Jun 2021

30

EWSS changes under Ireland’s Economic Recovery Plan

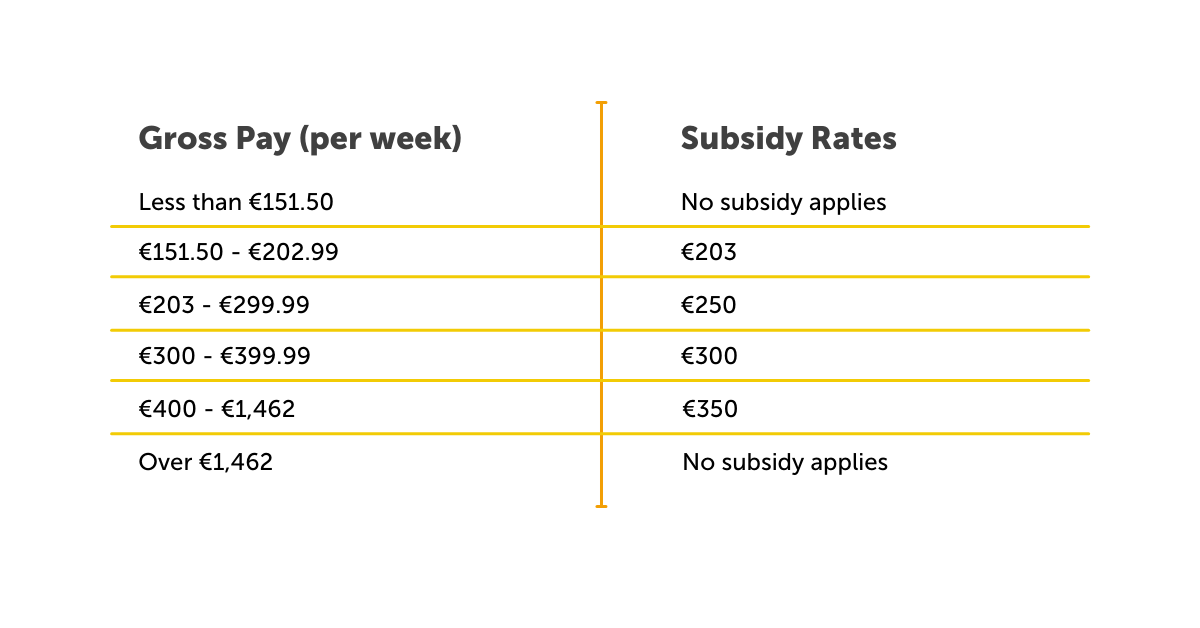

On the 1st of June 2021, the Government announced that the Employment Wage Subsidy Scheme (EWSS) would be extended until the 30th of December 2021 to support businesses as they continue to reopen and recover from the COVID-19 pandemic. The rates below will continue for July, August and September 2021.

A decision on the subsidy rates that will apply for October 2021 onwards, is expected to be announced toward the end of August or early September.

A decision on the subsidy rates that will apply for October 2021 onwards, is expected to be announced toward the end of August or early September.

The Government have set out an economic recovery plan for Ireland with measures to help businesses who have experienced significant negative economic disruption due to COVID-19 with a minimum of a 30% decline in turnover or in customer orders. The period for this been extended from 6 months to 12 months under the new recovery plan. If you are unsure whether you are within the guidelines or need more clarity, please see further Revenue guidance.

Although the EWSS is a subsidy payable to employers only and will not impact employee payslips, the scheme must still be administered through the payroll. Employers must operate PAYE on all payments, including regular deduction of income tax, USC and employee PRSI from your employees’ pay. With BrightPay payroll software you can simply tick that you wish to 'claim EWSS subsidy for this employee in this pay period' when processing the payroll.

Remember, you must continue to review your eligibility status on the last day of every month to ensure you continue to meet the eligibility criteria. If you no longer qualify, you should de-register for EWSS with effect from the following day and untick the EWSS tickbox in the payroll software.

Want to find out more about the Employment Wage Subsidy Scheme? Register for our next webinar on the 27th of July where our panel of payroll and HR experts will answer any questions that you may have.

Related articles:

Jun 2021

3

Avoid Annual Leave Backlog

Managers will likely be in a situation where many employees will request to take leave at the same time. Whether it’s during the summer months, winter months or during school holidays, there will be higher demand at certain times of the year. But how do you handle it?

Employers should have a clear policy on holiday requests. Typically, a “first-come, first-served” approach works well. While it might not be possible to please everyone and give them their requested time off, it is important that you deal with annual leave requests in a way that is transparent and fair to all employees.

With the average annual leave in Ireland at 4 weeks per year, a recent survey from Irishjob.ie revealed that the average employee only uses 60% of their full annual leave per year. Not taking the full allocation of annual leave has absolutely no benefit for employees. It also has no benefit for employers as if staff are not taking enough rest throughout the year it can lead to burn out and unproductivity. Employees should be encouraged to take their full annual leave days every year to avoid this.

Where possible, managers should allow and accept the annual leave requested. However, managers have the right to decline holiday requests (with the correct notice) if the timing of leave would result in the business being understaffed and unmanageable.

If your business is faced with a high demand for annual leave for certain time periods every year, you can require employees to take annual leave on dates chosen by the employer. Employers must give the employee at least one month notice before the period of leave requested.

By introducing BrightPay Connect, employees can access a self-service portal via an app on their smartphone or tablet device. They will be able to request leave 24/7 from anywhere, meaning they don’t need to be in the workplace to request leave. When an employee requests leave, the employer will get a notification to login to their online portal to approve or reject the leave. The requests will be time stamped so you can see the order in which they come in. Employers can access a company-wide calendar that will display all leave so that you can ensure adequate staffing before approving an annual leave request.

You can have multiple users on BrightPay Connect meaning each department/line manager can approve leave for their own department. More information on user access and permissions can be found here.

Book a 10-minute online demo of BrightPay Connect to discover how it can benefit your business.

Related articles

Jun 2021

1

BrightPay Customer Update: June 2021

Welcome to BrightPay's June update. Our most important news this month include:

-

Automatic enrolment delayed until 2023

-

How to use BrightPay when working remotely

-

Ransomware: How to protect your payroll data

Protect your payroll data from ransomware attacks

With the recent ransomware attack on the HSE still disrupting Irish health services, the subject of ransomware is on all our minds. Taking backups of your data is so important in order to quickly restore data to get back up and running as soon as possible. All data in BrightPay Connect is stored securely within Microsoft Azure data stores, access to which have been tightly restricted to a limited set of servers and IP addresses.

Employment Wage Subsidy Scheme extended

The EWSS continues to be a requirement for many, with 43% of small businesses still availing of the scheme. Yesterday it was announced that the scheme would be extended until 31 December 2021 with a modification to widen eligibility. The enhanced rates of support and the reduced rate of Employers’ PRSI will remain in place until at least September.

How to manage the annual leave backlog as the country Reopens

A self-service system is the simplest way to manage your staff's annual leave – both from a HR and employee perspective. Give employees control to request annual leave, view leave taken and leave remaining all through an app on their smartphone or tablet.

30 days until TWSS Reconciliation deadline

Employers have until June 30th, 2021, to:

- Accept the reconciliation calculation issued by Revenue

- Make corrections to payslips if necessary, or

- Make an enquiry through MyEnquiries

How Cloud innovation can help simplify the payroll process

By introducing cloud innovation to your business, employers can work more efficiently by streamlining administrative processes and delegating manual tasks to employees. Download our free guide to find out more.