Oct 2015

15

Budget 2016 – Employer Payroll Focus

Tax Rates and Standard Rate Cut Off Points (SRCOPs)

There has been no change to tax rates or SRCOPs. The standard rate of tax will remain at 20% and the higher rate of tax will remain at 40%.

There has been no change to the SRCOP and Tax Credits on the Emergency Basis of tax.

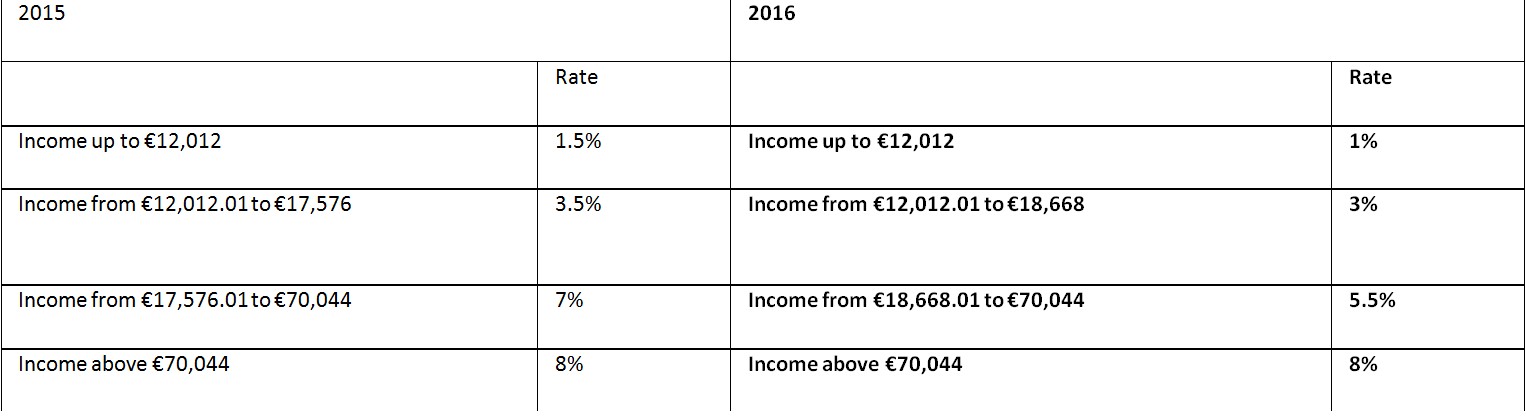

Universal Social Charge (USC)

The annual threshold for USC has been increased to €13,000 from €12,012.

Please note full medical card holders and individuals aged 70 and over whose aggregate income does not exceed €60,000 will pay a maximum rate of 3%.

The emergency rate of USC remains at 8%.

PRSI

Increase from €356.01 to €376.01 in the weekly threshold at which liability to employer’s PRSI increases from 8.5% to 10.75%.

A tapered PRSI credit has been introduced for employee PRSI; the PRSI credit will commence in respect of weekly income of €352.01 and will taper out as a weekly income reaches €424.

For earnings between €352.01 and €424, the maximum weekly PRSI credit of €12.00, is reduced by one-sixth of earnings in excess of €352.01.

Example:

Gross weekly earnings of €377

Maximum PRSI Credit €12

One-sixth of earnings in excess of €352.01

(€377-€352.01 = €24.99/6) (€4.17)

Reduced PRSI Credit €7.83

PRSI @ 4% €15.08

Less: Reduced PRSI Credit €7.83

Employee PRSI Weekly Liability €7.25