Mar 2017

31

Important Information for Employers - Changes to Civil Service Travel Rates

Where employees use their own private cars or motorcycles for business purposes, reimbursement in respect of allowable motoring expenses can be effected by way of flat-rate mileage allowances.

There are two types of mileage allowance schemes which are acceptable for tax purposes if an employee bears all the motoring expenses:

- The prevailing schedule of Civil Service rates; or

- Any other schedule with rates not greater than the Civil Service rates

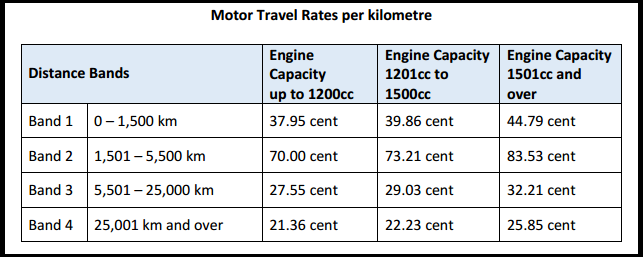

The Department of Public Expenditure and Reform has recently published circulars with new Civil Service Travel Rates, the revised rates are effective from 1st April 2017. The distance bands have increased from two to four with a lower recoupment rate for the first 1,500 kilometres.

Business travel carried out between 1st January and 31st March 2017 will not be affected by these new bands and rates, business travel to date from 1st January 2017 will count towards the cumulative business travel for the year.

Motor Travel Rates - Effective from 1st April 2017

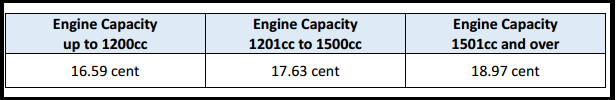

Reduced Motor Travel Rates per kilometre

The reduced rates are payable to Civil Service employees who undertake a journey associated with their job but not solely related to the performance of their duties, such as:

- Attendance at confined promotion competitions

- Attendance at approved courses of education

- Attendance at courses or conferences

- Return visits home at weekends during a period of temporary transfer

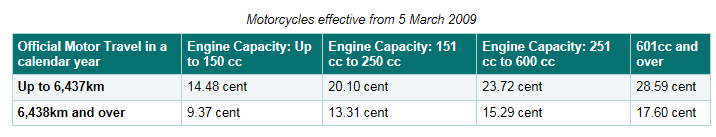

The Motor Travel Rates for motorcycles and bicycles remain unchanged as follows:

Motorcycle:

Bicycle: 8 cent per km

Please note, there are changes to subsistence rates which are also effective from 1st April 2017.

Please click here for the circular on Motor Travel Rates, and here for the circular on Subsistence

Mar 2017

20

New Illness, Maternity and Paternity Benefits rates in effect

Almost all welfare benefits and state pensions are to be increased in 2017.

The maximum weekly Illness Benefit payment will increase by €5.00 from €188 to €193 per week from week commencing 13 March 2017.

Illness benefit is considered as income for tax purposes and thus needs to be taken into account for PAYE purposes by an employer. It remains exempt from USC & PRSI.

No payment is made for the first six days of illness and for any Sunday.

Thesaurus Payroll Manager will automatically apply the increased rate of €193 per week as soon as Week 12 is reached in the software, which users should be aware of. Further information on how to process illness benefit in Payroll Manager can be found here:

In addition, standard Maternity and Paternity payments will increase from €230 to €235 per week from 13 March 2017. These are both taxable sources of income but aren’t liable to USC or PRSI. Unlike illness benefit, however, an employer must not tax these benefits through payroll. Instead, the Revenue will tax Maternity and Paternity Benefit via the employee’s tax credit Certificate by reducing the employee's SRCOP and tax credit on receipt of information from the Department of Social Protection.