Dec 2019

20

Minimum wage to rise to €10.10 per hour

Minister, Regina Doherty, has announced that from 1 February 2020, the minimum wage will increase from €9.80 per hour to €10.10.

The decision to increase minimum wage by 30 cent follows a recommendation in October by the Low Pay Commission. Strong economic growth and greater certainty surrounding Brexit were two key factors in the decision to introduce the increase.

In order to ensure that the increase in the minimum wage does not result in employers attracting a higher level of PRSI, the employer PRSI threshold will increase from €386 to €395 from 1 February 2020.

Minister Doherty is quoted as saying that; “with this most recent increase in the National Minimum Wage, an employee on minimum wage who works a full 39 hour week will now receive an additional €11.70 per week, or an extra €608.40 gross per year.” It is estimated that over 127,000 workers will benefit from the increase.

Employers should also note that the minimum wage for younger workers will also increase:

- Aged 19: €9.09

- Aged 18: €8.08

- Under 18: €7.07

Dec 2019

17

What's New in BrightPay 2020?

BrightPay 2020 is now available (for new customers and existing customers). Here’s a quick overview of what’s new:

2020 Tax Year Updates

- 2020 rates, thresholds and calculations for PAYE, USC, PRSI, LPT and ASC.

PAYE Modernisation

- Support for retrieving and using 2020 Revenue Payroll Notifications (RPN).

- Support for creating and sending 2020 Payroll Submission Requests (PSR).

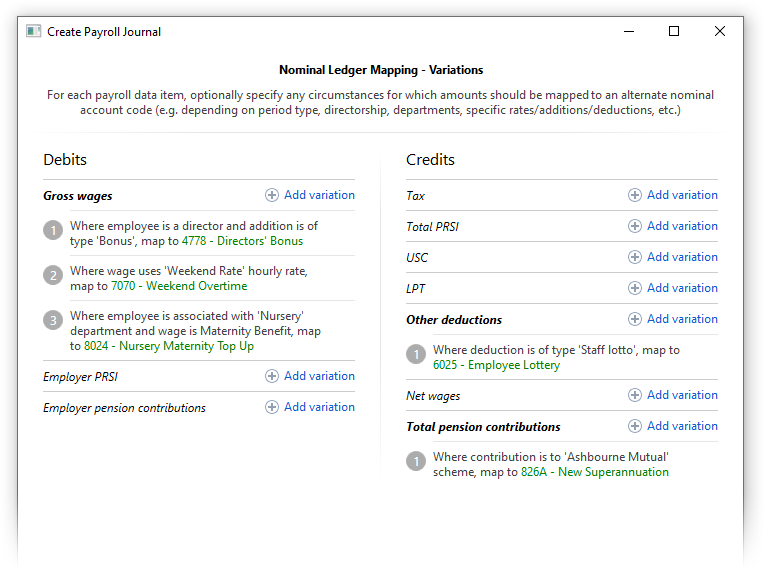

More Flexible Journals

A popular customer request has been to create a 'departmental' payroll journal in BrightPay. We've went one step further, allowing not only for a simple departmental mapping of nominal account codes, but for an advanced multi-option mapping as well.

For example, if you want to map commission paid to directors on a weekly basis in the sales department to a particular account code, you now can.

For Xero journals, BrightPay now supports including the department as the Xero tracking option, including where employees are split across multiple departments.

To make all this easier to manage, the Create Journal window in BrightPay now remembers it's size and position between usages.

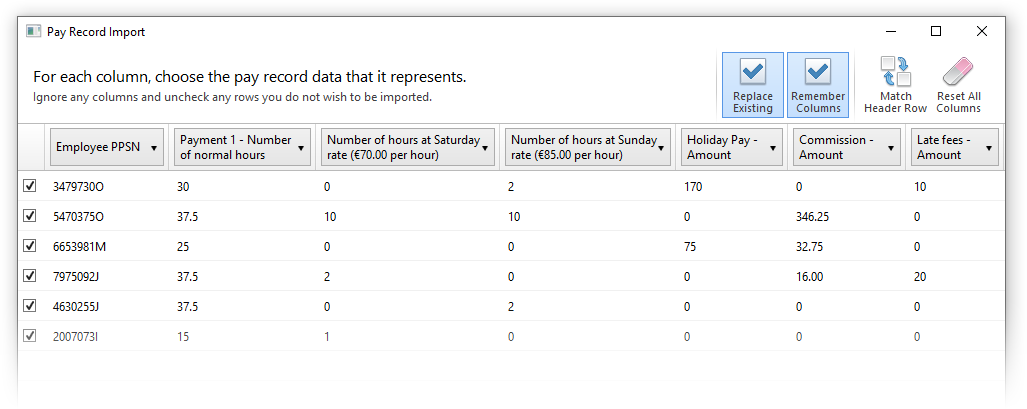

Importing Pay Records from CSV

We have significantly improved the power and flexibility of how pay records are imported from CSV, effectively allowing an entire pay run to be imported from a single CSV file if need be.

- Multiple pay items (of a single payment type, or mixed types) can now be imported from a single CSV line.

- Daily/hourly payments can more easily be imported under a named employer-wide daily/hourly rate

- Additions/deductions can more easily be imported under an employer-wide addition/deduction type

BrightPay Connect

In late 2019 we introduced a powerful new feature for Bureau customers of BrightPay Connect: the ability to request client payroll entry and/or approval for a payroll run, which is then automatically facilitated though a secure, GDPR-compliant process within the BrightPay Connect dashboard.

Sign in to your BrightPay Connect account and click the Requests header link to find out more.

Other Connect updates in BrightPay 2020 include:

- The Connect tab on the start-up window now directly shows your sign-in status.

- The list of employers (in the Open/Create Employer tab of start-up window) now shows cloud icons for employers that are linked to the signed-in BrightPay account.

- Ability to download and import a 2019 Connect backup into BrightPay 2020 (only applies for employers which have not yet been linked and synchronised for 2020).

- When an employer is opened in BrightPay 2020 that is not linked to Connect, but it is known that the 2019 version of that file was linked to Connect, BrightPay will now automatically prompt you to link the 2020 file to Connect.

Other 2020 Updates in BrightPay

- Ability to quickly create a new/additional employment for a previous/existing employee.

- Ability to print/export/email 'DRAFT' payslips.

- New period summary column options to see amounts in previous period.

- When selecting which analysis columns to include in a report, they are now grouped by category.

- New A4 payslip template, designed to be used where there are too many items to fit on the A5 template.

- New Bureau statistics report.

- As part of our new licensing model, Bureau customers can now view/edit the list of employers for which they have access.

- Lots of minor improvements throughout the entire BrightPay user interface, as well as the latest bug fixes.

What's Next?

We're continually at work on the next version of BrightPay, developing new features and making any required fixes and improvements. See our release notes to keep track of what has been changed to date at any time.

Dec 2019

11

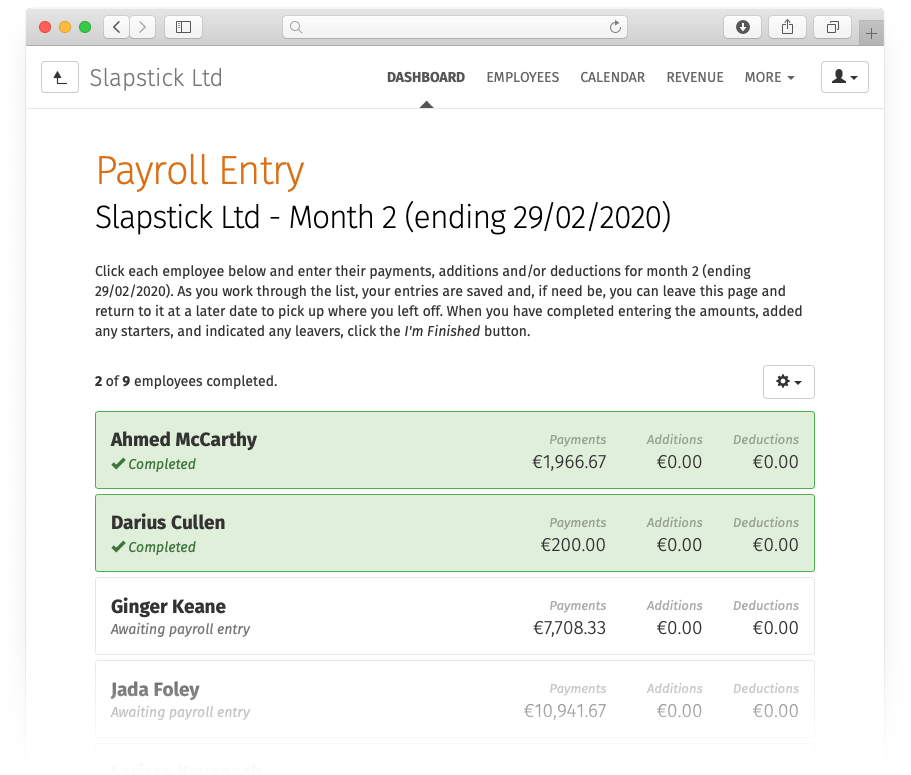

The 7 Unmistakable Benefits of Client Payroll Entry

BrightPay Connect is now even better than ever before. Bureau customers who use the cloud add-on now have the ability to send requests to clients through the secure portal. Requests can be sent to get client approval of the payroll summary before the payroll is finalised or to ask clients to upload their employees’ timesheets and payments, known as Client Payroll Entry.

With the new client request features, payroll bureaus can benefit from a reduced workload, increased efficiency, improved GDPR compliance and much more.

- Reduce your workload - By requesting employee timesheets from clients, bureaus can simply click a button to pre-populate the hours and payment information for their client’s employees, reducing the workload and manual data entry associated with running the payroll for your clients.

- Improve GDPR compliance - With the client payroll entry feature, clients can send payroll information containing sensitive personal data through a secure portal instead of sending it via email which would be less secure. The payroll summary can also be sent back to the client for approval through the portal before the payroll is finalised, adding an additional layer of GDPR protection to your client’s data.

- Reduce administration - Clients have the ability to add a new employee. Here the client must add all basic details required for processing the payroll, such as the new employee’s PPS number, date of birth, PRSI class etc. Once accepted by the bureau, the new employee is automatically added to the payroll software, eliminating the need for the bureau to gather this information from the client and manually set up the employee in the payroll software.

- Eliminate the risk of errors - Manual data entry comes with the additional risk of human error. By requesting the client to enter the data, then synchronising the data with the payroll software, bureaus will be eliminating this risk associated with manual data entry.

- Client responsibility - By getting the client to enter the employee payments and approve the payroll run before being finalised, bureaus can take less responsibility for errors and mistakes that occur, with the ultimate responsibility on the client for accuracy of data. There’s also an automated audit trail of users and timestamps of when the various requests were sent and submitted.

- Attract new clients - With less time spent on processing client’s payroll, bureaus will have more time to spend on attracting new clients and being able to cater for an increased number of clients. You will also be able to cater for more complex payroll clients, as the responsibility for entering the payments for irregular employees can be placed on the client themselves.

- Increase efficiency - Overall, bureaus can increase the efficiency of their practice. With less time spent on mundane administrative tasks such as entering employee hours and making corrections to the payroll and an increase in clients, you will be guaranteed to be running your practice much more efficiently and profitably.

Click here to find out more or book an online demo of BrightPay Connect to see how the new client entry features will work.

Dec 2019

3

Time to Renew for 2020

So you want to renew your Thesaurus or BrightPay payroll software, but unsure of which licence to choose. Hopefully the information below will guide you:

Standard Licence

If in 2019, you purchased a Standard (one employer) licence, then your software will confirm which licence to order. But just as a reminder, here is the 2020 pricing structure:

- 1 - 10 employees = €159 plus VAT

- 11 - 25 employees = €239 plus VAT

- 26+ employees = €319 plus VAT

To pay by card, please click here. Remember, click on the “Add to Order” box and then choose the correct licence you wish to purchase by clicking on the little arrow.

If in 2019, you purchased Standard and Additional licence(s) (2 employers or more), and you process all employers on one computer or laptop, then you must buy a Bureau licence for 2020. Please ignore the order form in your 2019 payroll, it automatically reverts to a standard licence.

With the Additional licence now gone, please don’t buy 2 or more standard licences, it won’t work!

There is only one exception to the above, if the 2nd or 3rd (or both) employers have 2 or less employees, this is considered a “Micro Employer”. You’ll be happy to know Micro Employers are free once you purchase a Standard licence for your 1st company and the additional companies never go over 2 employees within the same tax year.

Bureau Licence

If in 2019, you purchased a Bureau (multiple employers) licence, then your software will confirm which licence to order. But just as a reminder, here is the 2020 pricing structure:

- 2 - 10 employers = €339 plus VAT

- 11 - 25 employers = €499 plus VAT

- 26+ employers = €659 plus VAT

Connect – Cloud back-up and employee self-service

All Connect licences will be registered through the 2020 software when released in mid-December. For further details on this new process and pricing structure, please click here.

Dec 2019

3

The evolution of the payroll bureau

If you are an accountant working in practice, you may know that I was once one of you, before I escaped to the leafy suburbs of IT.

While in practice, part of my income came from providing a payroll bureau service.

This came with its challenges as I was tied to it, it wasn't very profitable and not all of my payroll clients understood that I actually needed to have the employees' hours before I could do the payroll.

I would send them their payslips with a summary report, reminded them when to pay Revenue and, in return, they would grudgingly pay my fees.

That was twenty years ago. A lot has happened since then, the two main things being technology and PAYE Modernisation.

I wish that PAYE Modernisation had been around in my time. I could really have used it to convince some of my less conscientious clients to change their ways or else. The "or else" being the big stick of Revenue fines.

Technology has enabled a lot of things. The arrival of the smart phone, cloud services and increased internet speeds have been transformative.

In my practice days, I had one client who considered themselves at the forefront of technology. They would have been blown away seeing the way their employees could now receive their payslips on their smart phone and all the other cool things e.g. holiday requests, a document portal and so on. Mind you, if I was still practising and had that same client, I think that these are things they would expect.

That same client would also expect to be able to log on to their own portal and get whatever payroll information they wanted 24/7.

What we are starting to see now is that this type of client is becoming more of a thing. A large part of the driving force for this is their increasingly youthful workforce. Millennials grow up with a smart phone attached to them and they want as much of their life on it as possible.

Another feature that I wish had been around in my time is getting clients to effectively update their own payroll. What I mean by this is that instead of the various ways they would send the hours (word documents, emails, scraps of paper), they would now log in to their portal, update the hours and these would flow seamlessly in to the payroll. Plus everything would be logged and time stamped, so they couldn't blame me if an employee was overpaid or not paid at all.

All of the above would have certainly transformed my basic payroll service of 20 years ago and forged a client base less likely to defect to some new accountant trending on social media.

The clients would still be getting the same attention as always but the "value added" would be enormous. They get to look much more modern with their employees, which can help with attracting and retaining employees. They also gain access to a HR tool with which they can manage holidays, roll out documents and ensure that employee contact information is always current. The vast majority of small/micro employers have nothing like this.

In the UK, this value added payroll service is more common than it is here and I have asked accountants there what they charge. As you can imagine it varies quite a bit and will depend on the type and size of business, but I have heard rates as high as £10 per payslip for higher net worth clients with the average closer to £5.

This type of pricing would certainly have catapulted my small bureau service in to one of my more profitable activities as the cost of all this technology can be as little as 8c per employee per month.

Paul Byrne fca

Recommended reading:

Thesaurus Connect for Payroll Bureaus & Accountants