Nov 2021

17

How to process a leaver in BrightPay

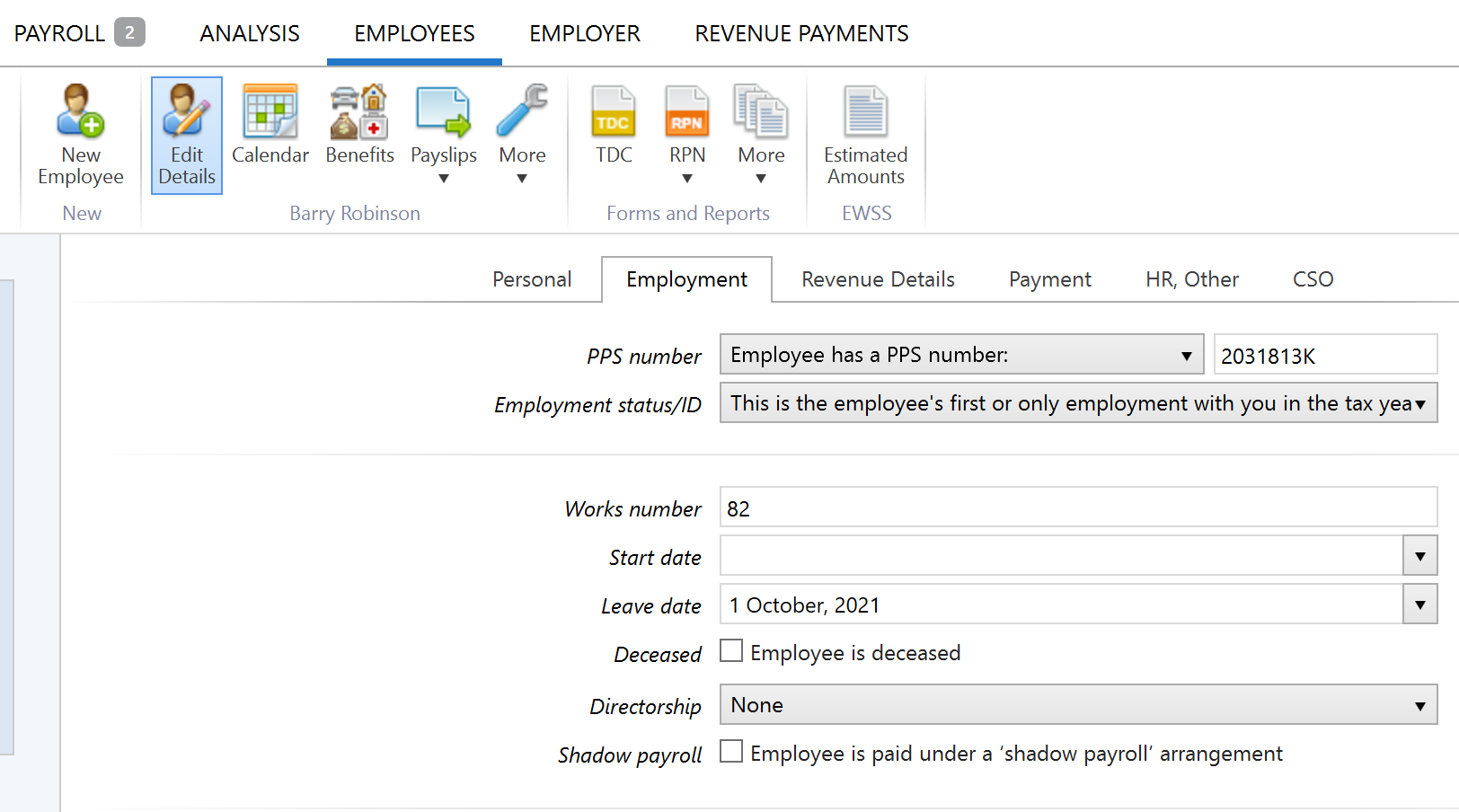

When an employee leaves their job, they must be marked as a leaver in the payroll. The employee’s leave date must be entered before their final pay period is finalised. This sends information to Revenue when the Payroll Submission Request is sent to let them know that the employee has left. Under PAYE Modernisation, employers are no longer required to issue a P45 to an employee and submit the P45 Part 1 to Revenue.

How to process a leaver in BrightPay

It couldn’t be easier to process a leaver in BrightPay. To do so, follow the step-by-step instructions below:

1) Before finalising the payslip, access the employee record by clicking on their name within the Payroll utility. Next, you can select the employee’s last day of work from the dropdown menu. Click 'Save Changes'.

2) Once saved, return to the Payroll utility and finalise the employee's payslip when ready to do so. On finalising the employee's payslip, you will be prompted to submit the associated payroll submission to Revenue. This submission will contain the employee's leave date and report it to Revenue.

As a result, the leaver will no longer be included in any future pay periods. However, the employees’ payslip history will be still available on BrightPay if needed.

BrightPay runs free online demos daily to show you the ins and outs of how the software works. Book your free place now.

Related articles:

Nov 2021

1

BrightPay Customer Update: November 2021

Welcome to BrightPay's November update. Our most important news this month include:

-

Report calls for pension age increase

-

Budget 2022 - Employer Payroll Focus

-

Payroll App – What your employees can and cannot see

New: Pay Employees through BrightPay

BrightPay is excited to introduce our latest integration with the payments platform, Modulr. This integration will give you a fast, secure and easy way to pay employees through BrightPay without the need to create bank files. Join our free webinar to find out how it works.

What to Include in a Hybrid Working Policy

Having hybrid working policies and agreements in place is essential when returning employees to the office and agreeing on a split between working remotely and working in the office. Book a demo of Bright Contracts to see how they can help your business today.

Next Generation Payroll Trends for Accountants

In today’s world, payroll can (and should) be profitable for accountants. Join our upcoming webinar where we explore various ways that accountants can automate payroll processes and become more efficient.

The App that Every Business should be using

Give employees more control with BrightPay Connect’s employee self-service app. Employees can view their payslips and HR documents, request annual leave and view their leave balance taken and remaining and can even update their personal details. Book a free 15-minute demo to find out more.

The Year that was: 2021 in Review

2021 was a year of both personal and business challenges. COVID-19 changed life as we knew it and resulted in a lot of changes being made worldwide. New policies were introduced, people's places of work changed as well as a number of other adjustments.

Join Bright Contracts for a look back at 2021 where we detail all the employment law changes that were made and a look forward as to what the year 2022 will bring.

Oct 2021

18

How to integrate AccountsIQ and BrightPay

At BrightPay we are continuously developing our suite of features in our payroll software to cater for the needs of our new and existing customers. Recently, we have developed direct API integration with accounting platform AccountsIQ as well as a number of other accounting software providers.

By using this direct API functionality, users can streamline their payroll and accounting processes allowing the payroll journal figures to be quickly and easily sent to the accounting package. This will eliminate the need to manually export and import the payroll journal files, reducing the risk of human error. This feature is a great way of automating payroll tasks and sets the standard for other payroll software providers. This must-have feature allows immediate data transfer from BrightPay to AccountsIQ with just the click of a button.

AccountsIQ are hosting a joint live webinar with BrightPay on 21st October where we will discuss the benefits of integrating your payroll and accounting software and demonstrate how you can streamline the entire process from start to finish. Discover how you can free up time for you to spend on other tasks that really need your attention. Book your place on the webinar here.

If you’re not currently using BrightPay but are interested in finding out more, book a free 15-minute online demo to get an overview of the software. You can also trial BrightPay for 60 days for free with no contracts or ties.

Related articles:

Oct 2021

1

BrightPay Customer Update: October 2021

Welcome to BrightPay's October update. Our most important news this month include:

-

BrightPay and Relate Software join forces to create an accounting and payroll software champion

-

Seamless accounting software integration at your fingertips

-

The hidden ways HR can benefit from managing payroll internally

EWSS eligibility rules and rates for October

Revenue have announced that the Employment Wage Subsidy Scheme (EWSS) eligibility rules and rates will remain unchanged for the month of October 2021.

5 ways to boost the efficiency of your payroll process (for employers)

Join our upcoming webinar on 20th October where we discuss practical ways you can streamline payroll and HR processes within your business using cloud technology.

6 tips for payroll success while making a profit (for bureaus)

Join our upcoming webinar on 7th October where we discuss practical ways you can streamline payroll and HR processes in your practice using cloud technology while making a profit.

Set up BrightPay for multiple users

Each BrightPay licence key can be installed and activated on up to 10 PCs. If shared access is required, the data location can be set to your server or cloud environment.

Let’s talk about family leave

Join our sister product Bright Contracts for their free webinar on 19th October about all things family leave related. From Maternity Leave to Parent’s Leave, Bright Contracts gives you all of the information about entitlements and pay that employers need to know.

A step closer to Sustainability

Earlier this year at Thesaurus Software we formed a ‘Green Team’ that will identify and implement opportunities that can improve the sustainability of our company. Follow us on our journey to keep up with our latest projects.

Sep 2021

22

The hidden ways HR can benefit from managing payroll internally

Every business must have payroll in some form or another. It is arguably one of the most important HR responsibilities for any employer. You must process payslips and payments correctly on time, every time. Payroll mistakes can leave you at risk of hefty fines, and so traditionally, payroll has been one of the most outsourced processes in the business world. However, managing payroll in-house is fast replacing the tendency to outsource the role, as cloud automation continues to simplify and streamline a once difficult task.

Naturally, one of the biggest advantages of processing your payroll in-house is the level of control you’ll have over the entire process. This means you can be more flexible with last-minute changes to timesheets or quickly correcting errors. It also may be more cost-effective to run payroll in-house as the cost of payroll software becomes ever more affordable. Businesses can save money by bringing their payroll in-house compared to outsourcing to a third party.

An in-house payroll process means you can keep all your employees’ information private. Some employers feel more at ease by controlling who can see salaries, benefits, bonuses and other sensitive employee data. Interestingly, the number of global companies with a fully outsourced payroll function dropped by 7% in just two years. It’s clear that attitudes towards outsourced payroll are rapidly changing in favour of an in-house operation.

So, what about other benefits that are not so obvious? Fortunately for HR professionals, cloud innovation can have a big impact on workflows, especially when it comes to the crossover between HR and payroll tasks. Read on to find out four ways your HR department can benefit from managing payroll in-house.

- Fewer calls and emails to HR: Employees can be invited to their own secure online self-service portal that can be downloaded via an app on their smartphone or tablet device. Historical payslips and payroll documents are accessible 24/7 by the employee, instantly reducing a huge volume of time-consuming requests to HR. Gone are the days of employees requesting a history of past or lost payslips, for example, when they are applying for a loan or mortgage.

- Effective employee management: BrightPay Connect offers employers a central online location to keep employee records safe and secure. Not only are payslips and payroll documents automatically available, but other HR and company documents can also be uploaded. Employment contracts, company handbooks, training documents and company newsletters can all be uploaded for easy distribution, again reducing the volume of related queries to HR. Documents with restricted access can be added, for example, appraisal and disciplinary documents to aid in ongoing performance evaluation.

- Easier annual leave management: The cumbersome nature of managing annual leave is made much easier with BrightPay Connect. With the employee self-service portal, employees can view their annual leave entitlement and leave balance remaining. They can also request annual leave through their self-service portal. This can reduce the high volume of tedious paper-trails and email traffic to HR. Payroll and HR managers can easily approve leave requests through the online employer dashboard. Approved leave then automatically synchronises back to the payroll software on your PC and is instantly updated on the company-wide online calendar, and so HR can easily track leave and plan staff cover.

- Happier employee culture: Research consistently shows that when employees feel empowered at work, it has the knock-on effect of stronger job performance, job satisfaction, and commitment to the business. BrightPay Connect’s employee smartphone and tablet app can empower employees by giving them access to view and manage their data online, providing a source of independence, power and control. That convenience adds up to creating a happy and productive workforce culture, the highest aspiration for any HR management team.

If your business is curious about how an in-house payroll solution can make your payroll process easier, book a demo today to discover how BrightPay can streamline and automate many of the day-to-day payroll and HR processes.

Related articles:

Sep 2021

1

BrightPay Customer Update: September 2021

Welcome to BrightPay's September update. Our most important news this month include:

-

Sick pay comes to Ireland: How does this affect employers and payroll processors?

-

Webinar on-demand: Employment Wage Subsidy Scheme (EWSS) Guest Speaker: Revenue

Employment Wage Subsidy Scheme (EWSS) changes in October

Join BrightPay for a free webinar on 30th September where we will be joined by representatives from the Revenue Commissioners to discuss upcoming changes to the Employment Wage Subsidy Scheme in October.

A video message from Paul, CEO of Thesaurus Software

Watch a short video where Paul talks about how our add-on product BrightPay Connect can reduce your stress and perhaps even help improve your bottom line as an accountant.

Link your payroll data to the cloud

With BrightPay Connect, you don't need to worry about manually backing up your payroll data. When you link an employer to BrightPay Connect, it will be automatically synchronised to the cloud as you run your payroll or make any changes.

What happens if I don't submit Revenue's Employer Eligibility Review Form?

Failure to complete and submit the EWSS Eligibility Review Form that confirms the required reduction and related declaration will result in the suspension of payment of the EWSS claim and possible penalties.

Customer survey 2021 results

The results are in for BrightPay’s annual customer survey. Our key findings include a 98.8% customer satisfaction rating, which is fantastic news! Some customer comments include:

“I found the functionality during my use of TWSS and EWSS outstanding”.

“A big thank you for your excellent TWSS / EWSS updates throughout the pandemic, they were very beneficial”.

“It is great to have an Irish company providing such a high level of service, support and innovation - the webinars are extremely useful”.

Aug 2021

31

2021 Customer Survey - the results are in!

We value our customers’ feedback and opinions as it allows us to improve and grow our business. We recently conducted an annual survey as it is a powerful indicator of overall success as a company as it captures the entire experience of using BrightPay, from the product features to the daily customer support to the live webinars and online documentation.

We are proud of the continued high marks and appreciate the thoughtful feedback from this year’s survey and would like to say a massive thank you to everyone who took part. The survey looked at customer satisfaction, software performance and customer support.

We’ve compiled the results of our latest survey and we wanted to share them with you.

The Results

As the survey was very comprehensive, we’re not going to share the results of each and every question. But we did want to share the main areas of focus and what you, our customers, have said.

- We asked: How satisfied are you with BrightPay?

- You said: BrightPay achieved a 98.8% customer satisfaction rate, which is fantastic news for everyone on the BrightPay team.

- We asked: How would you rate the following BrightPay Connect features?

- You said: The most highly rated BrightPay Connect features included automatic cloud backup (98.8%), online employer dashboard (100%) and employee self-service portal & app (100%).

- We asked: How satisfied are you with BrightPay's Customer Support?

- You said: The majority of customers rated our telephone support (97.5%), email support (99.2%), online help documentation (97.1%) and online video tutorials (98%) as excellent, very good or good, giving our customer support team an overall satisfaction rate of 97.9%.

- We asked: How would you rate BrightPay’s handling of COVID-19?

- You said: 99.5% of customers answered that they found our handling of COVID-19 overall to be either excellent, very good or good - in particular, our free online COVID-19 webinars (99.6%), payroll upgrades (99.7%), online help and support (98.8%) and phone and email support (99.99%).

Customer Testimonials

We also received a number of customer testimonials from the survey - all of which will be added to the BrightPay website in due course. Some of our favourite testimonials received include:

“I found the functionality during my use of TWSS and EWSS outstanding”.

“A big thank you for your excellent TWSS / EWSS updates throughout the pandemic, they were very beneficial”.

“It is great to have an Irish company providing such a high level of service, support and innovation - the webinars are extremely useful”.

Get in touch

If you feel that you’re not using the full suite of BrightPay or BrightPay Connect’s features to its fullest potential, you can book a free 15-minute online BrightPay and/or BrightPay Connect demo.

Aug 2021

31

What happens if you don't submit Revenue’s Employer Eligibility Review Form?

The Irish government has extended the Employment Wage Subsidy Scheme (EWSS) until 31st December 2021. The scheme gives employers impacted by COVID-19, a subsidy per employee to help keep them in employment. On 9 July, Revenue published guidelines to highlight the changes to the EWSS applicable for the period from 1 July 2021. The main change made to the scheme was in relation to eligibility.

To assist employers in ensuring continued eligibility for the scheme, from 30th June 2021, all employers are required to complete and submit an online monthly EWSS Eligibility Review Form (ERF) through ROS by the 15th of each month. Companies claiming EWSS must fill out a monthly eligibility form, showing their revenue for 2021 remains at least 30% below the reference period in 2019 and a declaration to confirm that the information submitted is correct and accurate to the best of their knowledge. Failure to complete and submit the EWSS Eligibility Review Form that confirms the required reduction and related declaration will result in suspension of payment of EWSS claims.

Revenue has stated: “Where Revenue determines that an employer, at any time over the term of the scheme, claimed and received payment by applying accounting practices that are clearly not appropriate, or by deliberately misrepresenting the true financial situation of the business, it will be excluded from the EWSS in its entirety. No further claims will be accepted, and all subsidy paid and PRSI credit issued will be immediately repayable together with interest and penalties. The business may also face possible criminal prosecution.”

The government has paid nearly €4 billion to date in EWSS payments on top of the €2.9 billion paid under the earlier TWSS. Revenue have launched an investigation on companies that are suspected of overclaiming pandemic wage subsidies.

According to Revenue’s code of practice for audits and non-audit interventions, officials can make unannounced site visits, conduct profile interviews with business owners, carry out assurance checks, and initiate investigations. Please ensure you are submitting correct information to avoid any penalties.

Upcoming webinar

Join BrightPay for a free webinar on 30th September where we will be joined by representatives from the Revenue Commissioners to discuss upcoming changes to the Employment Wage Subsidy Scheme in October and the Employer Eligibility Review Forms. There will also be a live Q&A session to answer any questions that you may have.

Limited Places Remaining – Click here to reserve your place.

Related articles:

Aug 2021

12

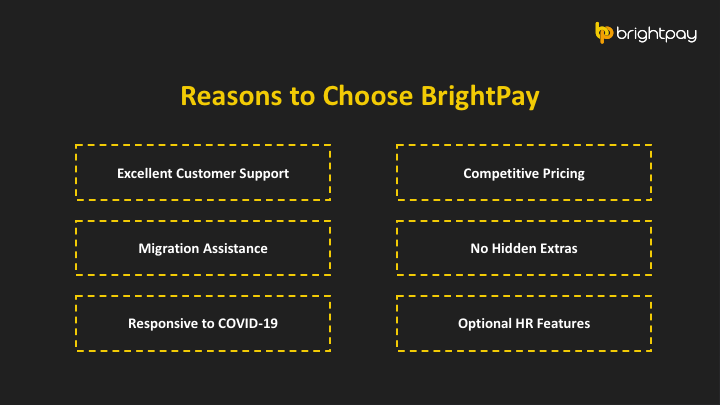

7 reasons why you should process payroll in-house

When we weigh up the pros and cons of outsourcing versus in-house payroll, you can see there are many benefits that your business can gain by making the switch to bringing payroll in-house. Internal staff resources can be reassigned to payroll processing to help mitigate the monetary impact of the pandemic on your business's outgoings.

Processing payroll in-house can offer financial rewards and provide several added benefits including:

- Reduced business overheads and potential cost savings

- Increased control over payroll reporting

- Internal flexibility over payroll scheduling and last-minute changes

- Minimal reduction in workload

- Streamlined HR and annual leave processes

- Self-service online access for employees

- Increased accurate reporting through API integration with accounting and bookkeeping software

Although there are some benefits to outsourcing your payroll, you can get the best of both scenarios when you choose the right payroll software.

Having the right provider for your business is crucial and can mean the difference between a laborious payroll process that you dread every pay period, and a quick and easy payroll that you hardly think about at all. But finding the right one isn’t necessarily as easy as it seems. There are so many payroll software providers today that sifting through them can be overwhelming. To make it easier for you, we have summarised the key reasons why you should use BrightPay.

Is BrightPay the right in-house payroll software for your business? If you’re thinking about bringing payroll in-house, now could be the right time to make that transition. Get in touch and book a free 15-minute online demo.

Related articles:

Aug 2021

3

BrightPay Customer Update: August 2021

Welcome to BrightPay's August update. Our most important news this month include:

-

Watch On-Demand: EWSS Changes & The Return to Work

-

Going paperless: how an employee app can help

-

How Statutory Sick Pay will be calculated when introduced in 2022

EWSS Employer Eligibility Review Form

Revenue confirmed it has extended the deadline for the completion and submission of the EWSS Eligibility Review Form in respect of June 2021 to 15 August 2021. The eligibility review form in respect of July 2021 is also due to be submitted on the same date. Watch our webinar on-demand where we cover everything you need to know.

BrightPay’s new payroll journal integration with accounting software

We are delighted to announce BrightPay’s new API integration with AccountsIQ, Quickbooks Online, Sage Business Cloud Accounting and Xero. BrightPay users will be able to create wages journals from the finalised payslips and send the payroll data directly into their accounting software.

Statutory Sick Pay - Coming January 2022

Currently, there is no legal obligation for employers in Ireland to pay employees who are on sick leave, and it is up to the discretion of each employer. However, it will be mandatory for employers in Ireland to provide Statutory Sick Pay (SSP) for employees from January 2022.

Employee self-service app – A must-have tool for every business

BrightPay Connect gives employees access to a user-friendly smartphone and tablet app that gives them access to their payslips, HR documents, annual leave calendar and much more. Self-service apps are becoming more popular as they benefit both the employer and employee.

Adopting a hybrid working model

The COVID-19 crisis has completely shifted the way we work and live with companies having to quickly adopt new initiatives and technologies to ensure employee safety whilst maintaining productivity. Join Bright Contracts for a free online webinar on the 25 August where our team of experts will discuss how hybrid working has changed the way we work and live and what this change means for your business.

.png)