Sep 2022

13

What’s the craic with Statutory Sick Pay in Ireland?

The year is 2021, the month is June. Olivia Rodrigo’s “Cool 4 U” is number one in the charts, we are still in the midst of a nationwide lockdown. You’re in bed sick, sipping flat 7-Up and your job doesn’t offer statutory sick pay. Things are looking bleak. But suddenly, your ears prick at an announcement on the news saying that the government plans on bringing in a national Statutory Sick Pay (SSP) scheme. A ray of light shines in the window.

Fast forward to today and you’re back in the office, lockdown is in the distant past and the Sick Leave Act 2022 has become law and will come into force early next year. Ireland was one of the only advanced economies in Europe without mandatory sick leave entitlement so this is excellent news. Before, sick leave was at the discretion of the employer.

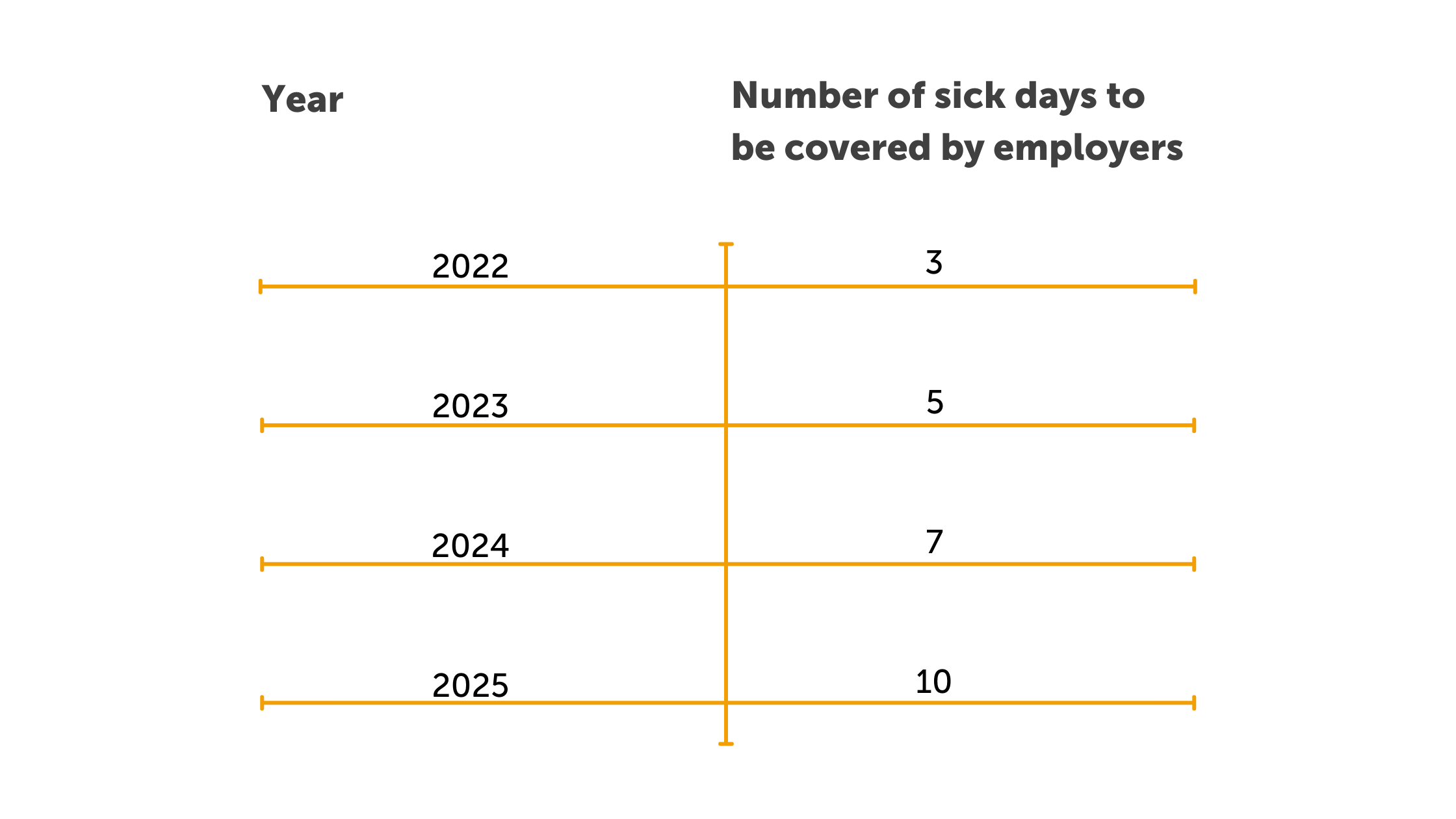

From January next year, SSP is being phased in over a four-year period starting with three days payable per year in 2023, rising to five days payable in 2024, seven days payable in 2025 and eventually, by 2026, employees will cover the cost of 10 sick days per year. The phased introduction is to allow employers to prepare and budget for the scheme and its associated cost.

So what do employers have to do? The SSP will be paid at the rate of 70% of the employee’s wage, subject to a daily threshold of €110. The eventual 10 days, or two working weeks, will be in addition to other leave, as well as public holidays.

There are some caveats however. Employees will have to provide a medical certificate to qualify for SSP and will need to have been employed by the employer for a minimum of six months before they can claim SSP. The leave must also be in relation to a day or days when an employee would usually work but is unable to due to illness or injury. The leave can also be taken as consecutive or non-consecutive days.

“And how will this affect employers” I hear you ask? Well, if you don’t already have a sick leave scheme in place at your company the new legislation may impose costs onto you. These include administrative costs in relation to setting up and implementing the scheme, along with maintaining records.

In the records you are required to keep information on:

- The employees’ period of employment

- The dates of statutory sick leave in respect of each employee

- The rate of statutory sick leave payment in relation to each employee

Employers may also wish to update their template contracts for new hires to include that contractual sick pay is inclusive of any applicable SSP entitlement. It is also important that you examine existing policies and contracts to make sure they comply with the minimum statutory entitlement under the SSP scheme when it comes into effect. Or, if you use employee contract software like Bright Contracts, this information will be automatically updated for you.

If you already have a sick pay scheme in your company and the existing provision is as favourable or more favourable than the statutory provision, you’re good to go and no changes are needed. It’s only when the existing provision in your standard entitlement employment contract is less favourable than the statutory provision that you will then have some work to do to bring it up to speed.

So there you have it! It might seem like a bit of a headache (no pun intended) but in the long run the scheme will benefit both employers and employees alike. You don’t have to deal with Margaret coming into work and coughing all over you, spreading germs. Plus, employees will feel more protected and valued when they can recover in the safety of their own bed with a hot water bottle and a good ol’ Netflix subscription.

Written by Aoibheann Byrne | BrightPay Payroll Software

Related articles:

Jul 2022

25

Employee paid sick leave: What you need to know

As of the 20th of July 2022, the Sick Leave Bill 2022 became law. Once the law is commenced, all Irish workers are entitled to paid sick leave. It will be introduced to all workplaces across Ireland and will be phased in over four stages, over the next four years.

Unlike most of Europe, before this Bill was enacted, Ireland had no statutory paid sick leave scheme. This new law now aligns us more with the European standard of paid sick leave.

How much leave are employees entitled to?

Once the law is commenced, employees are now entitled to a maximum of 3 paid sick days per year and will be paid 70% of their normal wage for each paid sick day taken. This payment will be made by their employers, with a maximum limit of €110 to be paid per sick day taken.

The government’s plan is to increase the number of sick days covered to a maximum of five days in 2024, seven days in 2025, and 10 days in 2026.

Which employees are entitled to sick pay?

To qualify for paid sick leave, an employee must:

- Be working for their employer for a minimum of 13 weeks.

- Provide a medical certificate from their GP to prove they are or were unable to work.

Is there anything else I should know about the paid Sick Leave scheme?

Annual leave and paid sick leave

It’s important to note that sick leave days cannot count towards an employees’ annual leave, once they meet the Sick Pay scheme requirements. However, if an employee is out of work due to long-term illness, they can carry over the annual leave days they’ve missed due to their illness, for up to a maximum of 15 months.

Public holidays and sick leave

If a full-time employee gets sick during a public holiday, they are entitled to receive sick pay for the public holiday that they’ve missed, or they may be paid for the day as normal. Part-time employees are also entitled to benefit for a public holiday they were on sick leave for, once they’ve worked at least 40 hours over the previous five weeks.

Employees not provided with a paid sick leave scheme

If an employee qualifies for paid sick leave and their employer doesn’t provide a Sick Pay scheme, they have the right to file a complaint to the Workplace Relations Commission. For further information, visit Citizens Information website.

Once the law has commenced, your payroll software should be updated to cater for this new employee entitlement. Here at BrightPay, we work hard in the background to provide you with the latest payroll news and legislative updates. Sign up to our weekly newsletter to stay in the loop. New to BrightPay? We are one of Ireland’s leading providers of payroll software for small businesses. Book a free 15-minute demo to see our award-winning payroll software in action today.

Related articles:

Aug 2021

19

Sick pay comes to Ireland: How does this affect employers and payroll processors?

In Ireland, employers currently do not have any legal obligation to pay employees who are absent from work due to illness. In the private sector, it is at the discretion of the employer as to whether or not they decide to pay employees who are unable to work due to sickness.

A survey from 2019 found that only 44% of employers offered their employees some form of paid sick leave. For employees working in the public sector, The Public Sector Sick Leave Scheme was introduced in 2014. Under the scheme, public sector employees are entitled to 7 days paid sick leave within a continuous 2-year period, without having to submit a medical certificate. When a medical certificate is provided, employees are entitled to 92 calendar days of fully paid sick leave followed by 91 calendar days on half pay, subject to a maximum of 183 calendar days in a rolling 4-year period.

The effects of the COVID-19 pandemic shone a light on the need for statutory sick pay to be introduced into the private sector. Having no sick pay entitlements meant that employees were more likely to attend work, despite experiencing symptoms of COVID-19, risking passing on the virus to colleagues. Employees who were working from home also took fewer sick days during the pandemic as because they did not have to leave their homes they continued to work, despite feeling unwell. Both of these situations can be damaging to an employee’s health.

How does offering sick pay benefit employers?

When there is no sick pay scheme in place, many employees will attend work while unwell as they do not want to miss out on pay. This does not benefit either the employer or the employee. If the employee is trying to work while they are sick, they are not going to be able to be as productive as they usually would be. This could also lengthen the time it takes for them to recover from the illness and they may not be able to work to their full potential for a lot longer than it would have been if they had taken the time off needed to recuperate.

Offering employees sick pay leave can actually help reduce the number of sick days taken by employees overall. As well as getting better faster, If the employee does not come into the workplace sick, they won't spread the sickness to other employees.

What sick pay is being introduced?

Statutory entitlement to sick pay will be phased in as part of a 4-year plan beginning in January 2022 and will be paid by employers at a rate of 70% of an employee’s wage, subject to a daily threshold of €110. The table below shows how the number of sick days covered by employers will rise over the four years.

How does the introduction of statutory sick pay affect payroll?

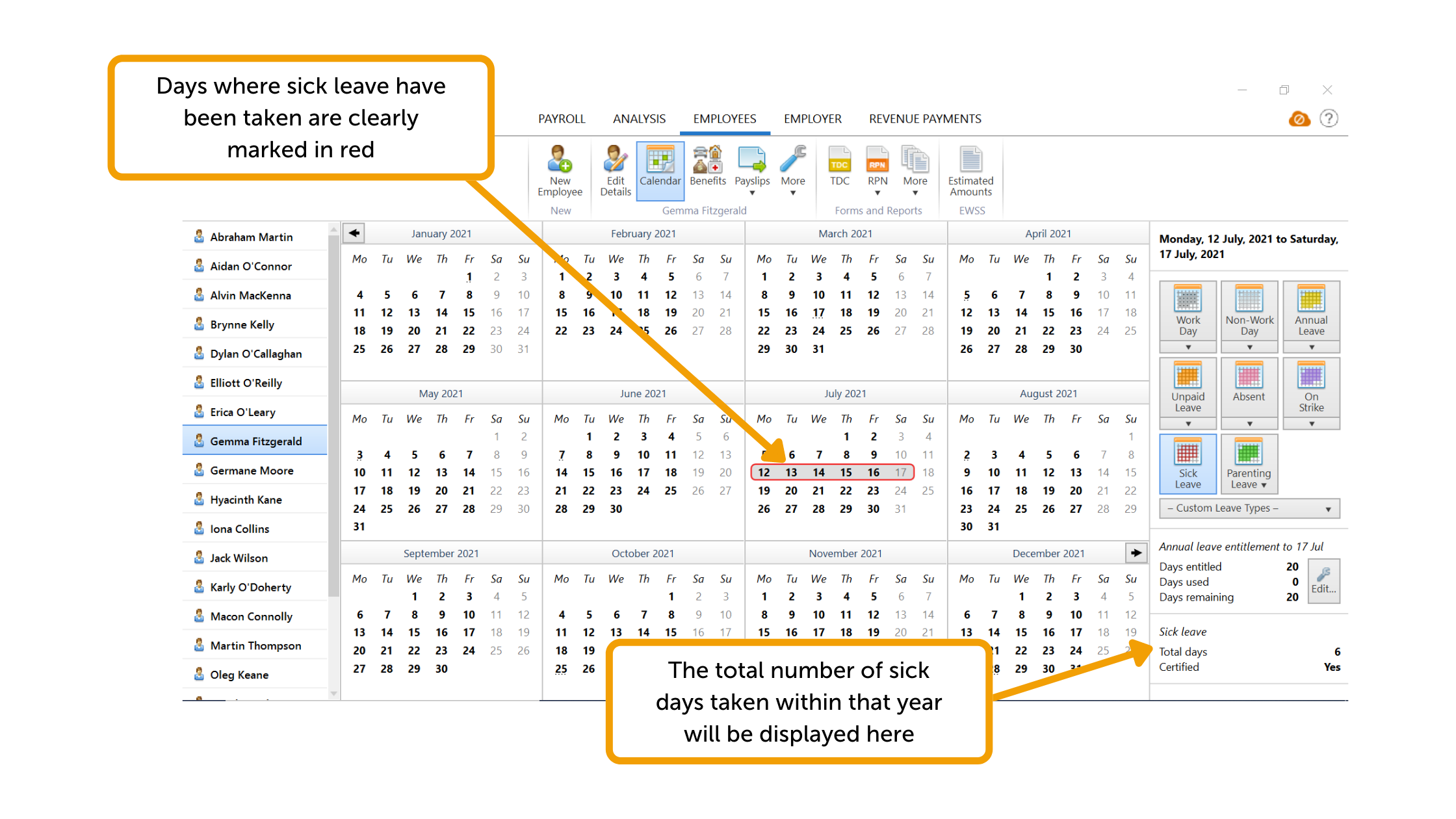

Payroll processors may be wondering how the introduction of statutory sick pay in Ireland will affect how they calculate pay for employees who have taken sick leave. Within BrightPay payroll software, at the moment, if an employer offers paid sick leave to their employees, payroll processors can add sick pay as an ‘addition type’ within the payroll software. The employer can then manually add the amount of sick pay owed to the employee when entering the employee’s pay information for that period. The employer can add sick days taken to the employee’s calendar and choose whether these days were certified or uncertified. The days where sick leave have been taken will be colour-coded and the total number of sick days taken will be displayed on the bottom right-hand side of the screen. This means that you can clearly track the number of sick days taken by each employee.

Through our optional cloud add-on, BrightPay Connect, employees can access an online portal through an internet browser or through the BrightPay Connect mobile app. Any days taken as sick leave will be highlighted meaning that the employee can keep track of how many sick days they have taken so far that year.

At BrightPay, through the UK version of our software, we have experience with applying sick leave entitlements to employee’s pay since 2012. Having this experience means we are well prepared to make any changes to the Irish version of our software that will make calculating and tracking an employee’s Statutory Sick Pay entitlements as easy as possible for payroll processors.

To learn more about BrightPay’s features, book a free online demo today.

Related articles:

Jul 2021

9

How Statutory Sick Pay will be calculated when introduced in Jan 2022

The Government is currently drafting the Sick Leave Bill 2021 which will make it mandatory for employers in Ireland to provide Statutory Sick Pay (SSP) for employees. The sick pay scheme aims to ensure that every worker in the private sector will have the security and peace of mind of knowing that if they fall ill and miss work, they will not lose out on a full day’s pay.

Currently, there is no legal obligation on employers in Ireland to pay employees who are on sick leave, and it is up to the discretion of each employer. At present, employees in companies who do not offer sick pay can apply for Illness Benefit after 3 days of illness. Different rates apply depending on the employee’s earnings - the maximum for those earning over €300 is €203 per week. COVID-19 had a particular impact on those employees in companies where sick pay was not provided and highlighted the fact that Ireland is one of just three remaining countries in the EU not to have introduced a Statutory Sick Pay Scheme.

See statement from Tánaiste, Leo Varadkar:

“Ireland is one of the few advanced countries in Europe not to have a mandatory sick pay scheme, and although about half employers do provide sick pay, we need to make sure that every worker, especially lower-paid workers in the private sector, have the security and peace of mind of knowing that if they fall ill and miss work, they won’t lose out on a full day’s pay. I believe this scheme can be one of the positive legacies of the pandemic as it will apply to illness of all forms and not just those related to COVID-19.”

The plan is to introduce SSP over a 4-year period commencing January 2022.

The initial plan is as follows:

- 2022 – 3 days covered

- 2023 – 5 days covered

- 2024 – 7 days covered

- 2025 – 10 days covered

The rate of pay will be calculated on 70% of the employee’s wages (subject to a daily maximum of €110). Employees will need to provide a medical certificate to qualify and they must be in that employment for a minimum period of 6 months before they can qualify.

The daily earnings threshold of €110 is based on 2019 mean weekly earnings of €786.33 and equates to an annual salary of €40,889.16. It can be revised over time by ministerial order in line with inflation and changing incomes.

Once entitlement to sick pay from their employer ends, employees who need to take more time off may qualify for Illness Benefit from the Department of Social Protection subject to PRSI contributions.

Employers will need to prepare for this new legislation and update Contracts of Employment and company policies accordingly. Check out our sister product, Bright Contracts, which can help you keep contracts of employment and staff handbooks up to date with changing legislation.

Please note that the above plan has not yet been legislated on and is subject to change.

Related articles:

Oct 2020

15

Budget 2021: Employer Payroll Focus

Here are the main points from Budget 2021, as delivered by Minister for Finance Paschal Donohoe.

Pay As You Earn (PAYE)

There is no change to tax rates for 2021, the standard rate will remain at 20% and the higher rate at 40%.

In addition, there is no change to Standard Rate Cut Off Points (SRCOPs).

Earned Income Tax Credit

The Earned Income Tax Credit will be increased by €150 from €1,500 to €1,650 to bring it in line with the PAYE tax credit.

Dependent Relative Tax Credit

The Dependent Relative Tax Credit will be increased by €175 from €70 to €245 to support families with caring responsibilities.

Universal Social Charge (USC)

- Exemption threshold remains at €13,000

- 2% threshold increased by €203 from €20,484 to €20,687

- Due to the increase to the 2% threshold, the income chargeable at 4.5% reduces from €49,560 to €49,357

- There are no changes to the rates of USC

For 2021, USC will apply at the following rates for those earning in excess of €13,000

| Rate Bands | Rate |

| Up to €12,012 | 0.5% |

| Next €8,675 | 2% |

| Next €49,357 | 4.5% |

| Balance | 8% |

Medical card holders and individuals aged 70 years and older whose aggregate income does not exceed €60,000 will pay a maximum rate of 2%.

The emergency rate of USC remains at 8%.

Non-PAYE income in excess of €100,000 is subject to USC at 11%.

National Minimum Wage

The National Minimum Wage will increase by 10 cent from €10.10 to €10.20 per hour from January 1st 2021.

Pay Related Social Insurance (PRSI)

The weekly threshold for the higher rate of employer PRSI will increase to €398 from €395, this is in line with the increase in the National Minimum Wage.

State Pension Age

The age to qualify for the State Pension will remain at 66 for 2021, it was due to increase to 67.

Illness Benefit

The ‘waiting days’ for Illness Benefit will reduce from 6 days to 3 days for all new claims from the end of February 2021.

Parent’s Leave

Parent’s Benefit has been increased by three weeks, this brings it up to five weeks. The leave must be taken during the first year following the birth of a child.

Wage Subsidy Scheme

The Employment Wage Subsidy Scheme (EWSS) is due to continue until 31st March 2021, a wage subsidy scheme in some form is expected to be in place until the end of 2021.

Warehousing of Tax Liabilities

The tax debt warehousing scheme will be expanded to include repayments of the Temporary Wage Subsidy Scheme (TWSS) owed by employers.

Covid Restrictions Support Scheme (CRSS)

A new scheme was introduced for businesses impacted by Covid-19 restrictions, it will provide support for businesses that have had to close because of Covid-19. The scheme is operational from October 13th until March 31st 2021.

The payment will be calculated as a percentage of the business’s average weekly VAT exclusive turnover in 2019 subject to a maximum payment of €5,000 per week. The first payments are expected to be made in Mid-November.

VAT

The 13.5% rate of VAT for the tourism and hospitality sector will be reduced to 9% from November 1st 2020, the reduced rate will remain in place until December 31st 2021.

For the latest payroll updates, don’t miss our next free webinar where we are joined by Revenue.

Webinar: Wage Subsidy Scheme with Revenue

10.30am | 19th November

Webinar Agenda

- TWSS Reconciliation

- Employment Wage Subsidy Scheme - Key Points

- Employer & Employee Eligibility Criteria

- Operation of Payroll & Processing of Subsidy Claims

- Operating EWSS with BrightPay & Thesaurus Payroll Manager

- Q&A Panel Discussion

If you are unable to attend the webinar at the specified time, simply register and we will send you the recording afterwards.

Related Articles:

BrightPay COVID-19 Resource Hub

Blog: Customer update October 2020

On-demand COVID-19 Webinars

Nov 2017

20

Taxation of Illness Benefit - 2018

Currently, employers are required to tax Illness Benefit and Occupational Injury Benefit payments paid to employees by the Department of Employment Affairs and Social Protection (DEASP).

With effect from 1st January 2018, employers will no longer be responsible for taxing Illness Benefit. From this date Revenue will tax Illness Benefit by adjusting employee's tax credits and/or rate bands. Revenue will receive real-time interfaces of taxable DEASP income and the adjusted tax credits and/or rate bands will be notified to employers via P2C files. As a result of this change there will be more frequent P2Cs for employees. While payroll operators will no longer need to tax Illness Benefit, it will be extremely important to implement amended P2Cs immediately.

In addition, from 1st January 2018 Illness Benefit letters will no longer be delivered to the ROS Inbox. In light of this change, employers may need to review their sick pay schemes.

Related Articles -

Thesaurus Payroll Software | BrightPay Payroll Software

Jun 2014

17

Thesaurus Gets Moving!

A physically active workforce makes so much sense. Research has proven that employees who are physically active have increased productivity, reduced injuries, reduced stress and take less sick days. It’s believed that physical activity reduces absenteeism by up to 20%.

Most employees spend eight hours a day at work, many sitting behind desks, driving or standing at workstations. Considering this, and the increasing rates of obesity in Ireland, it is extremely likely that many employees are not getting sufficient exercise to benefit their health.

Considering all of the above, employers are well advised to promote health and wellbeing in the workplace. There are a number of initiatives that employers can take to promote health and wellbeing, some of which include:

• Providing Health Screening e.g. blood pressure and cholesterol

• Providing healthy eating options in the canteen

• Encouraging employees to be active during their breaks

• Supporting employees to take a fitness class or join a gym

In Thesaurus we’re all office based and spend most of our days sitting behind our desks. In an effort to get our team moving and increase physical activity, we recently completed the Irish Heart Foundation Step Challenge.

We broke into teams and using pedometers counted our daily steps over a four week period. At the end of each week the teams totalled their steps, the totals were then logged on what soon became a very competitive scoreboard! The challenge was to walk at least 10,000 steps per day, some were more successful than others, but everyone got involved and everyone had fun!

The Irish Heart Foundation provided us with all the support material needed to get us up and running/walking. Any workplace looking to create awareness around a healthy lifestyle and looking to have some fun, should consider the Step Challenge. Further details can be found at www.irishheart.ie

Sep 2013

29

How to manage sickness absence

Managing sick leave can be a challenge for every employer. It is essential that businesses find the balance between supporting those employees who are genuinely sick and minimising unnecessary absences in order to reduce costs. Costs can include:

- Loss of productivity

- Employing temporary cover

- Paying other employees additional overtime costs

The 2011 IBEC Guide to Managing Absence found that over 11 million days are lost to absence in Ireland every year, costing businesses €1.5 billion or €818 per employee. The report also found that employees missed 5.98 days on average, an absence rate of 2.6%.

Managing Absences

Absence levels can be addressed by taking some simple steps:

- Sickness Policy: there should be a policy in place that clearly sets out the procedure that will be followed by both employees and management in cases of absence through illness. The policy should be clearly communicated and consistently implemented. The default company handbook in Bright Contracts contains such a policy.

- Record, Monitor & Measure: monitoring and measuring enable employers to identify trends and recognise points at which absence levels need to be further investigated.

Return to Work Interviews: these are informal meetings between a line manager and an employee on the first day the employee returns to work. Return to work interviews are consistently rated as one of the most effective methods of managing absenteeism levels and it is recommended that they should be included in all sickness absence policies.

Bright Contracts – Employment contracts and handbooks.

BrightPay – Payroll Software