Aug 2020

13

The Employment Wage Subsidy Scheme - Important Update

The Employment Wage Subsidy Scheme (EWSS) will replace the Temporary Wage Subsidy Scheme (TWSS) from September 1st 2020. Revenue are currently working through the finer details of the scheme. Below is some information to help you understand the scheme and to help prepare for it should you choose to avail of it.

The scheme provides a flat-rate subsidy to qualifying employers based on the number of paid and eligible employees on the employer’s payroll. The scheme is expected to operate until 31st March 2021.

- It is important to note that TWSS will cease on August 31st 2020.

- Employers wishing to avail of EWSS must register for it via ROS. Revenue are planning to have the registration facility available from August 19th.

- Employers must hold up to date tax clearance to register for the scheme and to receive the subsidy payments.

- Employers must be able to demonstrate that their turnover or customer orders between July 1st and December 31st 2020 are expected to suffer at least a 30% reduction as a result of Covid-19. Further information on the qualifying criteria can be found here.

- Registered childcare providers can avail of the EWSS without the requirement to meet the 30% reduction in turnover or customer orders.

- Employers must review their eligibility status on the last day of every month to ensure they continue to meet the eligibility criteria, if they no longer qualify they should deregister for EWSS with effect from the following day (1st of the month)

- Proprietary directors were due to be excluded from the scheme. It is now expected that they will be included where they retain ‘ordinary’ employees on the payroll.

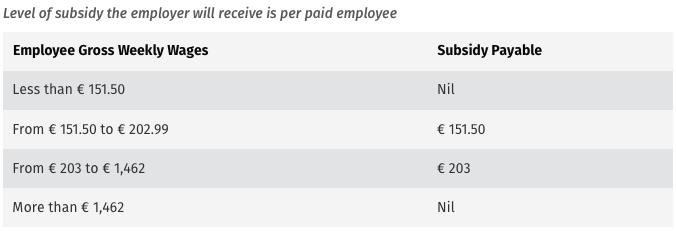

Subsidy Payment:

- The subsidy will be paid to employers monthly after the return due date (14th of the following month).

- Any changes made to payroll submissions after the return due date will not be processed for subsidy payments.

Please note, gross pay includes notional pay and is before any deductions for pension, salary sacrifice etc

Payroll:

- Employers will be required to pay employees in the normal manner i.e. calculating and deducting Income Tax, USC and employee PRSI through payroll.

- EWSS is a subsidy paid to an employer. It will not show on payslips or in myAccount.

Employer PRSI:

A 0.5% rate of employers PRSI will continue to apply for employments that are eligible for the subsidy. This is expected to work as follows:

- PRSI will be calculated as normal via payroll e.g. on PRSI class A1.

- Revenue will calculate a PRSI credit by calculating the difference between the rate on the normal class and the 0.5%.

- The credit will show on the Statement of Account to reduce the employer’s liability to Revenue.

July/August 2020

TWSS and EWSS will run in parallel from 1st July to 31st August. Employees already on TWSS must remain on TWSS until the end of August. Employers wishing to operate the scheme from July 1st i.e. for employees not eligible for TWSS, should process the payroll for these employees in the normal manner and Revenue will review these cases at a later date and refund the subsidy due.

Revenue plan to cater for this via myEnquiries. This will require employers to provide Revenue with the employee details etc. Payment should be made to employers in September.

Publication

A list of employers availing of EWSS will be published in January 2021 and April 2021 to www.revenue.ie.

Software Upgrades (to cater for EWSS)

We plan to release upgrades for Thesaurus Payroll Manager and BrightPay in the week commencing 24th August. Revenue are still fine tuning the details of the scheme and how it will interact with PAYE Modernisation. Therefore, unfortunately, we will be unable to release upgrades any earlier than this.

Apr 2020

28

Temporary Wage Subsidy Scheme - Operational Phase

The Temporary Wage Subsidy Scheme enters the operational phase on 4th May 2020.

In the operational phase, Revenue will provide all employers with details of the maximum subsidy and maximum top up for all employees currently on a J9 PRSI class and for any employees who might be placed on a J9 class during the remainder of the scheme.

This Revenue instruction will be in the form of a file (TWSS file) downloaded from ROS. It will not be an automatic download through the software but instead will require you to log in to your ROS account and download the file there. It will operate in much the same way as you would have downloaded P2C files in the past. The software will then import this file and update the subsidies of all J9 employees automatically.

This TWSS file will be available in ROS from 4th May and we will be releasing an upgrade to our software on the same day to cater for importing the TWSS file.

As the 4th May is a bank holiday, our support lines will be open on 5th May but we have plenty of on screen help and would ask that you only contact support if absolutely necessary.

This should be a one time download as the figures in the downloaded file will be based on payroll submissions made for January and February.

To ensure that you will be able to download the file, it is important that you know your ROS login certificate password and you should ensure that you have this to hand.

For your information, a preview of the relevant ROS screens can be viewed here.

Mar 2020

10

Covid-19 - are you ready?

In light of the recent Coronavirus outbreak, many employers are starting to prepare for the possibility of employees needing to work from home.

Have you Internet?

Whether you are a single employer or a bureau, you will need an internet connection for transmitting files to Revenue.

Are you using a computer other than your work computer?

Where you are using a different computer, BrightPay will need to be installed on that computer. This is a quick download from our website. Then, simply enter the activation key that was included on your invoice. If you can’t find this key, we can resend it to you.

You will also need to ensure that you have a valid ROS digital cert installed on this computer as this will be required for retrieval of RPNs and submission of PSRs. Help on doing this is contained at the bottom of this article.

Okay, you have an internet connection and a computer with BrightPay installed on it, what about the payroll file(s)?

Are you a single employer?

- Using your work computer - you already have the file and need read no further.

- Using Dropbox or Google Drive as your file save location - the files will automatically be available to you on any other machine which is also signed in to the shared drive.

- Using Connect - you can simply restore your payroll data into your BrightPay software by signing into your Connect account at home through the software.

Alternatively, before leaving the office, simply copy the payroll file to a USB key or email it to yourself.

There are some useful help links at the bottom of this article to help with any of these options.

Are you a payroll bureau?

- Using Connect – An Administrator can set relevant payroll staff members up as a user and give them access to the companies that they need to work on. Users can then simply restore the required payroll data into their BrightPay software from their Connect account and also synchronise completed payroll back up to Connect. Users will be able to log in to their Connect account at home through the software and restore in the latest cloud backup. Care however must be taken that synchronisation is up to date and that other users are not working on the same data file at the same time. When restoring in from a cloud backup, you will see the time and date of the most recent backup that was done. Setting up a user in Connect and Restoring from Connect are covered in the help articles below.

- Using remote desktop – log in to your remote desktop as normal. No further action is required.

- Using a shared drive (e.g. Dropbox) – Once your PC is logged in to the shared drive and BrightPay’s file save location was set as this drive, then all payroll files should be available within your home environment. You may need to browse to the shared file location when opening an employer.

Alternatively, before leaving the office, staff members may wish to save their payroll file(s) to an external drive, then follow the help below on Transferring BrightPay from one PC to another.

Help articles

Dec 2019

3

The evolution of the payroll bureau

If you are an accountant working in practice, you may know that I was once one of you, before I escaped to the leafy suburbs of IT.

While in practice, part of my income came from providing a payroll bureau service.

This came with its challenges as I was tied to it, it wasn't very profitable and not all of my payroll clients understood that I actually needed to have the employees' hours before I could do the payroll.

I would send them their payslips with a summary report, reminded them when to pay Revenue and, in return, they would grudgingly pay my fees.

That was twenty years ago. A lot has happened since then, the two main things being technology and PAYE Modernisation.

I wish that PAYE Modernisation had been around in my time. I could really have used it to convince some of my less conscientious clients to change their ways or else. The "or else" being the big stick of Revenue fines.

Technology has enabled a lot of things. The arrival of the smart phone, cloud services and increased internet speeds have been transformative.

In my practice days, I had one client who considered themselves at the forefront of technology. They would have been blown away seeing the way their employees could now receive their payslips on their smart phone and all the other cool things e.g. holiday requests, a document portal and so on. Mind you, if I was still practising and had that same client, I think that these are things they would expect.

That same client would also expect to be able to log on to their own portal and get whatever payroll information they wanted 24/7.

What we are starting to see now is that this type of client is becoming more of a thing. A large part of the driving force for this is their increasingly youthful workforce. Millennials grow up with a smart phone attached to them and they want as much of their life on it as possible.

Another feature that I wish had been around in my time is getting clients to effectively update their own payroll. What I mean by this is that instead of the various ways they would send the hours (word documents, emails, scraps of paper), they would now log in to their portal, update the hours and these would flow seamlessly in to the payroll. Plus everything would be logged and time stamped, so they couldn't blame me if an employee was overpaid or not paid at all.

All of the above would have certainly transformed my basic payroll service of 20 years ago and forged a client base less likely to defect to some new accountant trending on social media.

The clients would still be getting the same attention as always but the "value added" would be enormous. They get to look much more modern with their employees, which can help with attracting and retaining employees. They also gain access to a HR tool with which they can manage holidays, roll out documents and ensure that employee contact information is always current. The vast majority of small/micro employers have nothing like this.

In the UK, this value added payroll service is more common than it is here and I have asked accountants there what they charge. As you can imagine it varies quite a bit and will depend on the type and size of business, but I have heard rates as high as £10 per payslip for higher net worth clients with the average closer to £5.

This type of pricing would certainly have catapulted my small bureau service in to one of my more profitable activities as the cost of all this technology can be as little as 8c per employee per month.

Paul Byrne fca

Recommended reading:

Thesaurus Connect for Payroll Bureaus & Accountants

Nov 2016

17

PAYE Modernisation

Revenue propose to roll out real time reporting of PAYE from 1st January 2019.

This means that payroll software will submit data (much akin to the annual P35) to Revenue each pay period.

The technology behind this may pose some challenges, not least for Revenue who will need to handle significant volume. Most payroll software companies will be able to adapt, assuming that file specifications, test environments etc. are provided to them in good time by Revenue.

The core issue is the possible expectation that the periodic payroll data transmission should be sent to Revenue “on or before” each pay date. This is the position in the UK where RTI (real time information) has been in place for a number of years. The “on or before” requirement has caused problems and HMRC had to relax their requirements (and penalties regime) in the initial year or so.

“On or before” represents a seismic shift for bureaus and employers alike and a much better alternative might be the submission of monthly returns. This is where the monthly P30 is enhanced to include all the P35 fields.

Automatic retrieval of P2C data would be a nice feature of PAYE modernisation and hopefully this will be included as part of the overall package.

The consultation document can be found at http://www.revenue.ie/en/spotlights/paye-modernisation.html

Submissions are invited up to 12th December 2016.

Interested in finding out more about PAYE Modernisation? Register now for our free PAYE Modernisation webinar. Click here to find out more.

May 2014

1

Eircodes - the new postcodes for Ireland

Every address in Ireland will receive its unique Eircode in Spring 2015.

"The Eircodes will help the public, businesses and public bodies to locate every individual address in the State. Eircodes will bring many benefits to the daily lives of people, householders and businesses. Currently, around 35% of addresses - mainly in rural areas - do not have a unique name or number in their address. With Eircodes, delivery of services and goods will be much easier and quicker to these addresses." - www.eircode.ie

When people receive their Eircode next year, they will not need to change their address. They will just add the Eircode whenever it is needed or useful, so it will be very easy to start using it straight away.

Each Eircode has seven-characters that are unique to each mailing address. The seven characters are divided into two parts – a Routing Key and a Unique Identifier.

For businesses, some of the main things to consider are:

- Stationery, customer forms, websites and other places where your address is shown. Perhaps, plan print stocks of existing stationery items accordingly in the run up to Eircode Launch Date in Spring 2015.

- If you use a software package in your business, you will need to check with its supplier as to their plans for when and how they intend to incorporate Eircodes into the package.

- Some staff training may be needed especially if your systems or processes have changed somewhat to take advantage of Eircodes.

Our software offerings will all be updated to include an extra address field for eircodes and will incorporate all the required validation logic.

Feb 2014

14

What might be coming down the tracks for Irish employers

Here is an article that recently appeared in the online version of Business & Finance and that should be of interest to all Irish employers.

http://businessandfinance.com/whats-coming-down-the-track-for-irish-employers/?ref

Jan 2014

22

Will Ireland ever follow the UK lead and adopt auto enrolment?

Thankfully, we are living longer! This, however, presents a huge challenge for any country’s retirement strategy. Back in 1950, there were 7.2 people aged 20–64 for every person of 65 or over in the OECD countries. This is projected to reduce to 1.8 by 2050. The math is stark. To fund a state pension which pays modern day equivalents to people retiring at 65 will soon become an impossible task. Apart from increasing the already huge tax burden to pay for pensions, there are really only two ways of addressing the problem. One, the retirement age needs to increase and, two, people will need to have private pensions or other incomes to supplement their state pension.

Auto Enrolment addresses the latter. It imposes a legal obligation on employers to enrol their employees in pension schemes and to contribute to these pensions. A deduction is made from the employee’s pay plus the employer contributes as well. Auto Enrolment began in the UK for very large employers in 2012 and is being rolled out to include all employers by 2017. The combined minimum deduction and contribution of 2% is designed to ease employees and employers into the concept but this combined level rises to 8% by 2018.

It should be noted that employee participation is optional. The employer must enrol them but they may subsequently opt out. Therefore, employees who feel that they are otherwise covered (e.g. through rental property and/or other investments) do not have to partake in Auto Enrolment.

The various rules surrounding Auto Enrolment and the structures that need to be put in place are numerous and represent a major undertaking for government, employers and pension companies.

Auto Enrolment (or similar) is an absolute necessity and it is somewhat surprising that Irish plans in this regard are not more advanced.

Sep 2013

24

What our customers say!

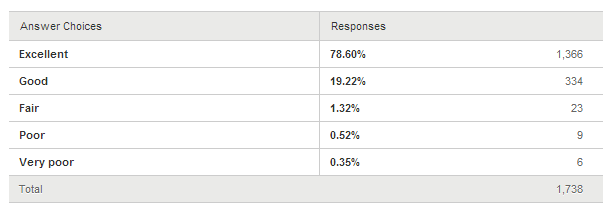

In a recent customer survey, 97.82% of respondents ranked the quality of our customer support as Excellent or Good.

This customer support covers our payroll software (Thesaurus Payroll Manager and BrightPay), our employment contracts software (Bright Contracts) and our accounts software (Solutions Plus) and is free to all registered users.

While the excellent/good percentage achieved would be way ahead of industry standards, we hope to reduce the 2.18% who ranked our support as fair or poor!

Aug 2013

27

Payroll World Awards - Shortlist announcement

BrightPay has been shortlisted as a finalist in the 'payroll software product' category for the Payroll World Awards 2013! The full list of finalists will be publicised on the Payroll World Awards website, via email and in the magazine on the 30 August.

Bright Contracts – Employment contracts and handbooks

BrightPay – Payroll Software