Oct 2021

11

What to include on a hybrid working policy

Since the further easing of pandemic restrictions on September 20th, 2021, employees who have previously been working remotely have been returning to their workplaces on a phased and staggered basis. On October 22nd, 2021, almost all COVID-19 restrictions are to be lifted and employees will no longer be required to work from home. To allow for the safe return of employees, businesses must ensure they follow government guidance and have the appropriate systems in place.

While it is great to now have the option of returning to the office, it doesn’t necessarily mean that everyone will want to, not on a full-time basis at least. Experiencing the longer lie-ins, no commute, and an overall better work-life balance, employers and employees alike have enjoyed the benefits of remote working. However, each employee is different and along with the benefits of working from home comes challenges such as employees feeling isolated and unmotivated. Phase II of the Remote Working during COVID-19 National Survey conducted in Ireland in October 2020 found that 94% of respondents would like to work remotely for at least part of their working week. Because of this, many businesses have adopted a hybrid working model, with many more set to do so in the coming months.

What is hybrid working and do employees have the right to request it?

In Ireland, hybrid working falls under remote working and may sometimes be referred to as e-working or flexible working. A hybrid working model is when an employee works part of their time in the workplace provided by their employer and part of their time from home or anywhere else other than the normal place of work. In Ireland, employees have the right to request that they work this way. However, currently there is no legal framework around how such a request should be made and how it should be handled by employers. The legislation giving employees the right to request remote working is expected to be published at the end of the year.

As an employer, you may already have experience with employees working from home and the advantages it can bring. You also may have already decided that you would like to adopt a hybrid working model into your workplace. If this is the case, a Hybrid Working Policy document should be created so that all staff are aware of how the new arrangement will operate.

What information should be included in a Hybrid Working Policy?

The rules and limitations surrounding the company’s hybrid working policy should be clearly outlined in the Hybrid Working Policy, including:

- Are there any roles within the company which may not be suitable for remote working

- Will employees need to follow a hybrid working schedule

- Are there certain tasks which you, as an employer, would prefer to be taken care of in the office rather than at home (or vice versa)

- While working remotely, is the employee allowed to work anywhere or are there limitations. Examples of this may be that the employee must stay in the country or cannot work in public settings due to cybersecurity concerns

- What hours should an employee be working. Are there set working hours, when should they take breaks and what is the maximum number of hours they should be working each day

The policy should include details of how staff will be managed and supported as they work from separate locations, including:

- How should employees communicate with managers and colleagues and what should be done to ensure effective and fair communication

- How should new staff be onboarded

- How will employees’ performance will be managed

- How will employees’ health, safety and wellbeing be maintained

Guidelines for remote working should be clearly defined, including:

- What equipment is suitable for remote working and how will the equipment be provided

- What are the insurance requirements for the employer and the employee

- Details of a home risk assessment

- How cyber security will be maintained

How should a Hybrid Working Policy be shared with employees?

Once you have put together a Hybrid Working Policy, what is the best way to share it with employees? When sharing the policy with employees, you may want to share it with all or multiple employees at the same time. As employees may be working from different locations, it’s likely not possible to physically hand out the document to each employee.

You could email the policy to employees. However, emails are not always an effective way of getting your employees' attention. In a 2019 survey, 34% of respondents said that they sometimes ignore HR emails from their employer, while 5.7% even said that they always ignore HR emails. The reason for this may be that employees are simply overwhelmed by the number of emails they receive at work.

A better way of getting employees to read your new Hybrid Working Policy is by sharing it with them through an app on their smartphones. BrightPay Connect is a cloud add-on to BrightPay payroll software which includes an employee app which can be used to take care of a number of HR tasks. With BrightPay Connect, employers will have access to their own employer dashboard from where they can upload employee documents to be shared with employees through the employee app. Employers can share documents with individual employees, multiple employees or all employees if they wish to do so. This means employees can easily access all their documents in one place, be it their individual contract of employment or company-wide documents. Since the documents are available on the employees' phones, it also means they can be accessed anytime, anywhere.

When a document is shared with employees this way, each employee will receive a push notification on their mobile to notify them that the document has become available for them to view. With push notifications, because users can instantly read the alert on their device, they are less likely to ignore it like they may do with an email. Furthermore, employers can track who has and who has not read each document and so you can give them a nudge if needs be.

Reviewing and updating your Hybrid Working Policy

As hybrid working is still a relatively new concept for many employers, the policy should be reviewed regularly. Employers may want to make changes to the policy as the needs of the business and employees change. The updated policy can be quickly reshared on BrightPay Connect, and employees are once again alerted to it by push notification.

As well as sharing documents, you can also easily share payslips with employees using BrightPay Connect. Other HR functions of BrightPay Connect which are done using the employee app are annual leave management and updating employee information. To learn more about the many benefits of BrightPay Connect and how they can improve your business and ease the transition to hybrid working, book a free online demo today.

Related articles:

Oct 2021

1

The hassle-free way to maximise your profits from processing payroll

Accountants and payroll bureaus sometimes find that processing payroll takes a lot longer than they would like. Because of this, some accountants may be making little to no profit from offering payroll as a service. Nevertheless, it is a service expected by customers. If you aren’t making a profit from payroll processing, this could be down to not using the right payroll software. By switching to a payroll software that automates tasks you can transform payroll from a time-consuming manual process into an easy process where certain tasks take care of themselves, saving you both time and money.

Not only can you make a profit from processing payroll but depending on what payroll software you use it can be an opportunity to maximise profits by allowing you to offer new services to your clients which you may not have considered before. When it comes to introducing your staff and your clients to new services, you may think you have enough on your plate and that it would take up too much of your time. However, BrightPay Connect, a cloud add-on to BrightPay Payroll software, has little to no learning curve, allowing you to immediately begin offering additional services to clients. Offering new features such as a self-service dashboard for clients, a mobile app for their employees or giving your clients access to new HR tools is a lot easier than you think.

In our upcoming free webinar, we will discuss how cloud technology and automation is transforming payroll services and allowing payroll bureaus and accountants to increase profits. Register here.

Webinar agenda:

- Automatic cloud backup

- Payroll reports accessible by the client

- Annual leave management tool

- Integration with accounting software

- Support for remote working

- Client payroll entry & approval

- Bureau and client self-service dashboards

Please note: This webinar is specifically designed for accountants, bookkeepers, and payroll bureaus.

Webinar Information:

The webinar takes place on 7th October at 11.00 am and is free to attend for accountants in practice and payroll bureaus.

If you are unable to attend the webinar at the specified time, simply register and we will send you the recording afterwards.

Aug 2021

19

Sick pay comes to Ireland: How does this affect employers and payroll processors?

In Ireland, employers currently do not have any legal obligation to pay employees who are absent from work due to illness. In the private sector, it is at the discretion of the employer as to whether or not they decide to pay employees who are unable to work due to sickness.

A survey from 2019 found that only 44% of employers offered their employees some form of paid sick leave. For employees working in the public sector, The Public Sector Sick Leave Scheme was introduced in 2014. Under the scheme, public sector employees are entitled to 7 days paid sick leave within a continuous 2-year period, without having to submit a medical certificate. When a medical certificate is provided, employees are entitled to 92 calendar days of fully paid sick leave followed by 91 calendar days on half pay, subject to a maximum of 183 calendar days in a rolling 4-year period.

The effects of the COVID-19 pandemic shone a light on the need for statutory sick pay to be introduced into the private sector. Having no sick pay entitlements meant that employees were more likely to attend work, despite experiencing symptoms of COVID-19, risking passing on the virus to colleagues. Employees who were working from home also took fewer sick days during the pandemic as because they did not have to leave their homes they continued to work, despite feeling unwell. Both of these situations can be damaging to an employee’s health.

How does offering sick pay benefit employers?

When there is no sick pay scheme in place, many employees will attend work while unwell as they do not want to miss out on pay. This does not benefit either the employer or the employee. If the employee is trying to work while they are sick, they are not going to be able to be as productive as they usually would be. This could also lengthen the time it takes for them to recover from the illness and they may not be able to work to their full potential for a lot longer than it would have been if they had taken the time off needed to recuperate.

Offering employees sick pay leave can actually help reduce the number of sick days taken by employees overall. As well as getting better faster, If the employee does not come into the workplace sick, they won't spread the sickness to other employees.

What sick pay is being introduced?

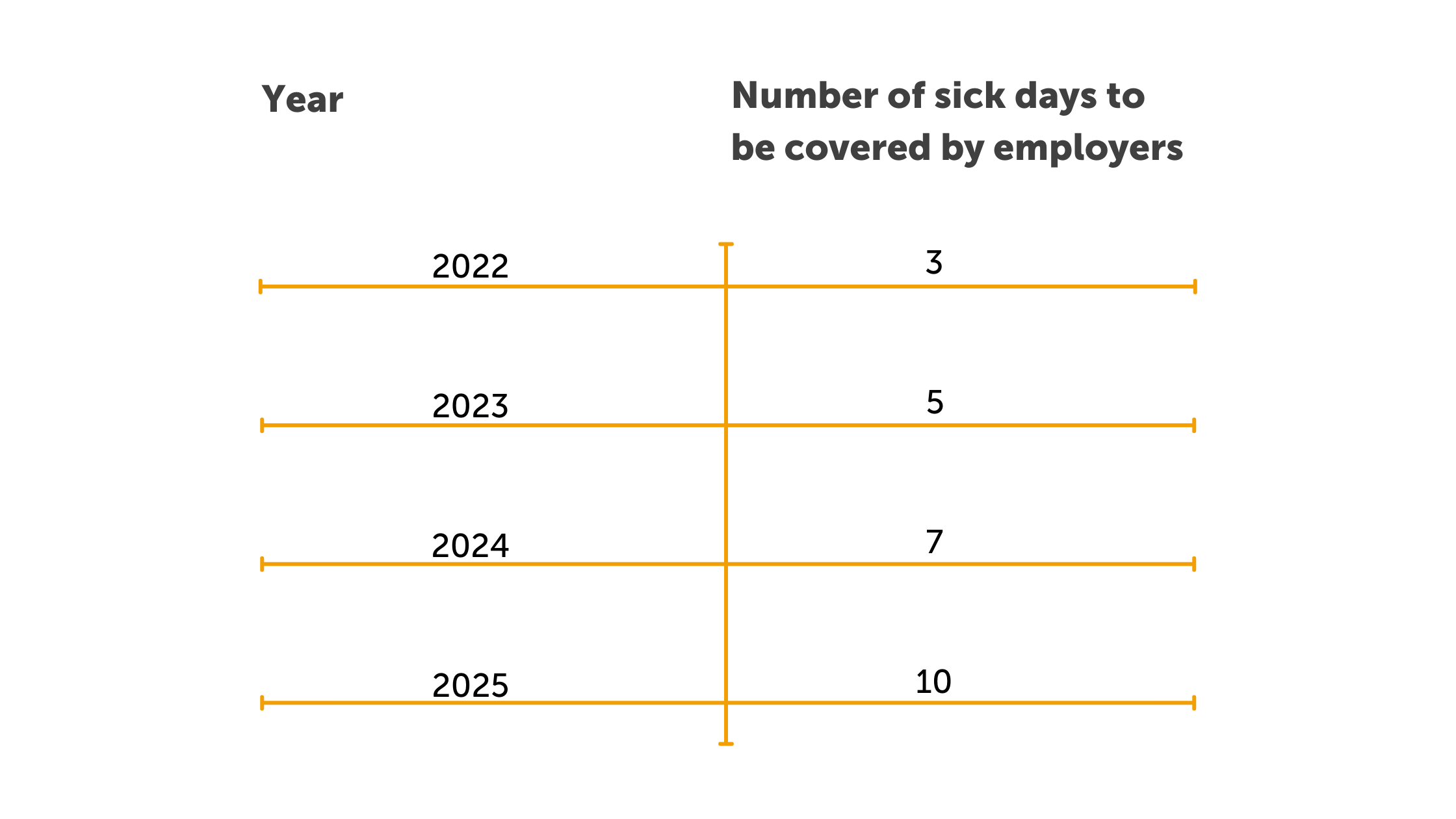

Statutory entitlement to sick pay will be phased in as part of a 4-year plan beginning in January 2022 and will be paid by employers at a rate of 70% of an employee’s wage, subject to a daily threshold of €110. The table below shows how the number of sick days covered by employers will rise over the four years.

How does the introduction of statutory sick pay affect payroll?

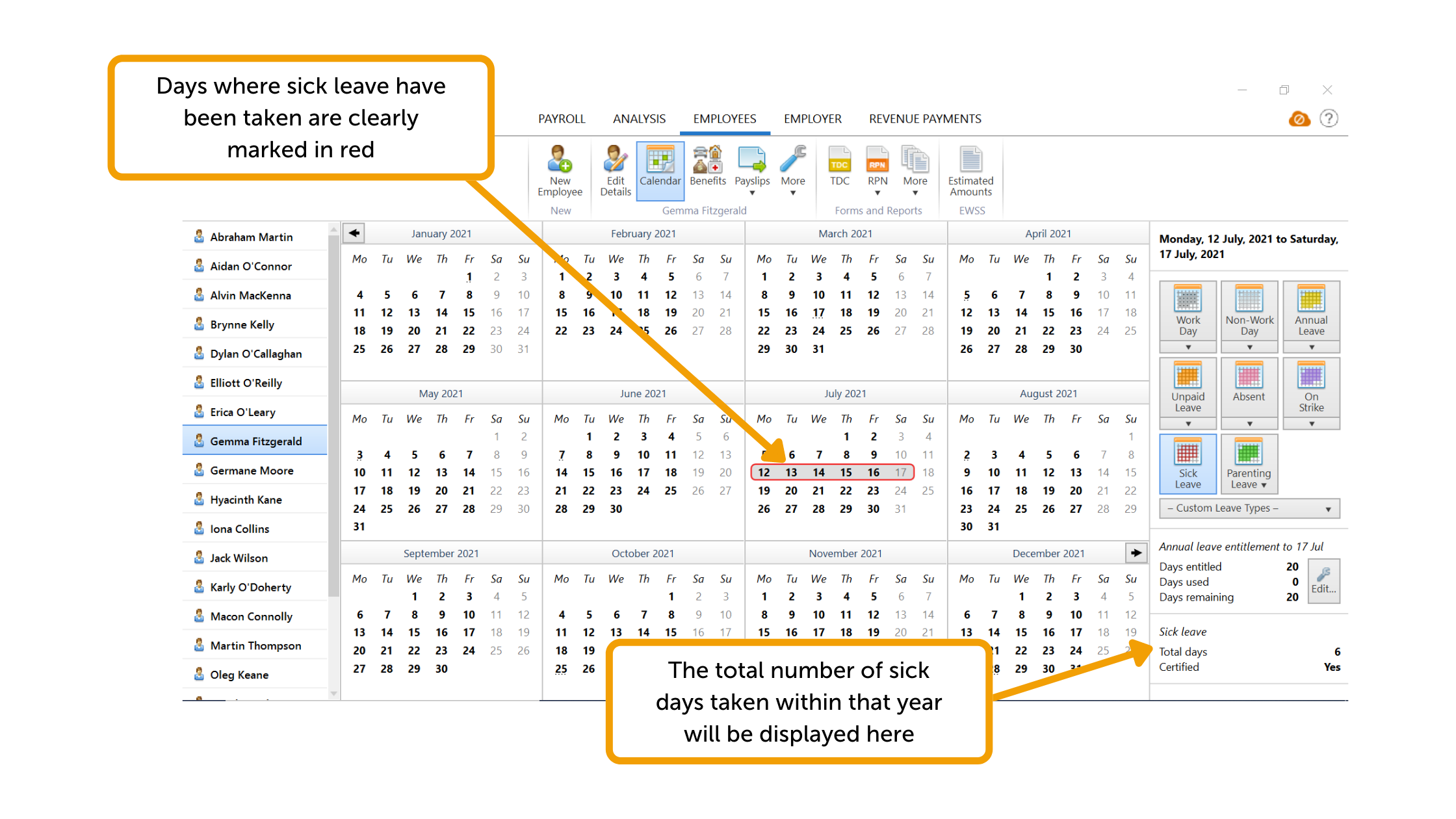

Payroll processors may be wondering how the introduction of statutory sick pay in Ireland will affect how they calculate pay for employees who have taken sick leave. Within BrightPay payroll software, at the moment, if an employer offers paid sick leave to their employees, payroll processors can add sick pay as an ‘addition type’ within the payroll software. The employer can then manually add the amount of sick pay owed to the employee when entering the employee’s pay information for that period. The employer can add sick days taken to the employee’s calendar and choose whether these days were certified or uncertified. The days where sick leave have been taken will be colour-coded and the total number of sick days taken will be displayed on the bottom right-hand side of the screen. This means that you can clearly track the number of sick days taken by each employee.

Through our optional cloud add-on, BrightPay Connect, employees can access an online portal through an internet browser or through the BrightPay Connect mobile app. Any days taken as sick leave will be highlighted meaning that the employee can keep track of how many sick days they have taken so far that year.

At BrightPay, through the UK version of our software, we have experience with applying sick leave entitlements to employee’s pay since 2012. Having this experience means we are well prepared to make any changes to the Irish version of our software that will make calculating and tracking an employee’s Statutory Sick Pay entitlements as easy as possible for payroll processors.

To learn more about BrightPay’s features, book a free online demo today.

Related articles:

Jul 2021

29

EWSS Eligibility Review Form

The Finance (Covid-19 and Miscellaneous Provisions) Bill 2021 was published on 23 June and extended the Employee Wage Subsidy Scheme (EWSS) to 31 December 2021. On 9 July, Revenue published guidelines to highlight the changes to the EWSS applicable for the period from 1 July 2021. The main change made to the scheme was in relation to eligibility.

Businesses who started trading before 1 January 2019 must compare their level of trade for 2021 to the level of trade for 2019 to assess their eligibility for the scheme. This will allow businesses whose trade was severely impacted due to government restrictions in the first half of 2021 to trade at higher levels for the second half of 2021 compared to 2019 and still avail of the scheme, subject to meeting the scheme conditions.

Employers must now submit monthly EWSS Eligibility Review Forms

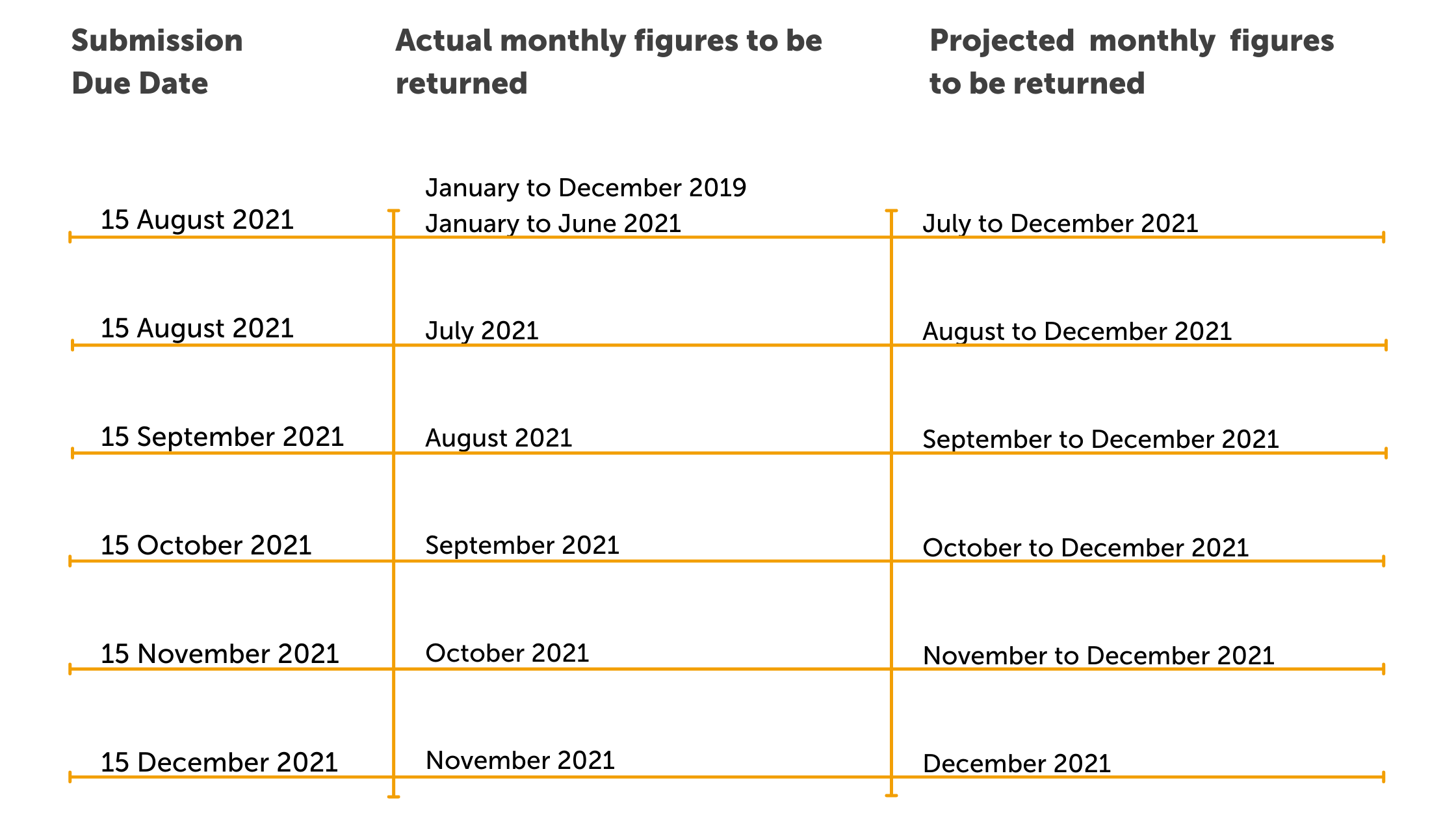

To assist employers in ensuring continued eligibility for the scheme, from 30 June 2021, all employers will be required to complete and submit an online monthly EWSS Eligibility Review Form (ERF) through ROS. Revenue has extended the deadline for completing and submitting the EWSS Eligibility Review Form in respect of June 2021 to 15 August 2021. The eligibility review form in respect of July 2021 is also due to be submitted on the same date.

Through ROS, employers will need to provide details of actual monthly turnover or customer order values for 2019, together with the same detail for the first six months of 2021. They will also need to provide details of monthly projections for the remainder of 2021 i.e. July to December 2021.

On 15th of every subsequent month during the scheme operation, employers will need to provide details of the actual results for the previous month, together with reviewing the original projections provided to ensure they remain valid. This can be summarised as follows:

Timely submission of the electronic form will provide assurance to both employers and Revenue that subsequent EWSS claims are appropriate and in line with the terms of the scheme. This, in turn, will reduce the possibility of employers claiming EWSS amounts to which they are not entitled and having to repay those amounts to Revenue.

Childcare businesses continue to be eligible for the scheme with no reduction in turnover or orders required. However, there is a requirement for such businesses to register for EWSS through ROS prior to submitting payroll for paydates in respect of which subsidies are being claimed.

Employer Declaration

As part of the monthly submission, employers (or agents on their behalf) must sign a declaration that the information submitted is correct and accurate with best-estimate projections for future months. Failure to complete and submit the EWSS Eligibility Review Form that confirms the required reduction and related declaration will result in suspension of payment of EWSS claims.

Childcare businesses and businesses who commenced trading after 1 November 2019 will have to complete a declaration as part of the Employer Eligibility Review platform on ROS to confirm their exemption.

For more information you can read Revenue's Guidelines on eligibility for the Employment Wage Subsidy Scheme from 1 July 2021 document here.

Related articles:

Jul 2021

26

Going paperless: how an employee app can help

COVID-19 has accelerated the move to paperless systems for businesses all over the world. In retail we saw outlets curtailing the use of cash due to fear of spreading the virus; causing payment habits to evolve faster than ever. With more of us working remotely, the office has also seen rapid innovation and it has become crucial that businesses digitalise their paper forms. While some of us may have found the move to digital difficult at first, many of us are now used to it and can easily visualise a future where paper is no longer needed in the workplace. The pros of a paperless workplace far outweigh the cons and it has the ability to revolutionise the way we work.

The move to paperless is nothing new in the world of payroll processing. Going back to a time where payroll was done manually and without the help of software is unimaginable to most payroll processers. However, if you are still using paper anywhere in your workflow, it’s time to make the change.

BrightPay Connect is a cloud add-on to our payroll software that can help you to digitalise payroll and HR processes, allowing you to cut down on your use of paper and even stop using it altogether. So how can BrightPay Connect help you achieve this?

BrightPay Connect digitalises the following tasks:

- Sharing documents with employees such as contracts of employment, staff handbooks etc.

- Distributing payslips to employees

- Annual leave management

What are the benefits of digitalizing payroll processes?

1. Your company can save money

Surveys have found that the average amount spent by businesses on printing is over €800 per employee. With 30% of print jobs not even being picked up from the printer and 50% of print jobs ending up in the bin within 24 hours, businesses are essentially throwing money away. A document such as a staff handbook can be as long as 100 pages. Say you have 40 employees, that adds up to 4000 pages and a lot of money being spent on paper and ink. Sharing the staff handbook through a cloud portal cuts out this cost altogether.

2. It is more convenient for you and your employees

With BrightPay Connect, staff have the ability to access important documents through the employee self-service app on their phone. This means they no longer have to store physical documents that can often be lost or get thrown away. It also means that if you would like to update or change any of the information in the document, it is easy to do so. Once the document has been updated, employees will receive a push notification to let them know the newly updated document is ready to be viewed.

Sharing a document online with a few clicks of a mouse is far more convenient than having to print off, sort through and physically distribute reams of paper. It also doesn’t matter where an employee is; in the office, working from home, or even travelling abroad, everyone will have access to the document at the same time.

3. You can save yourself hours of time

Paper-based processes are notoriously slow and are more prone to error which can end up taking you hours to correct. One way you can save time with BrightPay Connect is by digitalising your annual leave management processes. Instead of having employees submit paper forms, the employee can request leave wherever or whenever suits them; be it from their desk or even in their own time through the BrightPay Connect mobile or tablet app.

Once a request for leave has been made, the relevant manager will receive a notification on their own BrightPay Connect dashboard. From the dashboard, employers can either approve or deny the leave request. Through your dashboard, you can view a real-time, company-wide calendar where you can see which employees are on leave, when they are on leave and the type of leave, saving you hours of time when dealing with annual leave requests.

4. It improves accountability

Another great benefit of using BrightPay Connect's online document sharing feature instead of paper is that it allows for accountability. From the employer dashboard, users have the ability to track who has read the documents which have been shared with them and who hasn’t. When it comes to managing annual leave through BrightPay Connect, you can assign users to manage requests from specific employees. You also will have a record of who has requested leave, when, and who has dealt with the request.

5. It improves security

Employee documents, especially payslips, are highly confidential documents which contain sensitive personal information. It is the responsibility of the employer to ensure that the employees' information is kept safe and secure. If you are still sharing paper payslips with employees, you are leaving them at high risk of a data breach. In the BrightPay Connect mobile app, employees will receive an email and a push notification when their latest payslip becomes available to be viewed or downloaded. From the app, employees can also view and download all historic payslips. BrightPay Connect uses a design structure that maximises security. Each user will have their own login details and unique password. BrightPay Connect utilises the Microsoft Azure platform, keeping the employee’s personal information secure.

6. It helps you stay ahead of the competition

Technology is always evolving and by not moving from manual paper processes to digital ones, you are at risk of being left behind by the competition. Companies are having to continuously innovate to keep up with customers' expectations and payroll is no different. The digital transformation has changed employees’ expectations. To attract and retain top talent, employers need to replace old manual processes with digital solutions. In a recent employee survey, 91% of employees said they want digital solutions and 88% think that technology is a vital part of the employee experience.

7. You are helping the environment

Lastly, the biggest advantage of going paperless is that you are helping to save the environment. By curtailing the use of paper in the workplace not only are you saving trees, but you are also helping to reduce pollution, save water and cut down on the use of fossil fuels which are used to make ink. Turning a single tree into 17 reams of paper releases around 110 lbs of C02 into the atmosphere. It has become the responsibility of businesses to cut down on carbon emissions and going paperless is the first step you can take.

It is becoming increasingly important for businesses to make more environmentally friendly choices. BrightPay recently conducted a survey of our UK customers and over 70% of respondents said that they would like to make more environmentally friendly decisions for their business. From the same survey, 43% said that it was either extremely important or very important for them to choose suppliers who make a conscious effort to reduce the impact they have on the environment.

Read about our own sustainability efforts here.

Why not book a free online demo of BrightPay Connect today and find out more about its benefits and how it can help your business go paperless.

Related articles:

May 2021

13

How to Manage the Annual Leave Backlog as the Country Reopens

Employers are well used to staff wanting to take holidays at the same time. It is inevitable that certain times of year like Easter or Christmas will be more popular than others. As we remain in lockdown, many employees will have saved their time off for when more restrictions are lifted, and they can enjoy their free time as much as possible.

With Hotels, B&Bs, guesthouses, self-catering accommodation and outdoor hospitality set to reopen in early June, we can expect a scramble in workplaces for employees to get their holiday requests in. While it might not be possible to please everyone and give them time off on their preferred dates, it is important that you deal with annual leave requests in a way which is transparent and fair. If they wish to, employers are permitted to specify when an employee should take their holidays, provided they give the required notice. However, this can leave some employees feeling hard done by and annoyed that they do not have control over the dates that they take off, especially if they are forced to take time off during COVID-19 restrictions. So, what is the best option for all parties involved?

An employee app that manages staff holidays

BrightPay Connect, an optional add-on to BrightPay’s payroll software, is the simplest way to manage your staff's annual leave – headache free. BrightPay Connect streamlines leave requests and leave approval. This is how it works:

1. The employee requests leave from the calendar in their BrightPay Connect mobile app or from their PC or tablet. This means employees can request leave anytime, anywhere.

2. The employer (or the person who has been assigned to oversee the management of that employee’s annual leave) is notified of the request on the dashboard of their own BrightPay Connect account.

3. The employer/manager can then either approve or deny the request at the click of a button.

4. The employee will receive a notification on their device informing them of whether their request has been approved or denied.

The most popular policy of granting annual leave is on a first come, first served basis. While this policy is the most fair; depending on the system in place, it can still be difficult to keep track of which employee requested the leave first. With BrightPay Connect, you don’t have that problem as you will be able to see the order in which requests come in. Employees also have the ability to request half days or request to cancel leave which has already been granted.

In the employer’s dashboard, from the calendar tab, the employer or manager can view a real time, company-wide calendar. At a glance, employers see which employees are on leave and the type of leave. This is especially handy nowadays when staff may be working from home and it is hard to keep track of who is off and who is not. Cloud integration means any approved leave requests will flow directly back to your BrightPay payroll software on your PC.

Using BrightPay Connect to manage employee’s leave means less conflict in the workplace and less stress all round. Book a demo today to find out the many other ways BrightPay Connect can improve employer/employee relationships.

Why not register now for our upcoming free webinar where we will discuss the EWSS scheme and highlight important tips to remember as you return to the workplace.

Related articles:

Apr 2021

28

How we celebrated Earth Day 2021

As you may know, at BrightPay we recently moved into our new offices which are purpose built to be energy efficient, affording us the opportunity to record and monitor our carbon emissions. It's a new start for the team and inspired by our energy efficient offices we would like to encourage employees to live a more sustainable lifestyle overall.

To help raise awareness amongst our employees, we have established the BrightPay Green Team which is made up of 12 team members, across multiple departments. The Green Team have been working on coming up with creative ways to make the company's operations more environmentally friendly. They also aim to encourage change amongst colleagues on an individual level, at home, at work and in the community.

In our first campaign to raise awareness, the Green Team celebrated Earth Day 2021 (April, 22nd) with a number of activities planned throughout the week.

As we continue to work remotely, we encouraged everyone to get involved and share photos of their activities online.

The BrightPay Team getting involved in Earth Day celebrations.

We started off our ‘Earth Week’ with ‘Meat Free Monday’. The production of meat and dairy products account for around 14.5% of global greenhouse gas emissions each year and so we encouraged employees to eat vegetarian or vegan meals for the day. On Tuesday we encouraged employees to take a walk in their local area. On Wednesday we asked employees to unplug devices, cut down on emails and have a ‘digital clean-up' to save C02 emissions. Thursday, April 22nd, was Earth Day and to celebrate we had a live online talk from Dr Emma Reeves, Senior Ecologist at the Forest, Environmental Research & Services (FERS) Ltd who discussed reducing our waste, the benefits of living a more eco-friendly lifestyle and the small changes we as individuals can make to help the planet. Friday was ‘Fresh Friday’ where we encouraged employees to go litter picking in their local areas.

Earth week was a success and we accomplished what we set out to do, which was to raise environmental awareness amongst our colleagues and encourage involvement in the company's sustainability efforts.

We will continue our dedication to creating a greener future. Subscribe to BrightPay’s sustainability newsletter to follow our journey.

Related articles: