Entering Normal Pension Deductions

Click ‘Payroll’ on the menu bar and select the relevant employee’s name in the summary view.

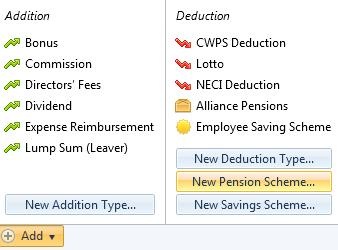

1) Within the ‘Additions & Deductions’ section on the employee’s payslip, click on ‘Add’. Under ‘Deduction’, choose an existing pension from the list or click ‘New Pension Scheme’ to add a new scheme.

2) The pension scheme will now appear in the ‘Additions & Deductions’ section. Enter your employee’s contribution and if applicable, any employer or additional voluntary contribution. Pension deductions can be applied on a set amount basis or on a percentage basis. To use the percentage basis, simply change the € sign to the % sign and enter the applicable percentage rate.

3) To add further pensions, click on ‘Add’ again and repeat the process.

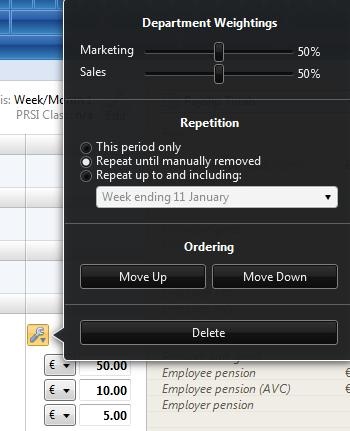

4) Should you wish to edit any pensions you have set up, simply click the ‘Edit’ button. Here you will find a facility to set a pension to repeat every pay period until you choose to manually remove it or to repeat up to and including a particular pay period in the future.

5) If you wish to re-order two or more additions/ deductions you have set up, an ‘Ordering’ facility is also available here.

6) If you wish to delete the pension deduction, click ‘Delete’.

Need help? Support is available at 01 8352074 or brightpayirelandsupport@brightsg.com.