and €7.79 per hour in the second year

Or

Where a trainee is doing a course which complies with S.I. No. 99 of 2000 for the 1st one third of the period the rate is €6.49 per hour, the 2nd one third the rate is €6.92 per hour, and the 3rd one third the rate is €7.79 per hour.

S.I. No 99 of 2000 is the Statutory Instrument which forms part of the National Minimum Wage Act, 2000

For the protection of both employees and employers a Contract of Employment, which is now a legal requirement, should be given to each employee as this will state clearly what is expected of both sides and will minimise or hopefully prevent issues arising that lead to ill feeling or disputes in the workplace.

Bright Contracts – Employment contracts and handbooks

BrightPay – Payroll Software