Full guidance on vehicle Benefit in Kind from Revenue is contained here

For further information on Benefit in Kind, click here

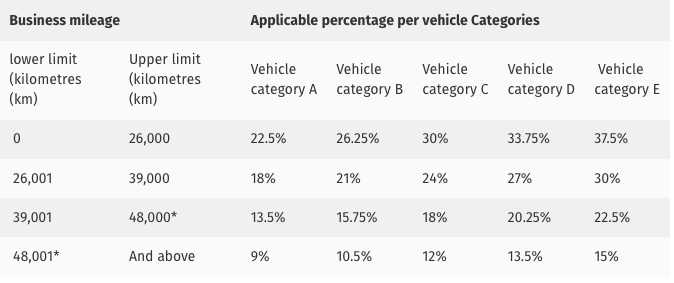

An employee's business kilometres to date and the car's CO2 Emissions will determine the amount of Notional Pay he/she will pay.

To calculate cumulative business kilometres to date:

Annual Business km's / by 52 or by X No. of weeks the car is used by the employee

e.g. Annual Business Km's: 26,000kms/52 weeks = 500 kms per week

500 kms x 10 weeks = 5000 kms

Annual business mileage is defined as total business mileage less a minimum of 8,000 private kms. In line with Revenue regulation, employees should submit periodical mileage records to the employer when an employee is provided with a company car.

Cumulative kilometres to date should be adjusted accordingly within the payroll to record an accurate value to the benefit given to the employee.

*Applies to 2023, 2024 and 2025 year of assessment only

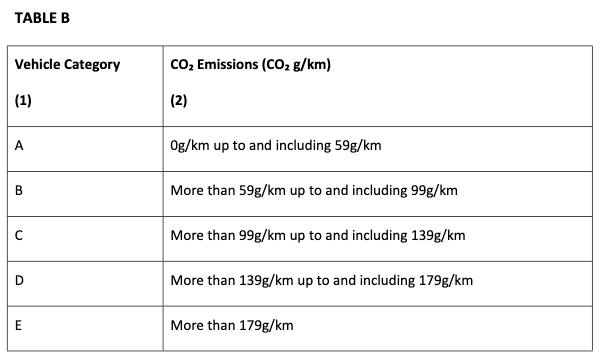

CO2 Emissions table

Employees with a company van will pay a set rate of 8% of the Original Market Value of the van regardless of business mileage.

To access this utility go to Employees, select the employee in question from the listing and click 'Benefits' on the menu toolbar, followed by 'Vehicle'.

1) Type - indicate whether the vehicle is a car or a van.

2) Description - enter a description of the vehicle e.g. make, model or vehicle registration number.

3) Original Market Value (OMV) - enter the OMV of the car/van. The OMV value of a vehicle is the price (including any duty, VRT or VAT) which the vehicle might reasonably have been expected to fetch, if sold in the State singly in a retail sale in the open market, immediately before the date of its first registration in the State or elsewhere.

4) Carbon Class - the carbon class will determine the rate of BIK to be applied to cars.

5) Reduction - tick the field provided if the employee qualifies for the reduced rate, due to being away from premises at least 70% of the time, along with other specific requirements.

6) Start Date - enter the date the employee first started using the vehicle in the current tax year.

7) End Date - if the employee returns the vehicle in the current tax year, enter the date of return.

8) Kilometres - to automatically increment the employee's business kms each pay period, enter the average number of kilometres the employee is expected to do each pay period.

9) Employee Contribution - enter any amount made good by the employee directly to the employer towards the cost of providing and running the vehicle.

9) Click Save to save the Benefit In Kind entry.

The 'Notional Pay' will be added to the employee's gross income each pay period to ensure that the correct PAYE, Universal Social Charge and PRSI are charged.

For fully battery-electric vehicles (EVs) provided to employees or directors, Benefit-in-Kind (BIK) is calculated under the revised 2023–2028 relief scheme. For vehicles made available in 2026, the Original Market Value (OMV) is reduced by €20,000 for the purpose of BIK calculation. For 2027 this reduction will be €10,000.

A new zero-emission vehicle category, Category A1, applies for EVs from 1 January 2026. Under this category, BIK rates range between 6% and 15%, depending on annual business mileage.

If after the €20,000 (or €10,000) OMV reduction the resulting value is nil, no BIK charge arises. Otherwise, BIK applies on the revised OMV at the percentage rate determined by the A1 band and business mileage.

The old exemption that applied from 2019–2022 (full BIK exemption on EVs up to €50,000 OMV) is no longer the baseline; the 2023–2028 scheme overrules it for vehicles made available from 2023 onward.

Note on hybrid vehicles: The EV-specific BIK relief applies only to vehicles powered exclusively by electricity. Hybrid (including plug-in hybrids) do not qualify for this EV relief.

The provision of an electric vehicle charging point on the employer’s business premises, available for use by employees or directors, does not give rise to a taxable benefit. This exemption has applied since 1 January 2018.

From 1 January 2025, a further exemption applies in respect of a charging point installed at an employee’s or director’s main private residence, provided certain conditions are met. No BIK charge applies where:

This exemption does not apply where the vehicle is a hybrid or plug-in hybrid vehicle; it applies only to vehicles that are powered exclusively by electricity.

Need help? Support is available at 01 8352074 or [email protected].